Cisco 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Cisco Systems, Inc.

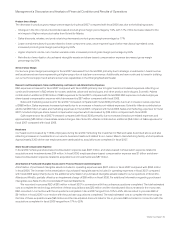

Management’s Discussion and Analysis of Financial Condition and Results of Operations

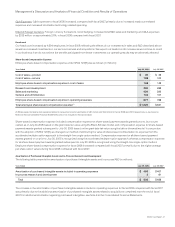

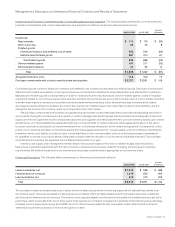

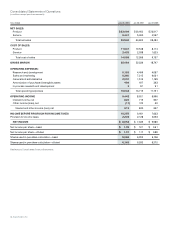

Long-Term Debt The following table summarizes our long-term debt (in millions):

July 28, 2007

Increase

(Decrease)July 26, 2008

Senior notes:

Floating-rate notes, due 2009 $ 500 $ 500 $ —

5.25% fixed-rate notes, due 2011 3,000 3,000 —

5.50% fixed-rate notes, due 2016 3,000 3,000 —

Total senior notes 6,500 6,500 —

Other notes 4 5 (1)

Unaccreted discount (15) (16) 1

Hedge accounting adjustment of the carrying amount of the fixed-rate debt 404 (81) 485

Total $ 6,893 $ 6,408 $ 485

Reported as:

Current portion of long-term debt $ 500 $ — $ 500

Long-term debt 6,393 6,408 (15)

Total $ 6,893 $ 6,408 $ 485

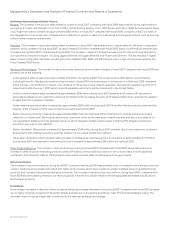

In February 2006, we issued $500 million of senior floating interest rate notes based on LIBOR due 2009 (the “2009 Notes”), $3.0 billion

of 5.25% senior notes due 2011 (the “2011 Notes”), and $3.0 billion of 5.50% senior notes due 2016 (the “2016 Notes”), for an aggregate

principal amount of $6.5 billion. The proceeds from the debt issuance were used to fund the acquisition of Scientific-Atlanta and for general

corporate purposes. The 2011 Notes and the 2016 Notes are redeemable by us at any time, subject to a make-whole premium. In fiscal

2008, we terminated $6.0 billion of interest rate swaps that we had entered into in connection with the issuance of our fixed-rate notes due

in 2011 and 2016 and received proceeds of $432 million, net of accrued interest, which was recorded as a hedge accounting adjustment

to the carrying amount of the fixed-rate debt and is amortized as a reduction to interest expense over the remaining terms of the fixed-rate

notes. See Note 8 to the Consolidated Financial Statements. We were in compliance with all debt covenants as of July 26, 2008.

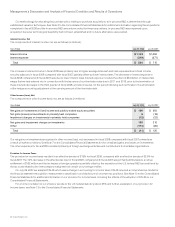

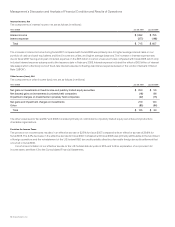

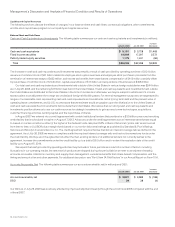

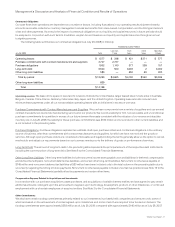

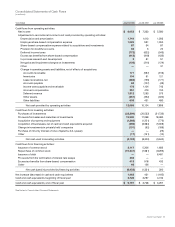

Deferred Revenue The following table presents the breakdown of deferred revenue (in millions):

July 28, 2007

Increase

(Decrease)July 26, 2008

Service $ 6,133 $ 4,840 $ 1,293

Product 2,727 2,197 530

Total $ 8,860 $ 7,037 $ 1,823

Reported as:

Current $ 6,197 $ 5,391 $ 806

Noncurrent 2,663 1,646 1,017

Total $ 8,860 $ 7,037 $ 1,823

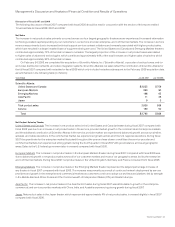

The increase in deferred service revenue reflects an increase in the volume of technical support contract initiations and renewals, including

several large multiyear service agreements, partially offset by the ongoing amortization of deferred service revenue. The increase in

deferred product revenue was primarily related to shipments not having met revenue recognition criteria, other revenue deferrals, and the

timing of cash receipts related to unrecognized revenue from two-tier distributors.