Cisco 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 43

Quantitative and Qualitative Disclosures About Market Risk

Investments

We maintain an investment portfolio of various holdings, types, and maturities. See Note 7 to the Consolidated Financial Statements. As of

July 26, 2008, these securities are classified as available-for-sale and consequently are recorded in the Consolidated Balance Sheets at

fair value with unrealized gains or losses, to the extent unhedged, reported as a separate component of accumulated other comprehensive

income, net of tax.

We consider various factors in determining whether we should recognize an impairment charge for our fixed income securities and

equity securities, including the length of time and extent to which the fair value has been less than our cost basis, the financial condition

and near-term prospects of the investee, and our intent and ability to hold the investment for a period of time sufficient to allow for any

anticipated recovery in market value.

Fixed Income Securities

At any time, a sharp rise in interest rates or credit spreads could have a material adverse impact on the fair value of our fixed income

investment portfolio. Conversely, declines in interest rates, including the impact from lower credit spreads, could have a material adverse

impact on interest income from our investment portfolio. Our fixed income instruments are not leveraged as of July 26, 2008 and are held

for purposes other than trading. We monitor our interest rate and credit risks, including our credit exposures to specific rating categories

and to individual issuers. There were no impairment charges on our investments in fixed income securities in fiscal 2008, 2007, or 2006.

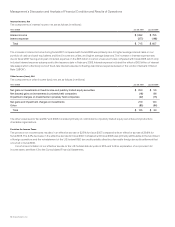

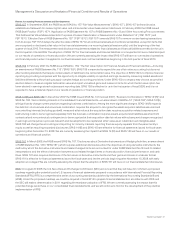

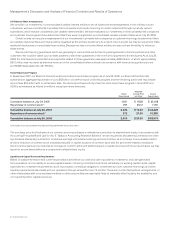

The following tables present the hypothetical fair values of fixed income securities, including the effects of the interest rate swaps

discussed further under “Interest Rate Derivatives” below, as a result of selected potential market decreases and increases in interest rates.

Market changes reflect immediate hypothetical parallel shifts in the yield curve of plus or minus 50 basis points (“BPS”), 100 BPS, and

150 BPS. The hypothetical fair values as of July 26, 2008 and July 28, 2007 are as follows (in millions):

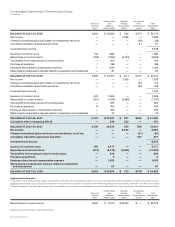

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS

FAIR VALUE

AS OF

JULY 26,

2008

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

Fixed income securities $ 20,216 $ 20,100 $ 19,985 $ 19,869 $ 19,753 $ 19,638 $ 19,522

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS

FAIR VALUE

AS OF

JULY 28,

2007

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

Fixed income securities $ 17,673 $ 17,548 $ 17,422 $ 17,297 $ 17,172 $ 17,046 $ 16,921

Publicly Traded Equity Securities

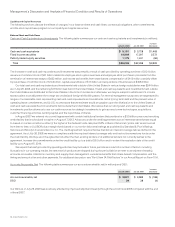

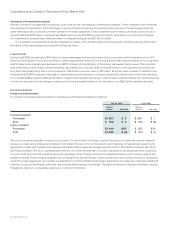

The values of our equity investments in several publicly traded companies are subject to market price volatility. The following tables

present the hypothetical fair values of publicly traded equity securities as a result of selected potential decreases and increases in the

price of each equity security in the portfolio, excluding hedged equity securities. Potential fluctuations in the price of each equity security

in the portfolio of plus or minus 10%, 20%, and 30% were selected based on potential near-term changes in those security prices. The

hypothetical fair values as of July 26, 2008 and July 28, 2007 are as follows (in millions):

VALUATION OF SECURITIES

GIVEN AN X% DECREASE IN

EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 26,

2008

VALUATION OF SECURITIES

GIVEN AN X% INCREASE IN

EACH STOCK’S PRICE

(30%) (20%) (10%) 10% 20% 30%

Publicly traded equity securities $ 736 $ 842 $ 947 $ 1,052 $ 1,157 $ 1,262 $ 1,368

VALUATION OF SECURITIES

GIVEN AN X% DECREASE IN

EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 28,

2007

VALUATION OF SECURITIES

GIVEN AN X% INCREASE IN

EACH STOCK’S PRICE

(30%) (20%) (10%) 10% 20% 30%

Publicly traded equity securities $ 548 $ 626 $ 705 $ 783 $ 861 $ 940 $ 1,018

Our equity portfolio consists of securities with characteristics that most closely match the Standard & Poor’s 500 Index or NASDAQ

Composite Index. These equity securities are held for purposes other than trading. There were no impairment charges on publicly traded

equity securities in fiscal 2008, 2007, or 2006.