Cisco 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Cisco Systems, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

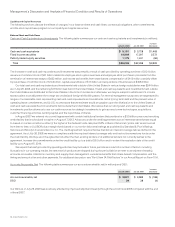

Our methodology for allocating the purchase price, relating to purchase acquisitions, to in-process R&D is determined through

established valuation techniques. See Note 3 to the Consolidated Financial Statements for additional information regarding the acquisitions

completed in fiscal 2008 and the in-process R&D amounts recorded for these acquisitions. In-process R&D was expensed upon

acquisition because technological feasibility had not been established and no future alternative uses existed.

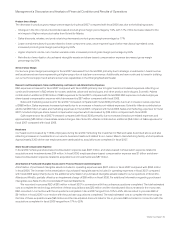

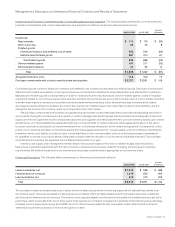

Interest Income, Net

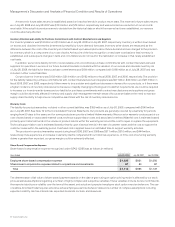

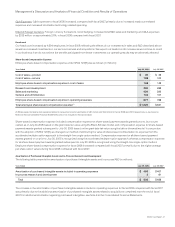

The components of interest income, net, are as follows (in millions):

Years Ended July 26, 2008 July 28, 2007

Interest income $ 1,143 $ 1,092

Interest expense (319) (377)

Total $ 824 $ 715

The increase in interest income in fiscal 2008 was primarily due to higher average total cash and cash equivalents and fixed income

security balances in fiscal 2008 compared with fiscal 2007, partially offset by lower interest rates. The decrease in interest expense in

fiscal 2008 compared with fiscal 2007 was due to lower interest rates. Interest expense includes the effect of $6.0 billion of interest rate

swaps that we had entered into in connection with the issuance of our fixed-rate notes due in 2011 and 2016, prior to the termination of

these interest rate swaps in the third quarter of fiscal 2008, and also includes, for the period following such termination, the amortization

of the hedge accounting adjustment of the carrying amount of the fixed-rate debt.

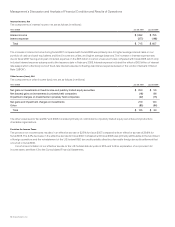

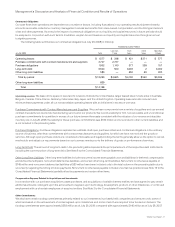

Other Income (Loss), Net

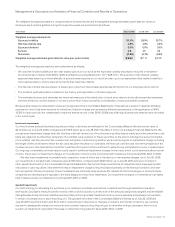

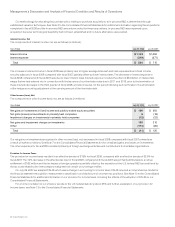

The components of other income (loss), net, are as follows (in millions):

Years Ended July 26, 2008 July 28, 2007

Net gains on investments in fixed income and publicly traded equity securities $ 109 $ 250

Net gains (losses) on investments in privately held companies 6 (18)

Impairment charges on investments in privately held companies (12) (22)

Net gains and impairment charges on investments 103 210

Other (114) (85)

Total $ (11) $ 125

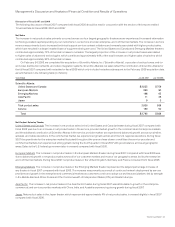

Our net gains on investments recognized in other income (loss), net, decreased in fiscal 2008 compared with fiscal 2007 primarily as

a result of market conditions. See Note 7 to the Consolidated Financial Statements for the unrealized gains and losses on investments.

The other expenses for fiscal 2008 consisted primarily of foreign exchange activities and contributions to charitable organizations.

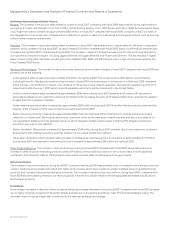

Provision for Income Taxes

The provision for income taxes resulted in an effective tax rate of 21.5% for fiscal 2008, compared with an effective tax rate of 22.5% for

fiscal 2007. The 1.0% decrease in the effective tax rate for fiscal 2008, compared with fiscal 2007, was primarily attributable to a net tax

settlement of $162 million and the tax impact of foreign operations partially offset by the expiration of the U.S. federal R&D tax credit and by

the tax costs related to the intercompany realignment of certain of our foreign entities.

On July 29, 2007, we adopted FIN 48, which was a change in accounting for income taxes. FIN 48 required a comprehensive model for

the financial statement recognition, measurement, classification, and disclosure of uncertain tax positions. See Note 13 to the Consolidated

Financial Statements for additional information on our provision for income taxes, including the effects of the adoption of FIN 48 on our

Consolidated Financial Statements.

For a full reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and further explanation of our provision for

income taxes, see Note 13 to the Consolidated Financial Statements.