Cisco 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 75

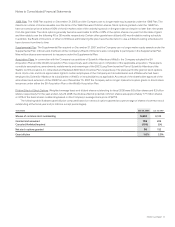

Notes to Consolidated Financial Statements

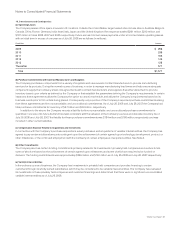

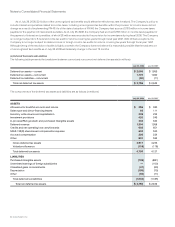

The aggregate intrinsic value in the preceding table represents the total pretax intrinsic value, based on the Company’s closing stock price

of $22.43 as of July 25, 2008, which would have been received by the option holders had those option holders exercised their stock

options as of that date. The total number of in-the-money stock options exercisable as of July 26, 2008 was 463 million. As of July 28, 2007,

829 million outstanding stock options were exercisable and the weighted-average exercise price was $30.13.

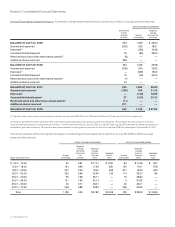

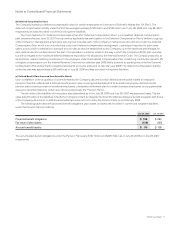

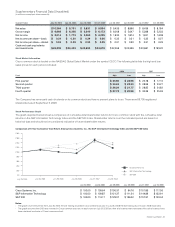

Valuation and Expense Information Under SFAS 123(R) Share-based compensation expense recognized under SFAS 123(R) consists

primarily of expenses for stock options, stock purchase rights, restricted stock, and restricted stock units granted to employees. The

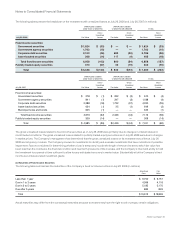

following table summarizes employee share-based compensation expense (in millions):

Years Ended July 26, 2008 July 28, 2007 July 29, 2006

Cost of sales—product $ 40 $ 39 $ 50

Cost of sales—service 108 104 112

Employee share-based compensation expense in cost of sales 148 143 162

Research and development 295 289 346

Sales and marketing 434 392 427

General and administrative 148 107 115

Employee share-based compensation expense in operating expenses 877 788 888

Total employee share-based compensation expense(1) $ 1,025 $ 931 $ 1,050

(1) Share-based compensation expense of $87 million, $34 million, and $87 million related to acquisitions and investments for fiscal 2008, 2007, and 2006, respectively,

is disclosed in Note 3 and is not included in the above table.

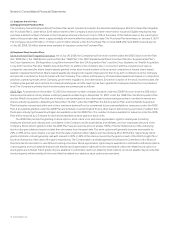

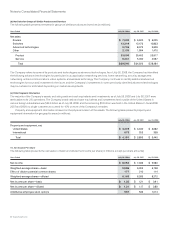

As of July 26, 2008, total compensation cost related to unvested share-based awards, including share-based compensation relating

to acquisitions and investments, not yet recognized was $3.4 billion, which is expected to be recognized over approximately 3.5 years

on a weighted-average basis. The income tax benefit for employee share-based compensation expense was $330 million, $342 million,

and $294 million for fiscal 2008, 2007, and 2006, respectively.

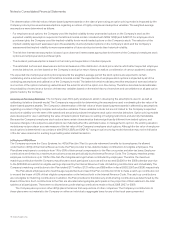

Lattice-Binomial Model Upon adoption of SFAS 123(R) at the beginning of fiscal 2006, the Company began estimating the value of

employee stock options and employee stock purchase rights on the date of grant using a lattice-binomial model. Prior to the adoption

of SFAS 123(R), the value of each employee stock option and employee stock purchase right was estimated on the date of grant using

the Black-Scholes model.

The Company’s employee stock options have vesting provisions and various restrictions including restrictions on transfer and

hedging, among others, and are often exercised prior to their contractual maturity. Lattice-binomial models are more capable of

incorporating the features of the Company’s employee stock options than closed-form models such as the Black-Scholes model. The use

of a lattice-binomial model requires extensive actual employee exercise behavior data and a number of complex assumptions including

expected volatility, risk-free interest rate, expected dividends, kurtosis, and skewness. The weighted-average assumptions, using the lattice-

binomial model, and the weighted-average expected life and estimated grant date fair values of employee stock options granted during the

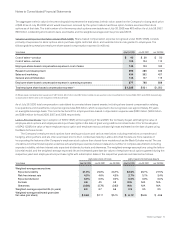

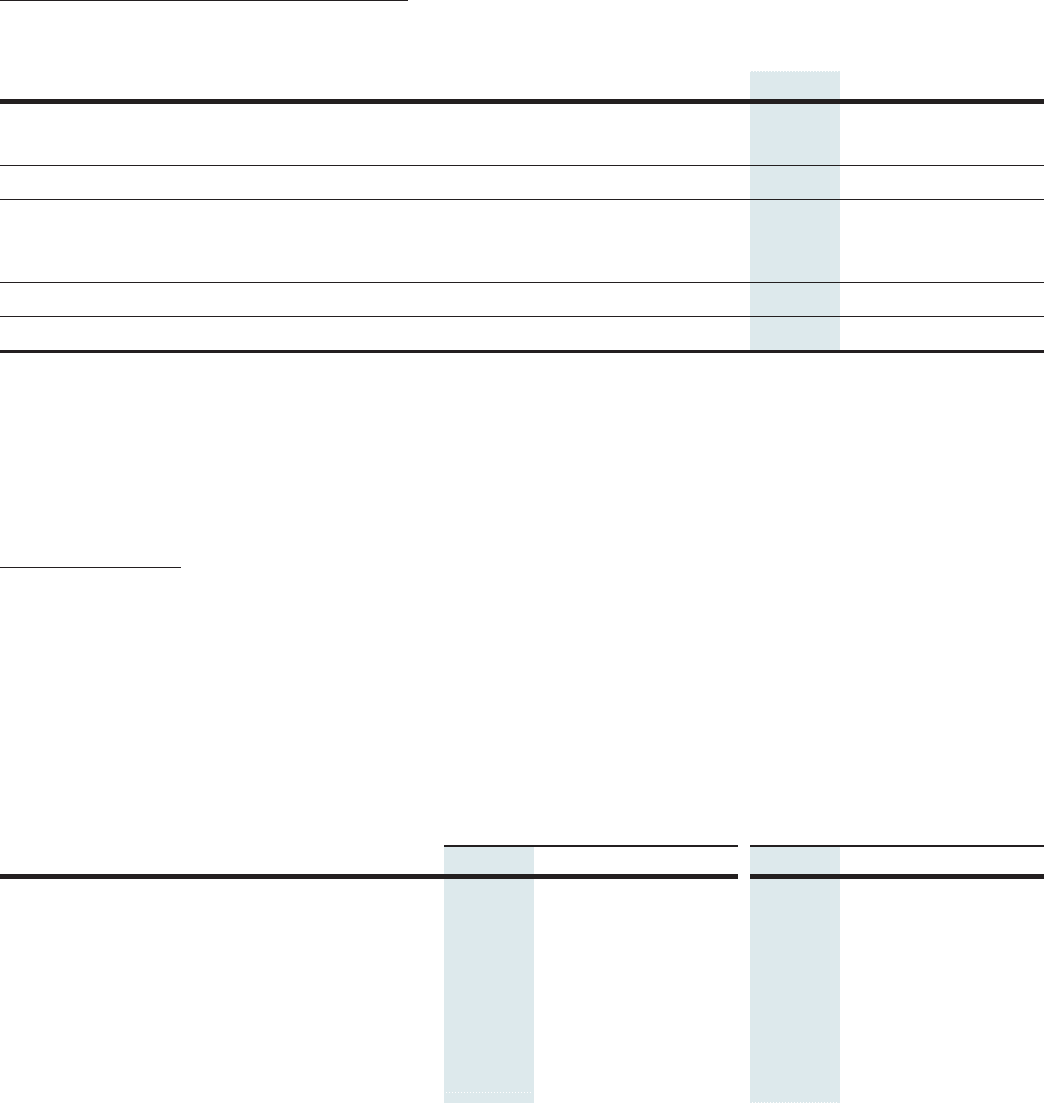

respective years and employee stock purchase rights with subscription dates in the respective years are summarized as follows:

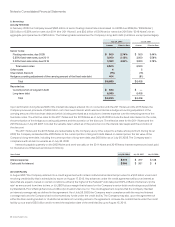

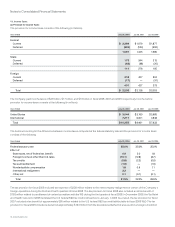

EMPLOYEE STOCK OPTIONS EMPLOYEE STOCK PURCHASE RIGHTS

Years Ended July 26, 2008 July 28, 2007 July 29, 2006 July 26, 2008 July 28, 2007 July 29, 2006

Weighted-average assumptions:

Expected volatility 31.0% 26.0% 23.7% 32.6% 26.1% 27.5%

Risk-free interest rate 4.3% 4.6% 4.3% 2.7% 5.1% 3.4%

Expected dividend 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Kurtosis 4.6 4.5 4.3 N/A N/A N/A

Skewness (0.80) (0.79) (0.62) N/A N/A N/A

Weighted-average expected life (in years) 6.3 6.7 6.6 0.5 0.5 0.5

Weighted-average estimated grant date

fair value (per share) $ 9.60 $ 7.11 $ 5.15 $ 6.12 $ 6.46 $ 4.66