Cisco 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

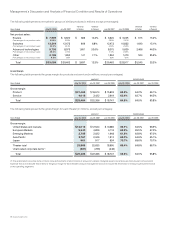

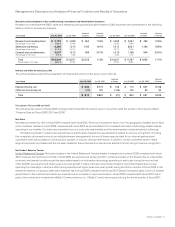

18 Cisco Systems, Inc.

The following selected financial data should be read in conjunction with the Consolidated Financial Statements and related notes which

appear on pages 47 to 82 of this Annual Report:

July 26, 2008 July 28, 2007 July 29, 2006 July 30, 2005 July 31, 2004

Net sales $ 39,540(1) $ 34,922(1) $ 28,484(1) $ 24,801 $ 22,045

Net income $ 8,052(2) $ 7,333(2) $ 5,580(2) $ 5,741 $ 4,401(3)

Net income per share—basic $ 1.35 $ 1.21 $ 0.91 $ 0.88 $ 0.64

Net income per share—diluted $ 1.31 $ 1.17 $ 0.89 $ 0.87 $ 0.62

Shares used in per-share calculation—basic 5,986 6,055 6,158 6,487 6,840

Shares used in per-share calculation—diluted 6,163 6,265 6,272 6,612 7,057

Cash and cash equivalents and investments $ 26,235 $ 22,266 $ 17,814 $ 16,055 $ 19,267

Total assets $ 58,734 $ 53,340 $ 43,315 $ 33,883 $ 35,594

Long-term debt $ 6,393 $ 6,408 $ 6,332 $ — $ —

(1) Includes net sales from Scientific-Atlanta, Inc. (“Scientific-Atlanta”) since its acquisition in February 2006.

(2) Net income for fiscal 2008, 2007, and 2006 included share-based compensation expense under Statement of Financial Accounting Standards No. 123 (revised 2004),

“Share-Based Payment” (“SFAS 123(R)”), of $750 million, $617 million, and $836 million, net of tax, during the respective years. There was no employee share-based

compensation expense under Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”), prior to fiscal 2006

because the Company did not adopt the recognition provisions of SFAS 123. See Note 12 to the Consolidated Financial Statements.

(3) Net income for fiscal 2004 included a noncash charge for the cumulative effect of accounting change relating to share-based compensation expense of $567 million,

net of tax, related to the adoption of the Financial Accounting Standards Board (FASB) Interpretation No. 46(R), “Consolidation of Variable Interest Entities” (“FIN 46(R)”).

Selected Financial Data

Five Years Ended July 26, 2008 (in millions, except per-share amounts)