Cisco 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 65

Notes to Consolidated Financial Statements

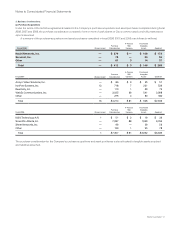

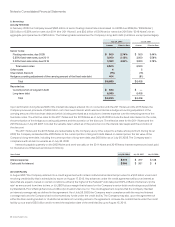

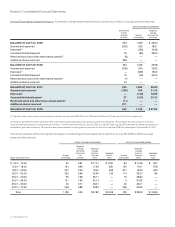

The following tables present the breakdown of the investments with unrealized losses at July 26, 2008 and July 28, 2007 (in millions):

UNREALIZED LOSSES

LESS THAN 12 MONTHS

UNREALIZED LOSSES

12 MONTHS OR GREATER TOTA L

Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

LossesJuly 26, 2008

Fixed income securities:

Government securities $ 1,824 $ (33) $ — $ — $ 1,824 $ (33)

Government agency securities 1,763 (10) — — 1,763 (10)

Corporate debt securities 2,103 (46) 683 (50) 2,786 (96)

Asset-backed securities 368 (14) 117 (4) 485 (18)

Total fixed income securities 6,058 (103) 800 (54) 6,858 (157)

Publicly traded equity securities 370 (57) 32 (19) 402 (76)

Total $ 6,428 $ (160) $ 832 $ (73) $ 7,260 $ (233)

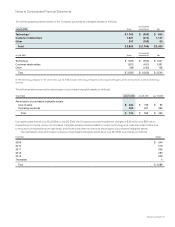

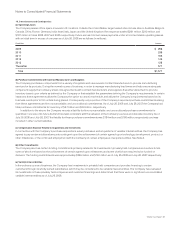

UNREALIZED LOSSES

LESS THAN 12 MONTHS

UNREALIZED LOSSES

12 MONTHS OR GREATER TOTA L

Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

LossesJuly 28, 2007

Fixed income securities:

Government securities $ 278 $ (1) $ 332 $ (3) $ 610 $ (4)

Government agency securities 841 (1) 347 (3) 1,188 (4)

Corporate debt securities 2,288 (18) 1,732 (37) 4,020 (55)

Asset-backed securities 624 (1) 25 (1) 649 (2)

Municipal notes and bonds 645 (1) — — 645 (1)

Total fixed income securities 4,676 (22) 2,436 (44) 7,112 (66)

Publicly traded equity securities 309 (14) — — 309 (14)

Total $ 4,985 $ (36) $ 2,436 $ (44) $ 7,421 $ (80)

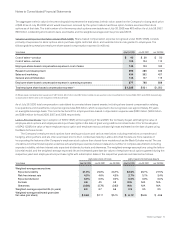

The gross unrealized losses related to fixed income securities as of July 26, 2008 were primarily due to changes in interest rates and

credit market conditions. The gross unrealized losses related to publicly traded equity securities as of July 26, 2008 were due to changes

in market prices. The Company’s management has determined that the gross unrealized losses on its investment securities at July 26,

2008 are temporary in nature. The Company reviews its investments to identify and evaluate investments that have indications of possible

impairment. Factors considered in determining whether a loss is temporary include the length of time and extent to which fair value has

been less than the cost basis, the financial condition and near-term prospects of the investee, and the Company’s intent and ability to hold

the investment for a period of time sufficient to allow for any anticipated recovery in market value. Substantially all of the Company’s fixed

income securities are rated investment grade.

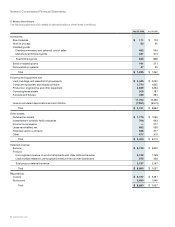

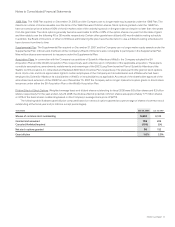

(c) Maturities of Fixed Income Securities

The following table summarizes the maturities of the Company’s fixed income securities at July 26, 2008 (in millions):

Amortized

Cost

Fair

Value

Less than 1 year $ 9,750 $ 9,757

Due in 1 to 2 years 4,096 4,116

Due in 2 to 5 years 5,185 5,170

Due after 5 years 882 826

Total $ 19,913 $ 19,869

Actual maturities may differ from the contractual maturities because borrowers may have the right to call or prepay certain obligations.