Cisco 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 51

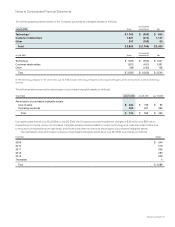

Notes to Consolidated Financial Statements

1. Basis of Presentation

The fiscal year for Cisco Systems, Inc. (the “Company” or “Cisco”) is the 52 or 53 weeks ending on the last Saturday in July. Fiscal 2008,

2007, and 2006 were 52-week fiscal years. The Consolidated Financial Statements include the accounts of Cisco and its subsidiaries.

All significant intercompany accounts and transactions have been eliminated. The Company conducts business globally and is primarily

managed on a geographic basis in the following theaters: United States and Canada; European Markets; Emerging Markets; Asia Pacific;

and Japan. The Emerging Markets theater consists of Eastern Europe, Latin America, the Middle East and Africa, and Russia and the

Commonwealth of Independent States (CIS).

2. Summary of Significant Accounting Policies

(a) Cash and Cash Equivalents The Company considers all highly liquid investments purchased with an original or remaining maturity

of less than three months at the date of purchase to be cash equivalents. Cash and cash equivalents are maintained with various

financial institutions.

(b) Investments The Company’s investments include government and government agency securities, corporate debt securities, asset-

backed securities, municipal notes and bonds, and publicly traded equity securities. These investments are held in the custody of several

major financial institutions. The specific identification method is used to determine the cost basis of fixed income securities disposed of.

The weighted-average method is used to determine the cost basis of publicly traded equity securities disposed of. At July 26, 2008 and

July 28, 2007, the Company’s investments were classified as available-for-sale and these investments are recorded in the Consolidated

Balance Sheets at fair value. Unrealized gains and losses on these investments, to the extent the investments are unhedged, are included

as a separate component of accumulated other comprehensive income, net of tax.

The Company recognizes an impairment charge when a decline in the fair value of its investments below the cost basis is judged to

be other-than-temporary. The Company considers various factors in determining whether to recognize an impairment charge, including

the length of time and extent to which the fair value has been less than the Company’s cost basis, the financial condition and near-term

prospects of the investee, and the Company’s intent and ability to hold the investment for a period of time sufficient to allow for any

anticipated recovery in market value.

The Company also has investments in privately held companies. These investments are included in other assets in the Consolidated

Balance Sheets and are primarily carried at cost. The Company monitors these investments for impairment and makes appropriate

reductions in carrying values if the Company determines that an impairment charge is required based primarily on the financial condition

and near-term prospects of these companies.

(c) Inventories Inventories are stated at the lower of cost or market. Cost is computed using standard cost, which approximates actual cost,

on a first-in, first-out basis. The Company provides inventory write-downs based on excess and obsolete inventories determined primarily

by future demand forecasts. The write down is measured as the difference between the cost of the inventory and market based upon

assumptions about future demand and charged to the provision for inventory, which is a component of cost of sales. At the point of the loss

recognition, a new, lower-cost basis for that inventory is established, and subsequent changes in facts and circumstances do not result

in the restoration or increase in that newly established cost basis. In addition, the Company records a liability for firm, noncancelable, and

unconditional purchase commitments with contract manufacturers and suppliers for quantities in excess of the Company’s future demand

forecasts consistent with its valuation of excess and obsolete inventory.

(d) Allowance for Doubtful Accounts The allowance for doubtful accounts is based on the Company’s assessment of the collectibility of

customer accounts. The Company regularly reviews the allowance by considering factors such as historical experience, credit quality, the

age of the accounts receivable balances, and current economic conditions that may affect a customer’s ability to pay.

(e) Financing Receivables and Guarantees The Company provides financing arrangements, including leases, financed service contracts,

and loans, for certain qualified customers to build, maintain, and upgrade their networks. Lease receivables primarily represent sales-type

and direct-financing leases. Leases and loans typically have two- to three-year terms and are usually collateralized by a security interest in

the underlying assets. The Company maintains an allowance for uncollectible financing receivables based on a variety of factors, including

the risk rating of the portfolio, macroeconomic conditions, historical experience, and other market factors. The Company also provides

financing guarantees, which are generally for various third-party financing arrangements to channel partners and other customers. The

Company could be called upon to make payment under these guarantees in the event of nonpayment to the third party. See Note 6.