Cisco 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 31

Management’s Discussion and Analysis of Financial Condition and Results of Operations

G&A Expenses G&A expenses for fiscal 2008 increased, compared with fiscal 2007, primarily due to increased headcount-related

expenses and increased information technology-related spending.

Effect of Foreign Currency Foreign currency fluctuations, net of hedging, increased total R&D, sales and marketing, and G&A expenses

by $332 million, or approximately 2.5%, in fiscal 2008 compared with fiscal 2007.

Headcount

Our headcount increased by 4,594 employees in fiscal 2008, reflecting the effects of our investments in sales and R&D described above

as well as increased investments in our service business and acquisitions. We expect our headcount to increase as we continue to invest

in our business. If we do not achieve the benefits anticipated from these investments, our operating results may be adversely affected.

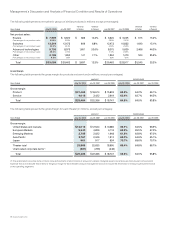

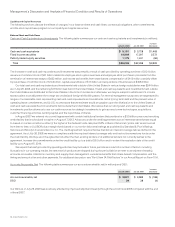

Share-Based Compensation Expense

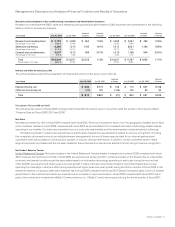

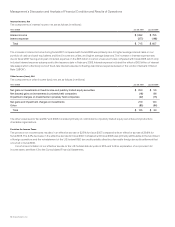

Employee share-based compensation expense under SFAS 123(R) was as follows (in millions):

Years Ended July 26, 2008 July 28, 2007

Cost of sales—product $ 40 $ 39

Cost of sales—service 108 104

Employee share-based compensation expense in cost of sales 148 143

Research and development 295 289

Sales and marketing 434 392

General and administrative 148 107

Employee share-based compensation expense in operating expenses 877 788

Total employee share-based compensation expense(1) $ 1,025 $ 931

(1) Share-based compensation expense related to acquisitions and investments of $87 million and $34 million for fiscal 2008 and 2007, respectively, is disclosed in

Note 3 to the Consolidated Financial Statements and is not included in the above table.

Share-based compensation expense included compensation expense for share-based payment awards granted prior to, but not yet

vested, as of July 30, 2005 based on the grant date fair value using the Black-Scholes model, and compensation expense for share-based

payment awards granted subsequent to July 30, 2005 based on the grant date fair value using the lattice-binomial model. In conjunction

with the adoption of SFAS 123(R), we changed our method of attributing the value of share-based compensation to expense from the

accelerated multiple-option approach to the straight-line single-option method. Compensation expense for all share-based payment

awards granted on or prior to July 30, 2005 is recognized using the accelerated multiple-option approach, whereas compensation expense

for all share-based payment awards granted subsequent to July 30, 2005 is recognized using the straight-line single-option method.

Employee share-based compensation expense for fiscal 2008 increased compared with fiscal 2007 primarily due to the higher average

per share option values during fiscal 2008 compared with fiscal 2007.

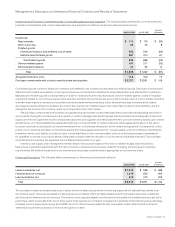

Amortization of Purchased Intangible Assets and In-Process Research and Development

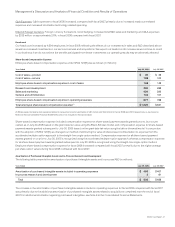

The following table presents the amortization of purchased intangible assets and in-process R&D (in millions):

Years Ended July 26, 2008 July 28, 2007

Amortization of purchased intangible assets included in operating expenses $ 499 $ 407

In-process research and development 3 81

Total $ 502 $ 488

The increase in the amortization of purchased intangible assets included in operating expenses for fiscal 2008 compared with fiscal 2007

was primarily due to the additional amortization of purchased intangible assets related to acquisitions completed near the end of fiscal

2007. For additional information regarding purchased intangibles, see Note 4 to the Consolidated Financial Statements.