Cisco 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

(f) Guarantees and Product Warranties

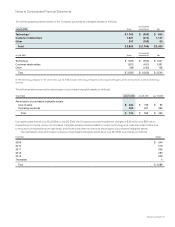

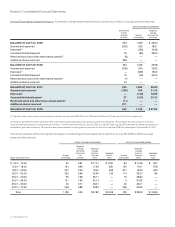

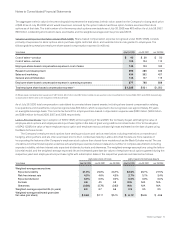

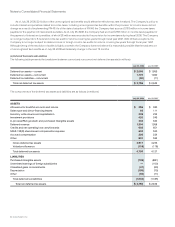

The following table summarizes the activity related to the product warranty liability during fiscal 2008 and 2007 (in millions):

July 26, 2008 July 28, 2007

Balance at beginning of fiscal year $ 340 $ 309

Provision for warranties issued 511 510

Payments (455) (479)

Fair value of warranty liability acquired 3 —

Balance at end of fiscal year $ 399 $ 340

The Company accrues for warranty costs as part of its cost of sales based on associated material product costs, labor costs for technical

support staff, and associated overhead. The products sold are generally covered by a warranty for periods ranging from 90 days to five

years, and for some products the Company provides a limited lifetime warranty.

In the normal course of business, the Company indemnifies other parties, including customers, lessors, and parties to other

transactions with the Company, with respect to certain matters. The Company has agreed to hold the other parties harmless against

losses arising from a breach of representations or covenants, or out of intellectual property infringement or other claims made against

certain parties. These agreements may limit the time within which an indemnification claim can be made and the amount of the claim. In

addition, the Company has entered into indemnification agreements with its officers and directors, and the Company’s bylaws contain

similar indemnification obligations to the Company’s agents. It is not possible to determine the maximum potential amount under these

indemnification agreements due to the Company’s limited history with prior indemnification claims and the unique facts and circumstances

involved in each particular agreement. Historically, payments made by the Company under these agreements have not had a material

effect on the Company’s operating results, financial position, or cash flows.

The Company also provides financing guarantees, which are generally for various third-party financing arrangements to channel

partners and other customers. See Note 6. The Company’s other arrangements as of July 26, 2008 that were subject to recognition and

disclosure requirements under FIN 45 were not material.

(g) Legal Proceedings

The Company and other defendants were subject to claims asserted by Telcordia Technologies, Inc. on July 16, 2004 in the Federal District

Court for the District of Delaware alleging that various Cisco routers, switches and optical products infringed United States Patent Nos.

4,893,306, 4,835,763, and Re 36,633. Telcordia sought damages and injunctive relief. The Court ruled that, as a matter of law, the Company

does not infringe Patent No. 4,893,306. After conclusion of a trial, on May 10, 2007, a jury found that infringement had occurred on the other

patents and awarded damages in an amount that is not material to the Company. The Company has asked the Court to reverse the verdict

as a matter of law, and if necessary, the Company intends to appeal the decision. Telcordia has asked the Court to enhance damages and

award it attorneys’ fees and also has the right to appeal. The Company believes that the ultimate outcome of this matter and aggregate

potential damages will not be material.

Brazilian authorities are investigating certain employees of the Company’s Brazilian subsidiary and certain employees of a Brazilian

importer of the Company’s products relating to the allegation of evading import taxes and other alleged improper transactions involving the

subsidiary and the importer. The Company is conducting a thorough review of the matter. To date, Brazilian authorities have not asserted a

claim against the Company. The Company is unable to determine the likelihood of an unfavorable outcome on any potential claims against

it or to reasonably estimate a range of loss, if any. In addition, the Company is investigating the allegations regarding improper transactions,

the Company has proactively communicated with United States authorities to provide information and report on its findings, and the

United States authorities are currently investigating such allegations.

In addition, the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of business, including

intellectual property litigation. While the outcome of these matters is currently not determinable, the Company does not expect that the

ultimate costs to resolve these matters will have a material adverse effect on its consolidated financial position, results of operations,

or cash flows.