Cisco 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

(d) Financing Guarantees

The Company provides financing guarantees, which are generally for various third-party financing arrangements extended to channel

partners and other customers. The Company could be called upon to make payment under these guarantees in the event of nonpayment

to the third party. As of July 26, 2008, the total maximum potential future payments related to these guarantees was approximately

$830 million, of which approximately $610 million was recorded as deferred revenue on the consolidated balance sheet in accordance

with revenue recognition policies and FIN 45.

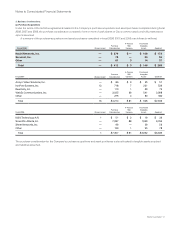

7. Investments

(a) Summary of Investments

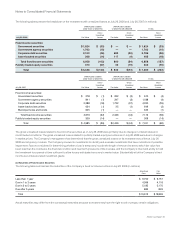

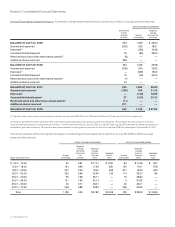

The following tables summarize the Company’s investments (in millions):

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

ValueJuly 26, 2008

Fixed income securities:

Government securities $ 7,249 $ 50 $ (33) $ 7,266

Government agency securities 5,815 34 (10) 5,839

Corporate debt securities 5,814 24 (96) 5,742

Asset-backed securities 1,035 5 (18) 1,022

Total fixed income securities 19,913 113 (157) 19,869

Publicly traded equity securities 860 391 (76) 1,175

Total $ 20,773 $ 504 $ (233) $ 21,044

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

ValueJuly 28, 2007

Fixed income securities:

Government securities $ 4,557 $ 25 $ (4) $ 4,578

Government agency securities 2,362 4 (4) 2,362

Corporate debt securities 6,895 5 (55) 6,845

Asset-backed securities 1,870 2 (2) 1,870

Municipal notes and bonds 1,643 — (1) 1,642

Total fixed income securities 17,327 36 (66) 17,297

Publicly traded equity securities 901 354 (14) 1,241

Total $ 18,228 $ 390 $ (80) $ 18,538

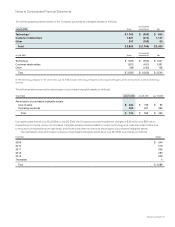

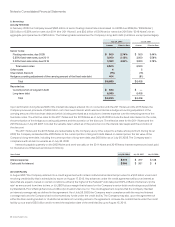

(b) Gains and Losses on Investments

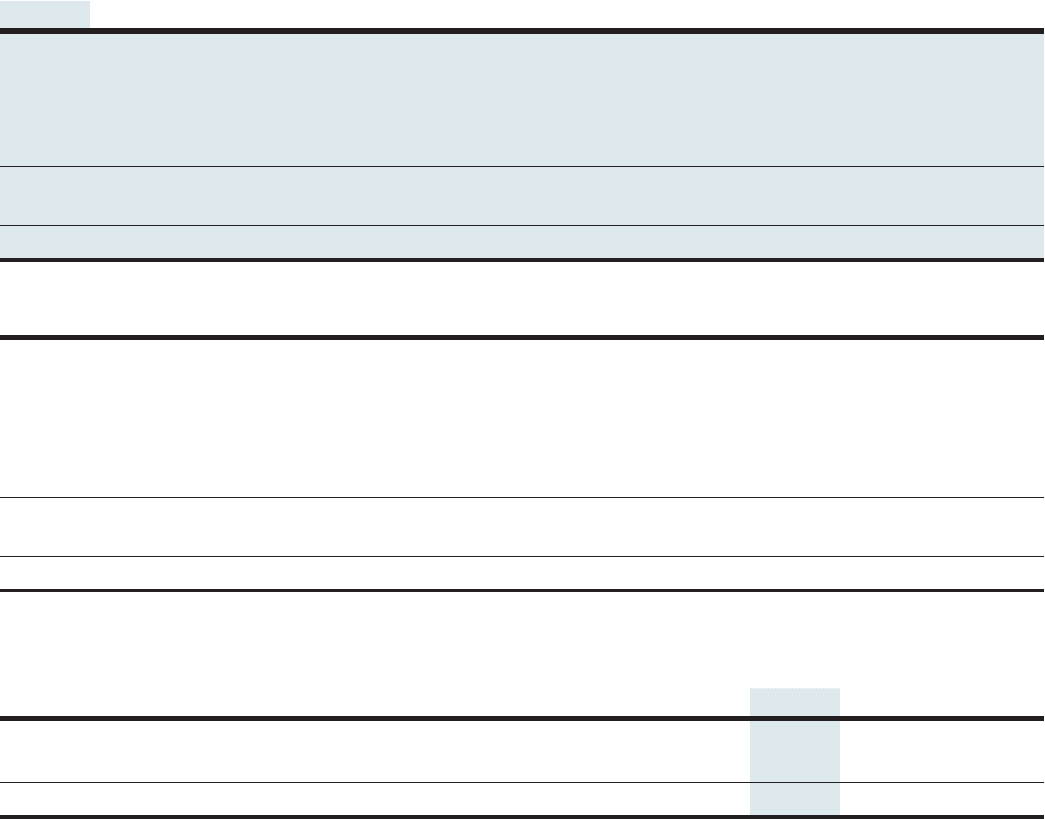

The following table presents gross realized gains and losses related to the Company’s investments (in millions):

Years Ended July 26, 2008 July 28, 2007 July 29, 2006

Gross realized gains $ 306 $ 269 $ 141

Gross realized losses (197) (19) (88)

Total $ 109 $ 250 $ 53