Cisco 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

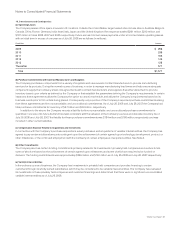

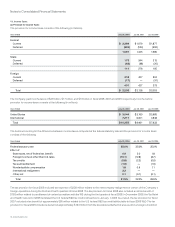

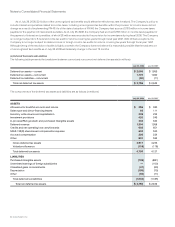

13. Income Taxes

(a) Provision for Income Taxes

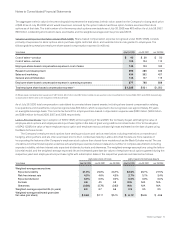

The provision for income taxes consists of the following (in millions):

Years Ended July 26, 2008 July 28, 2007 July 29, 2006

Federal:

Current $ 2,384 $ 1,979 $ 1,877

Deferred (693) (554) (292)

1,691 1,425 1,585

State:

Current 173 344 215

Deferred (62) (68) (20)

111 276 195

Foreign:

Current 418 427 304

Deferred (17) — (31)

401 427 273

Total $ 2,203 $ 2,128 $ 2,053

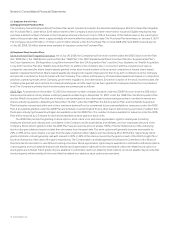

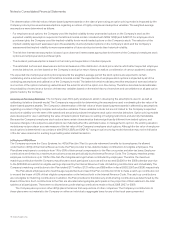

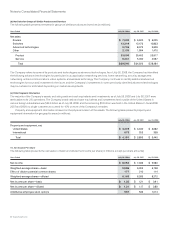

The Company paid income taxes of $2.8 billion, $1.7 billion, and $1.6 billion in fiscal 2008, 2007, and 2006, respectively. Income before

provision for income taxes consists of the following (in millions):

Years Ended July 26, 2008 July 28, 2007 July 29, 2006

United States $ 3,044 $ 3,160 $ 2,685

International 7,211 6,301 4,948

Total $ 10,255 $ 9,461 $ 7,633

The items accounting for the difference between income taxes computed at the federal statutory rate and the provision for income taxes

consists of the following:

Years Ended July 26, 2008 July 28, 2007 July 29, 2006

Federal statutory rate 35.0% 35.0% 35.0%

Effect of:

State taxes, net of federal tax benefit 0.9 2.0 1.8

Foreign income at other than U.S. rates (16.1) (12.8) (8.7)

Tax credits (0.8) (2.2) (0.6)

Tax audit settlement (1.6) — (1.6)

Nondeductible compensation 1.8 0.6 1.1

International realignment 2.2 — —

Other, net 0.1 (0.1) (0.1)

Total 21.5% 22.5% 26.9%

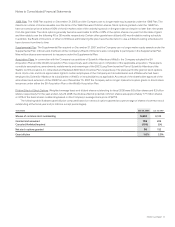

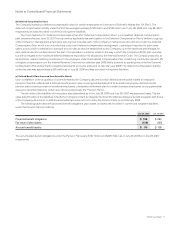

The tax provision for fiscal 2008 included tax expense of $229 million related to the intercompany realignment of certain of the Company’s

foreign operations during the third and fourth quarters of fiscal 2008. The tax provision for fiscal 2008 also included a net tax benefit of

$162 million related to a settlement of certain tax matters with the IRS during the first quarter of fiscal 2008. In December 2006, the Tax Relief

and Health Care Act of 2006 reinstated the U.S. federal R&D tax credit, retroactive to January 1, 2006. As a result, the tax provision for fiscal

2007 included a tax benefit of approximately $60 million related to the U.S. federal R&D tax credit attributable to fiscal 2006 R&D. The tax

provision for fiscal 2006 included a benefit of approximately $124 million from the favorable settlement of a tax audit in a foreign jurisdiction.