Cisco 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 Cisco Systems, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Factors That May Impact Net Sales and Gross Margin

Net product sales may continue to be affected by factors including the challenges that are currently affecting economic conditions in the

United States; changes in the geopolitical environment and global economic conditions; competition, including price-focused competitors

from Asia, especially from China; new product introductions; sales cycles and product implementation cycles; changes in the mix of our

customers between service provider and enterprise markets; changes in the mix of direct sales and indirect sales; variations in sales

channels; and final acceptance criteria of the product, system, or solution as specified by the customer. Sales to the service provider

market have been characterized by large and sporadic purchases, especially relating to our router sales and sales of certain advanced

technologies. In addition, service provider customers typically have longer implementation cycles, require a broader range of services,

including network design services, and often have acceptance provisions that can lead to a delay in revenue recognition. Certain of our

customers in the Emerging Markets theater also tend to make large and sporadic purchases and the net sales related to these transactions

may similarly be affected by the timing of revenue recognition. As we focus on new market opportunities, customers may require greater

levels of financing arrangements, service, and support, especially in the Emerging Markets theater, which may result in a delay in the timing

of revenue recognition. To improve customer satisfaction, we continue to focus on managing our manufacturing lead-time performance,

which may result in corresponding reductions in order backlog. A decline in backlog levels could result in more variability and less

predictability in our quarter-to-quarter net sales and operating results.

Net product sales may also be adversely affected by fluctuations in demand for our products, especially with respect to Internet

businesses and telecommunications service providers, whether or not driven by any slowdown in capital expenditures in the service

provider market, price and product competition in the communications and information technology industry, introduction and market

acceptance of new technologies and products, adoption of new networking standards, and financial difficulties experienced by our

customers. We may, from time to time, experience manufacturing issues that create a delay in our suppliers’ ability to provide specific

components, resulting in delayed shipments. To the extent that manufacturing issues and any related component shortages result in

delayed shipments in the future, and particularly in periods when we and our suppliers are operating at higher levels of capacity, it is

possible that revenue for a quarter could be adversely affected if such matters are not remediated within the same quarter. For additional

factors that may impact net product sales, see “Part I, Item 1A. Risk Factors” in our Annual Report on Form 10-K. Our distributors and retail

partners participate in various cooperative marketing and other programs. In addition, increasing sales to our distributors and retail partners

generally results in greater difficulty in forecasting the mix of our products and, to a certain degree, the timing of orders from our customers.

We recognize revenue for sales to our distributors and retail partners based on a sell-through method using information provided by them,

and we maintain estimated accruals and allowances for all cooperative marketing and other programs.

Product gross margin may be adversely affected in the future by changes in the mix of products sold, including further periods

of increased growth of some of our lower-margin products; introduction of new products, including products with price-performance

advantages; our ability to reduce production costs; entry into new markets, including markets with different pricing structures and cost

structures, as a result of internal development or through acquisitions; changes in distribution channels; price competition, including

competitors from Asia, especially from China; changes in geographic mix of our product sales; the timing of revenue recognition and

revenue deferrals; sales discounts; increases in material or labor costs; excess inventory and obsolescence charges; warranty costs;

changes in shipment volume; loss of cost savings due to changes in component pricing; effects of value engineering; inventory holding

charges; and the extent to which we successfully execute on our strategy and operating plans. Service gross margin may be impacted

by various factors such as the change in mix between technical support services and advanced services, the timing of technical support

service contract initiations and renewals, and the timing of our strategic investments in headcount and resources to support this business.

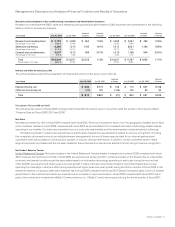

Research and Development, Sales and Marketing, and General and Administrative Expenses

R&D Expenses R&D expenses increased in fiscal 2008 compared with fiscal 2007 primarily due to higher headcount-related expenses

and compensation expense related to our purchase of the minority interest in Nuova Systems, Inc. (“Nuova Systems”). See Note 3 to the

Consolidated Financial Statements. The higher headcount-related expenses reflect our continued investment in R&D efforts for routers,

switches, advanced technologies, and other product technologies. We have also continued to purchase or license technology in order to

bring a broad range of products to market in a timely fashion. If we believe that we are unable to enter a particular market in a timely manner

with internally developed products, we may license technology from other businesses or acquire businesses as an alternative to internal

R&D. All of our R&D costs have been expensed as incurred.

Sales and Marketing Expenses Sales and marketing expenses in fiscal 2008 increased compared with fiscal 2007 primarily due to an

increase in sales expenses of approximately $935 million. Sales expenses increased primarily due to an increase in headcount-related

expenses including the addition of sales expenses related to WebEx, which we acquired in the fourth quarter of fiscal 2007. Foreign

currency fluctuations, net of hedging, increased total sales and marketing expenses by approximately $250 million during fiscal 2008

compared with fiscal 2007.