Cisco 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 73

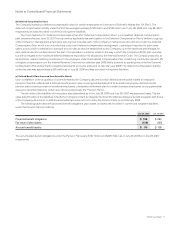

Notes to Consolidated Financial Statements

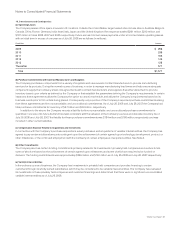

1996 Plan The 1996 Plan expired on December 31, 2006, and the Company can no longer make equity awards under the 1996 Plan. The

maximum number of shares issuable over the term of the 1996 Plan was 2.5 billion shares. Stock options granted under the 1996 Plan

have an exercise price of at least 100% of the fair market value of the underlying stock on the grant date and expire no later than nine years

from the grant date. The stock options generally become exercisable for 20% or 25% of the option shares one year from the date of grant

and then ratably over the following 48 or 36 months, respectively. Certain other grants have utilized a 60-month ratable vesting schedule.

In addition, the Board of Directors, or other committees administering the plan, have the discretion to use a different vesting schedule and

have done so from time to time.

Supplemental Plan The Supplemental Plan expired on December 31, 2007, and the Company can no longer make equity awards under the

Supplemental Plan. Officers and members of the Company’s Board of Directors were not eligible to participate in the Supplemental Plan.

Nine million shares were reserved for issuance under the Supplemental Plan.

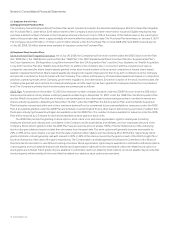

Acquisition Plans In connection with the Company’s acquisitions of Scientific-Atlanta and WebEx, the Company adopted the SA

Acquisition Plan and the WebEx Acquisition Plan, respectively, each effective upon completion of the applicable acquisition. These plans

constitute assumptions, amendments, restatements, and renamings of the 2003 Long-Term Incentive Plan of Scientific-Atlanta and the

WebEx Communications, Inc. Amended and Restated 2000 Stock Incentive Plan, respectively. The plans permit the grant of stock options,

stock, stock units, and stock appreciation rights to certain employees of the Company and its subsidiaries and affiliates who had been

employed by Scientific-Atlanta or its subsidiaries or WebEx or its subsidiaries, as applicable. As a result of the shareholder approval of the

amendment and extension of the 2005 Plan, as of November 15, 2007, the Company will no longer make stock option grants or direct share

issuances under either the SA Acquisition Plan or the WebEx Acquisition Plan.

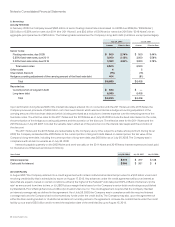

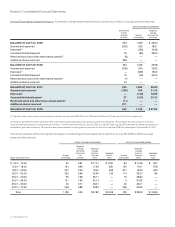

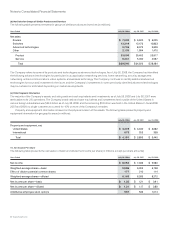

Dilutive Effect of Stock Options Weighted-average basic and diluted shares outstanding for fiscal 2008 were 6.0 billion shares and 6.2 billion

shares, respectively. For the year ended July 26, 2008, the dilutive effect of potential common shares was approximately 177 million shares

or 3.0% of the basic shares outstanding based on the Company’s average share price of $27.15.

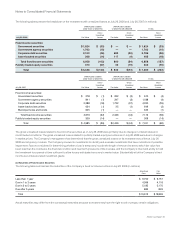

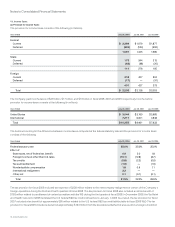

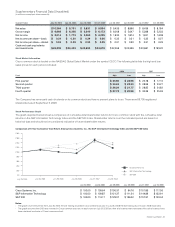

The following table illustrates grant dilution computed based on net stock options granted as a percentage of shares of common stock

outstanding at the fiscal year end (in millions, except percentages):

Years Ended July 26, 2008 July 28, 2007

Shares of common stock outstanding 5,893 6,100

Granted and assumed 159 206

Canceled/forfeited/expired (103) (54)

Net stock options granted 56 152

Grant dilution 1.0% 2.5%