Cisco 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

8. Borrowings

(a) Long-Term Debt

In February 2006, the Company issued $500 million of senior floating interest rate notes based on LIBOR due 2009 (the “2009 Notes”),

$3.0 billion of 5.25% senior notes due 2011 (the “2011 Notes”), and $3.0 billion of 5.50% senior notes due 2016 (the “2016 Notes”), for an

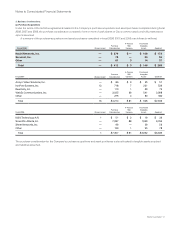

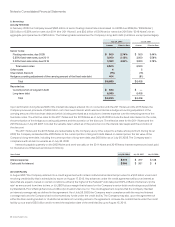

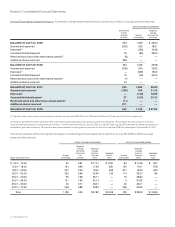

aggregate principal amount of $6.5 billion. The following table summarizes the Company’s long-term debt (in millions, except percentages):

July 26, 2008 July 28, 2007

Amount Effective Rate Amount Effective Rate

Senior notes:

Floating-rate notes, due 2009 $ 500 2.74% $ 500 5.44%

5.25% fixed-rate notes, due 2011 3,000 3.12% 3,000 5.56%

5.50% fixed-rate notes, due 2016 3,000 4.34% 3,000 5.79%

Total senior notes 6,500 6,500

Other notes 4 5

Unaccreted discount (15) (16)

Hedge accounting adjustment of the carrying amount of the fixed-rate debt 404 (81)

Total $ 6,893 $ 6,408

Reported as:

Current portion of long-term debt $ 500 $ —

Long-term debt 6,393 6,408

Total $ 6,893 $ 6,408

Upon termination during fiscal 2008 of the interest rate swaps entered into in connection with the 2011 Notes and the 2016 Notes, the

Company received proceeds of $432 million, net of accrued interest, which was recorded as a hedge accounting adjustment of the

carrying amount of the fixed-rate debt and which is being amortized as a reduction to interest expense over the remaining terms of the

fixed-rate notes. The effective rates for the 2011 Notes and the 2016 Notes as of July 26, 2008 include the fixed rate interest on the notes,

the amortization of the hedge accounting adjustment and the accretion of the discount. The effective rates for the 2011 Notes and the

2016 Notes as of July 28, 2007 included the variable rate in effect as of the period end on the interest rate swaps and the accretion of

the discount.

The 2011 Notes and the 2016 Notes are redeemable by the Company at any time, subject to a make-whole premium. During fiscal

2008, the Company reclassified the 2009 Notes to the current portion of long-term debt. Based on market prices, the fair value of the

Company’s long-term debt, including the current portion of long-term debt, was $6.6 billion as of July 26, 2008. The Company was in

compliance with all debt covenants as of July 26, 2008.

Interest is payable quarterly on the 2009 Notes and semi-annually on the 2011 Notes and 2016 Notes. Interest expense and cash paid

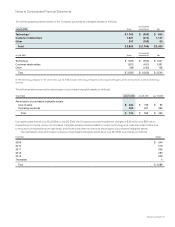

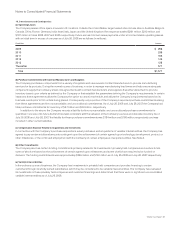

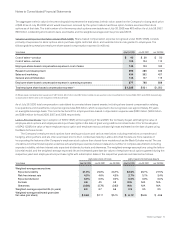

for interest are summarized as follows (in millions):

Years Ended July 26, 2008 July 28, 2007 July 29, 2006

Interest expense $ 319 $ 377 $ 148

Cash paid for interest $ 366 $ 361 $ 6

(b) Credit Facility

In August 2007 the Company entered into a credit agreement with certain institutional lenders that provides for a $3.0 billion unsecured

revolving credit facility that is scheduled to expire on August 17, 2012. Any advances under the credit agreement will accrue interest at

rates that are equal to, based on certain conditions, either (i) the higher of the Federal Funds rate plus 0.50% or Bank of America’s “prime

rate” as announced from time to time, or (ii) LIBOR plus a margin that is based on the Company’s senior debt credit ratings as published

by Standard & Poor’s Ratings Services and Moody’s Investors Service, Inc. The credit agreement requires that the Company maintain

an interest coverage ratio as defined in the agreement. As of July 26, 2008, the Company was in compliance with the required interest

coverage ratio and the Company had not borrowed any funds under the credit facility. The Company may also, upon the agreement of

either the then existing lenders or of additional lenders not currently parties to the agreement, increase the commitments under the credit

facility up to a total of $5.0 billion and/or extend the expiration date of the credit facility up to August 15, 2014.