Cisco 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 77

Notes to Consolidated Financial Statements

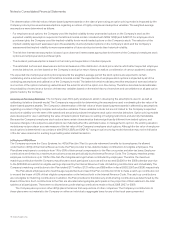

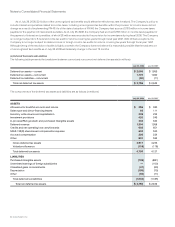

(d) Deferred Compensation Plans

The Company maintains a deferred compensation plan for certain employees and directors of Scientific-Atlanta (the “SA Plan”). The

deferred compensation liability under the SA Plan was approximately $126 million and $109 million, as of July 26, 2008 and July 28, 2007,

respectively, and was recorded in current and long-term liabilities.

The Cisco Systems, Inc. Deferred Compensation Plan (the “Deferred Compensation Plan”), a nonqualified deferred compensation

plan, became effective June 25, 2007. As required by applicable law, participation in the Deferred Compensation Plan is limited to a group

of the Company’s management employees, which group includes each of the Company’s named executive officers. Under the Deferred

Compensation Plan, which is an unfunded and unsecured deferred compensation arrangement, a participant may elect to defer base

salary, bonus, and/or commissions, pursuant to such rules as may be established by the Company, up to the maximum percentages for

each deferral election as described in the plan. This operates in a manner similar to the way in which the Company’s 401(k) plan operates,

but without regard to the maximum deferral limitations imposed on 401(k) plans by the Internal Revenue Code. The Company may also, at

its discretion, make a matching contribution to the employee under the Deferred Compensation Plan. A matching contribution equal to 4%

of eligible compensation over the Internal Revenue Code limit for calendar year 2008 that is deferred by participants under the Deferred

Compensation Plan will be made to eligible participants’ accounts at the end of calendar year 2008. The deferred compensation liability

under this plan was approximately $45 million as of July 26, 2008 and was recorded in long-term liabilities.

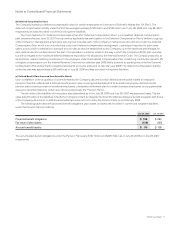

(e) Defined Benefit Plans Assumed from Scientific-Atlanta

Upon completion of the acquisition of Scientific-Atlanta, the Company assumed certain defined benefit plans related to employee

pensions. Scientific-Atlanta had a defined benefit pension plan covering substantially all of its domestic employees, defined benefit

pension plans covering certain international employees, a restoration retirement plan for certain domestic employees, and supplemental

executive retirement plans for certain key officers (collectively, the “Pension Plans”).

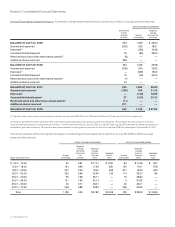

The fair value of the liabilities of these plans was determined as of the July 26, 2008 and July 28, 2007 measurement dates. The fair

value determination of the liabilities reflects the Company’s intent to integrate the Scientific-Atlanta employee benefit programs with those

of the Company. As a result, no additional benefits have been accrued under the Pension Plans since February 2008.

The following table sets forth projected benefit obligations, plan assets, and amounts recorded in current and long-term liabilities

under the Pension Plans (in millions):

July 26, 2008 July 28, 2007

Projected benefit obligations $ 199 $ 234

Fair value of plan assets (109) (125)

Accrued benefit liability $ 90 $ 109

The accumulated benefit obligations under the Pension Plans were $197 million and $225 million as of July 26, 2008 and July 28, 2007,

respectively.