Cisco 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 59

Notes to Consolidated Financial Statements

This information is presented for informational purposes only and is not indicative of the results of operations that would have been

achieved if the acquisition of Scientific-Atlanta and issuance of $6.5 billion of debt (see Note 8) had taken place at the beginning of fiscal

2006. The debt was issued to finance the acquisition of Scientific-Atlanta as well as for general corporate purposes. For the purposes

of this pro forma financial information, the interest expense on the entire debt, including the effects of hedging, were included in the pro

forma financial adjustments. The pro forma financial information also included incremental share-based compensation expense due to

the acceleration of Scientific-Atlanta employee stock options prior to the acquisition date, investment banking fees, and other acquisition-

related costs, recorded in Scientific-Atlanta’s historical results of operations during February 2006. In addition, the pro forma financial

information also included the purchase accounting adjustments on historical Scientific-Atlanta inventory, adjustments to depreciation on

acquired property and equipment, a charge for in-process research and development, amortization charges from acquired intangible

assets, adjustments to interest income, and related tax effects.

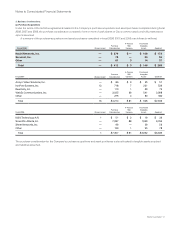

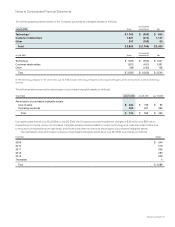

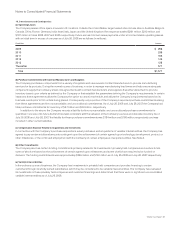

The following table summarizes the pro forma financial information (in millions, except per-share amounts):

Year Ended July 29, 2006

Net sales $ 29,632

Net income $ 5,366

Net income per share—basic $ 0.87

Net income per share—diluted $ 0.86

(c) Compensation Expense Related to Acquisitions and Investments

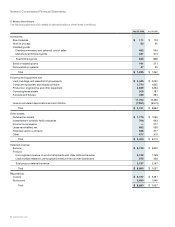

The following table presents the compensation expense related to acquisitions and investments (in millions):

Years Ended July 26, 2008 July 28, 2007 July 29, 2006

Share-based compensation expense $ 87 $ 34 $ 87

Cash compensation expense 340 59 36

Total $ 427 $ 93 $ 123

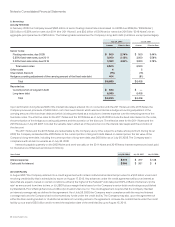

Share-Based Compensation Expense Beginning in fiscal 2006, share-based compensation related to acquisitions and investments is

measured under SFAS 123(R) and includes deferred share-based compensation relating to acquisitions completed prior to fiscal 2006. As

of July 26, 2008, the remaining balance of share-based compensation related to acquisitions and investments to be recognized over the

vesting periods was $245 million.

Cash Compensation Expense In connection with the Company’s purchase acquisitions, asset purchases, and acquisitions of variable

interest entities, the Company has agreed to pay certain additional amounts contingent upon the achievement of certain agreed-upon

technology, development, product, or other milestones, or the continued employment with the Company of certain employees of the

acquired entities. In each case, any additional amounts paid will be recorded as compensation expense. As of July 26, 2008, the Company

may be required to recognize future compensation expense pursuant to these agreements of up to $558 million, including the remaining

potential amount of additional compensation expense related to Nuova Systems, Inc., as discussed below.

Nuova Systems, Inc. During fiscal 2008, the Company purchased the remaining interests in Nuova Systems, Inc. not previously held by

the Company, representing approximately 20% of Nuova Systems. Under the terms of the merger agreement, the former minority interest

holders of Nuova Systems are eligible to receive up to three milestone payments based on agreed-upon formulas. As a result, during 2008

the Company recorded compensation expense of $277 million related to the fair value of amounts that are expected to be earned by the

minority interest holders pursuant to a vesting schedule. Actual amounts payable to the former minority interest holders of Nuova Systems

will depend upon achievement under the agreed-upon formulas.

Subsequent changes to the fair value of the amounts probable of being earned and the continued vesting will result in adjustments to

the recorded compensation expense. The potential amount that could be recorded as compensation expense may be up to a maximum of

$678 million, including the amount that has been expensed as of the end of fiscal 2008. The compensation is expected to be paid during

fiscal 2010 through fiscal 2012.