Cisco 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24 Cisco Systems, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

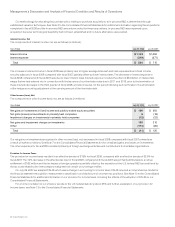

Income Taxes

We are subject to income taxes in the United States and numerous foreign jurisdictions. Our effective tax rates differ from the statutory rate

primarily due to the tax impact of state taxes, foreign operations, R&D tax credits, tax audit settlements, nondeductible compensation, and

international realignments. Our effective tax rate was 21.5%, 22.5%, and 26.9% in fiscal 2008, 2007, and 2006, respectively.

Effective at the beginning of the first quarter of 2008, we adopted Financial Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes-an interpretation of FASB Statement No. 109” (“FIN 48”), which is a change in accounting for income taxes. FIN 48 contains a two-

step approach to recognizing and measuring uncertain tax positions accounted for in accordance with Statement of Financial Accounting

Standards (SFAS) No. 109, “Accounting for Income Taxes” (“SFAS 109”). The first step is to evaluate the tax position for recognition by

determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained on audit, including

resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest amount that is more

than 50% likely of being realized upon settlement. As a result of the implementation of FIN 48, we reduced the liability for net unrecognized

tax benefits by $451 million and accounted for the reduction as a cumulative effect of a change in accounting principle that resulted in an

increase to retained earnings of $202 million and an increase to additional paid-in capital of $249 million. See Note 13 to the Consolidated

Financial Statements for additional information.

Significant judgment is required in evaluating our uncertain tax positions and determining our provision for income taxes. Although

we believe our reserves are reasonable, no assurance can be given that the final tax outcome of these matters will not be different

from that which is reflected in our historical income tax provisions and accruals. We adjust these reserves in light of changing facts and

circumstances, such as the closing of a tax audit or the refinement of an estimate. To the extent that the final tax outcome of these matters is

different than the amounts recorded, such differences will affect the provision for income taxes in the period in which such determination

is made. The provision for income taxes includes the effect of reserve provisions and changes to reserves that are considered appropriate,

as well as the related net interest.

Significant judgment is also required in determining any valuation allowance recorded against deferred tax assets. In assessing the

need for a valuation allowance, we consider all available evidence, including past operating results, estimates of future taxable income, and

the feasibility of tax planning strategies. In the event that we change our determination as to the amount of deferred tax assets that can be

realized, we will adjust our valuation allowance with a corresponding effect to the provision for income taxes in the period in which such

determination is made.

Our provision for income taxes is subject to volatility and could be adversely impacted by earnings being lower than anticipated in

countries that have lower tax rates and higher than anticipated in countries that have higher tax rates; by changes in the valuation of our

deferred tax assets and liabilities; by expiration of or lapses in the R&D tax credit laws; by transfer pricing adjustments including the post-

acquisition integration of purchased intangible assets from certain acquisitions into our intercompany R&D cost sharing arrangement;

by tax effects of nondeductible compensation; by tax costs related to intercompany realignments; or by changes in tax laws, regulations,

or accounting principles, including accounting for uncertain tax positions or interpretations thereof. Significant judgment is required

to determine the recognition and measurement attribute prescribed in FIN 48. In addition, FIN 48 applies to all income tax positions,

including the potential recovery of previously paid taxes, which if settled unfavorably could adversely affect our provision for income taxes

or additional paid-in capital. Further, as a result of certain of our ongoing employment and capital investment actions and commitments,

our income in certain countries is subject to reduced tax rates and in some cases is wholly exempt from tax. Our failure to meet these

commitments could adversely affect our provision for income taxes. In addition, we are subject to the continuous examination of our income

tax returns by the Internal Revenue Service and other tax authorities. We regularly assess the likelihood of adverse outcomes resulting

from these examinations to determine the adequacy of our provision for income taxes. There can be no assurance that the outcomes from

these continuous examinations will not have an adverse impact on our operating results and financial condition.

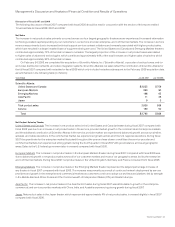

Loss Contingencies

We are subject to the possibility of various losses arising in the ordinary course of business. We consider the likelihood of loss or

impairment of an asset or the incurrence of a liability, as well as our ability to reasonably estimate the amount of loss, in determining loss

contingencies. An estimated loss contingency is accrued when it is probable that an asset has been impaired or a liability has been

incurred and the amount of loss can be reasonably estimated. We regularly evaluate current information available to us to determine

whether such accruals should be adjusted and whether new accruals are required.

Third parties, including customers, have in the past and may in the future assert claims or initiate litigation related to exclusive

patent, copyright, trademark, and other intellectual property rights to technologies and related standards that are relevant to us. These

assertions have increased over time as a result of our growth and the general increase in the pace of patent claims assertions, particularly

in the United States. If any infringement or other intellectual property claim made against us by any third party is successful, or if we fail

to develop non-infringing technology or license the proprietary rights on commercially reasonable terms and conditions, our business,

operating results, and financial condition could be materially and adversely affected.