Cisco 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 41

Management’s Discussion and Analysis of Financial Condition and Results of Operations

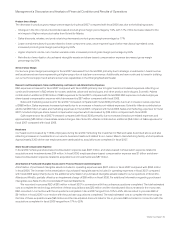

Contractual Obligations

Our cash flows from operations are dependent on a number of factors, including fluctuations in our operating results, shipment linearity,

accounts receivable collections, inventory management, excess tax benefits from share-based compensation, and the timing and amount

of tax and other payments. As a result, the impact of contractual obligations on our liquidity and capital resources in future periods should

be analyzed in conjunction with such factors. In addition, we plan for and measure our liquidity and capital resources through an annual

budgeting process.

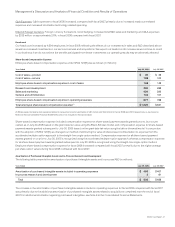

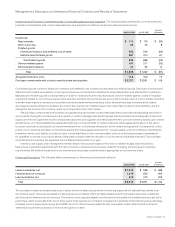

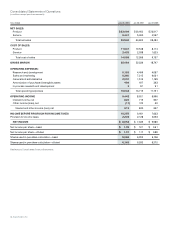

The following table summarizes our contractual obligations at July 26, 2008 (in millions):

PAYMENTS DUE BY PERIOD

Total

Less than

1 Year

1 to 3

Years

3 to 5

Years

More than

5 YearsJuly 26, 2008

Operating leases $ 1,577 $ 298 $ 431 $ 271 $ 577

Purchase commitments with contract manufacturers and suppliers 2,727 2,727 — — —

Purchase obligations 1,902 1,140 377 228 157

Long-term debt 6,504 500 3,002 2 3,000

Other long-term liabilities 589 — 350 39 200

Total by period $ 13,299 $ 4,665 $ 4,160 $ 540 $ 3,934

Other long-term liabilities 829

Total $ 14,128

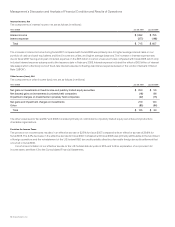

Operating Leases We lease office space in several U.S. locations. Outside the United States, larger leased sites include sites in Australia,

Belgium, Canada, China, France, Germany, India, Israel, Italy, Japan, and the United Kingdom. Operating lease amounts include future

minimum lease payments under all our noncancelable operating leases with an initial term in excess of one year.

Purchase Commitments with Contract Manufacturers and Suppliers We purchase components from a variety of suppliers and use several

contract manufacturers to provide manufacturing services for our products. We record a liability for firm, noncancelable, and unconditional

purchase commitments for quantities in excess of our future demand forecasts consistent with the valuation of our excess and obsolete

inventory. As of July 26, 2008, the liability for these purchase commitments was $184 million and is recorded in other current liabilities and

is not included in the preceding table.

Purchase Obligations Purchase obligations represent an estimate of all open purchase orders and contractual obligations in the ordinary

course of business, other than commitments with contract manufacturers and suppliers, for which we have not received the goods or

services. Although open purchase orders are considered enforceable and legally binding, the terms generally allow us the option to cancel,

reschedule, and adjust our requirements based on our business needs prior to the delivery of goods or performance of services.

Long-Term Debt The amount of long-term debt in the preceding table represents the principal amount of the respective debt instruments

including the current portion of long-term debt. See Note 8 to the Consolidated Financial Statements.

Other Long-Term Liabilities Other long-term liabilities include noncurrent income taxes payable, accrued liabilities for deferred compensation

and defined benefit plans, noncurrent deferred tax liabilities, and certain other long-term liabilities. Noncurrent income taxes payable of

$749 million and noncurrent deferred tax liabilities of $80 million have been included only in the total column in the preceding table due to

uncertainty regarding the timing of future payments. Noncurrent income taxes payable includes uncertain tax positions (see Note 13 to the

Consolidated Financial Statements) partially offset by payments and certain other items.

Compensation Expense Related to Acquisitions and Investments

In connection with our purchase acquisitions, asset purchases, and acquisitions of variable interest entities, we have agreed to pay certain

additional amounts contingent upon the achievement of agreed-upon technology, development, product, or other milestones, or continued

employment with us of certain employees of acquired entities. See Note 3 to the Consolidated Financial Statements.

Other Commitments

We also have certain funding commitments primarily related to our investments in privately held companies and venture funds, some of

which are based on the achievement of certain agreed-upon milestones, and some of which are required to be funded on demand. The

funding commitments were approximately $359 million as of July 26, 2008, compared with approximately $140 million as of July 28, 2007.