Cisco 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Cisco Systems, Inc.

Quantitative and Qualitative Disclosures About Market Risk

Investments in Privately Held Companies

We have invested in privately held companies, some of which are in the startup or development stages. These investments are inherently

risky because the markets for the technologies or products these companies are developing are typically in the early stages and may

never materialize. We could lose our entire investment in these companies. These investments are primarily carried at cost, which as of

July 26, 2008 was $706 million, compared with $643 million at July 28, 2007, and are recorded in other assets. Our impairment charges

on investments in privately held companies were not material during fiscal 2008, 2007, or 2006.

Our evaluation of investments in private companies is based on the fundamentals of the businesses, including, among other factors,

the nature of their technologies and potential for financial return.

Long-Term Debt

During fiscal 2008, we terminated $6.0 billion of interest rate swaps that we had entered into in connection with the issuance of our 2011

Notes and 2016 Notes. Prior to their termination, these swaps had the effect of converting the fixed-rate interest expense on our long-term

debt to floating-rate interest expense based on LIBOR. Following the termination of the interest rate swaps, the fair value of the long-term

debt effectively became subject to market interest rate volatility. As of July 26, 2008, we had $6.0 billion in principal amount of fixed-rate

long-term debt outstanding, with a carrying amount of $6.4 billion and a fair value of $6.1 billion, which fair value is based on market prices.

A hypothetical 50 BPS increase or decrease in interest rates would decrease or increase, respectively, the fair value of the fixed-rate debt

as of July 26, 2008 by approximately $120 million. However, this hypothetical change in interest rates would not impact the interest expense

on the fixed-rate debt. A sharp change in rates would not have a material impact on the fair value of our $500 million variable-rate debt.

Derivative Instruments

Foreign Currency Derivatives

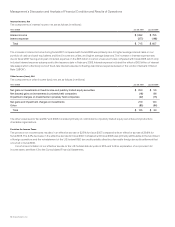

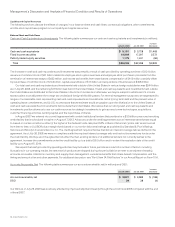

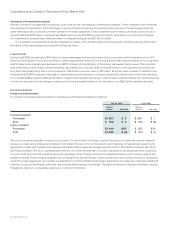

Our foreign exchange forward and option contracts are summarized as follows (in millions):

July 26, 2008 July 28, 2007

Notional

Amount Fair Value

Notional

Amount Fair Value

Forward contracts:

Purchased $ 1,803 $ 5 $ 1,601 $ 1

Sold $ 902 $ 2 $ 613 $ (8)

Option contracts:

Purchased $ 1,440 $ 50 $ 652 $ 24

Sold $ 1,256 $ (6) $ 310 $ (1)

We conduct business globally in numerous currencies. The direct effect of foreign currency fluctuations on sales has not been material

because our sales are primarily denominated in U.S. dollars. Foreign currency fluctuations, net of hedging, increased total research and

development, sales and marketing, and general and administrative expenses by approximately 2.5% in fiscal 2008 compared with fiscal

2007. Approximately 70% of our operating expenses are U.S.-dollar denominated. To reduce variability in operating expenses caused by

non-U.S.-dollar denominated operating expenses, we hedge certain foreign currency forecasted transactions with currency options and

forward contracts. These hedging programs are not designed to provide foreign currency protection over long time horizons. In designing

a specific hedging approach, we consider several factors, including offsetting exposures, significance of exposures, costs associated with

entering into a particular hedge instrument, and potential effectiveness of the hedge. The gains and losses on foreign exchange contracts

mitigate the effect on our operating expenses of currency movements.