Cisco 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report 45

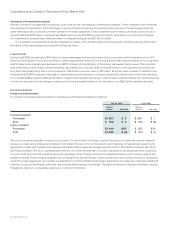

Quantitative and Qualitative Disclosures About Market Risk

We also enter into foreign exchange forward contracts to reduce the short-term effects of foreign currency fluctuations on

receivables, investments, and payables, primarily denominated in Australian, Canadian, Japanese, and several European currencies,

including the euro and British pound. Our market risks associated with our foreign currency receivables, investments, and payables relate

primarily to variances from our forecasted foreign currency transactions and balances. Our forward and option contracts generally have

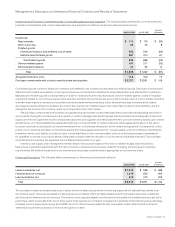

the following maturities:

Maturities

Forward and option contracts—forecasted transactions related to operating expenses Less than 18 months

Forward contracts—current assets and liabilities 1 to 3 months

Forward contracts—long-term customer financings Up to 2 years

Forward contracts—investments Less than 2 years

We do not enter into foreign exchange forward or option contracts for trading purposes.

Interest Rate Derivatives

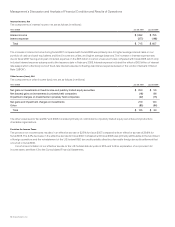

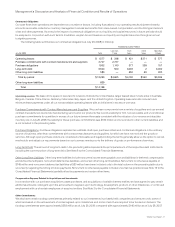

Our interest rate derivatives are summarized as follows (in millions):

July 26, 2008 July 28, 2007

Notional

Amount Fair Value

Notional

Amount Fair Value

Interest rate swaps—investments $ 1,000 $ (4) $ 1,000 $ 29

Interest rate swaps—long-term debt $ — $ — $ 6,000 $ (81)

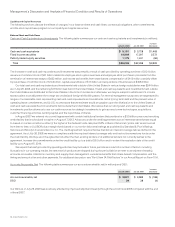

Our primary objective for holding fixed income securities is to achieve an appropriate investment return consistent with preserving

principal and managing risk. To realize these objectives, we may utilize interest rate swaps or other derivatives designated as fair value

or cash flow hedges.

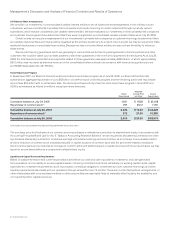

Interest Rate Swaps, Investments We have entered into $1.0 billion of interest rate swaps designated as fair value hedges of our investment

portfolio. Under these interest rate swap contracts, we make fixed-rate interest payments and receive interest payments based on

LIBOR. The effect of these swaps is to convert fixed-rate returns to floating-rate returns based on LIBOR for a portion of our fixed income

portfolio. The gains and losses related to changes in the value of the interest rate swaps are included in other income (loss), net, and offset

the changes in fair value of the underlying hedged investment. The fair values of the interest rate swaps designated as hedges of our

investments are reflected in prepaid expenses and other current assets or other current liabilities.

Interest Rate Swaps, Long-Term Debt In conjunction with our issuance of fixed-rate senior notes in February 2006, we entered into

$6.0 billion of interest rate swaps designated as fair value hedges of the fixed-rate debt. The effect of these swaps was to convert fixed-rate

interest expense to floating-rate interest expense based on LIBOR. During the third quarter of fiscal 2008, we terminated these interest

rate swaps and received proceeds of $432 million, net of accrued interest, which was recorded as a hedge accounting adjustment to the

carrying amount of the fixed-rate debt and is being amortized as a reduction of interest expense over the remaining terms of the fixed-rate

notes. While such interest rate swaps were in effect, their fair values were reflected in other assets or other long-term liabilities, and prior to

their termination, the gains and losses related to changes in the value of such interest rate swaps were included in other income (loss), net,

and offset the changes in fair value of the underlying debt.