CarMax 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

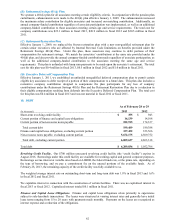

fiscal 2012 and $25.80 in fiscal 2011. The total costs for matching contributions are included in share-based

compensation expense.

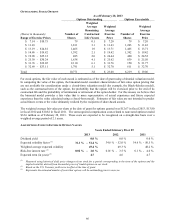

12. NET EARNINGS PER SHARE

Nonvested share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents

(whether paid or unpaid) are participating securities and should be included in the computation of net earnings per

share pursuant to the two-class method as discussed in Note 2(X). Our restricted stock awards are considered

participating securities because they contain nonforfeitable rights to dividends and are included in the computation

of net earnings per share pursuant to the two-class method. Nonvested MSUs do not receive nonforfeitable dividend

equivalent rights, and therefore, are not considered participating securities. RSUs are nonparticipating, non-equity

instruments, and therefore, are excluded from net earnings per share calculations. There were no outstanding

participating securities during fiscal 2013.

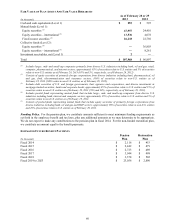

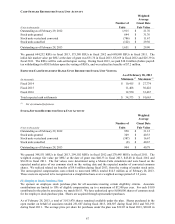

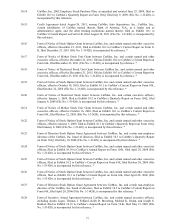

BASIC AND DILUTIVE NET EARNINGS PER SHARE RECONCILIATIONS

Years Ended February 28 or 29

(In thousands except per share data) 2013 2012 2011

N

et earnings $ 434,284 $ 413,795 $ 377,495

Less net earnings allocable to restricted stock ― 166 1,623

N

et earnings available for basic common shares 434,284 413,629 375,872

Adjustment for dilutive potential common shares ― ― 38

N

et earnings available for diluted common shares $ 434,284 $ 413,629 $ 375,910

Weighted average common shares outstanding 228,095 226,282 223,449

Dilutive potential common shares:

Stock options 3,161 3,608 3,540

Stock-settled restricted stock units 567 831 612

Weighted average common shares and dilutive

potential common shares 231,823 230,721 227,601

Basic net earnings per share $ 1.90

$ 1.83 $ 1.68

Diluted net earnings per share $ 1.87

$ 1.79 $ 1.65

Certain weighted-average options to purchase shares of common stock were outstanding and not included in the

calculation of diluted net earnings per share because their inclusion would be antidilutive. In fiscal 2013, weighted

average options to purchase 3,877,165 shares were not included. In fiscal 2012, weighted-average options to

purchase 1,750,473 shares were not included. In fiscal 2011, weighted-average options to purchase 1,656,658

shares were not included.

68