CarMax 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

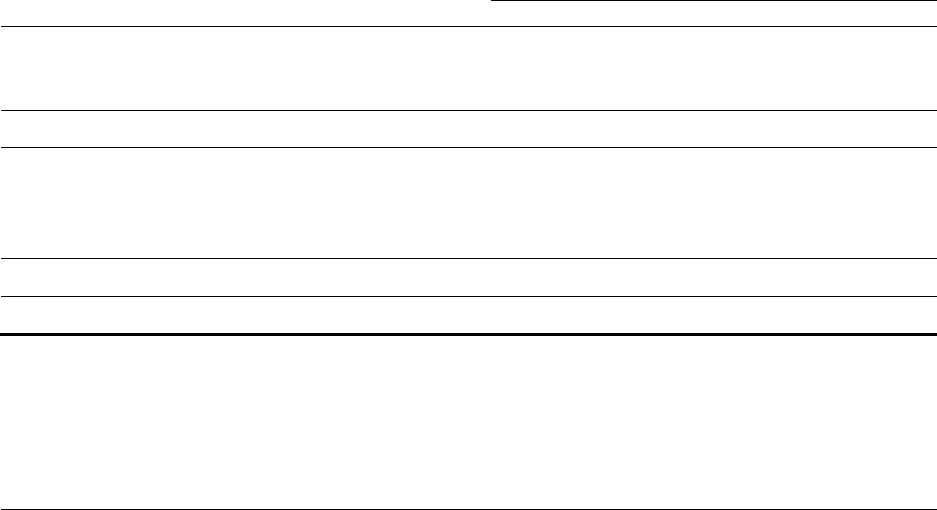

As of February 28, 2013, we had interest rate caps outstanding with offsetting (asset and liability) notional amounts

of $615.5 million that were not designated as accounting hedges. As of February 28, 2013, there were no interest

rate swaps outstanding that were not designated as accounting hedges.

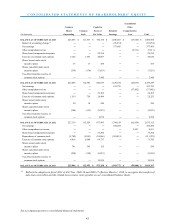

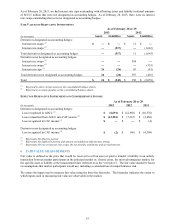

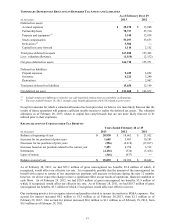

FAIR VALUES OF DERIVATIVE INSTRUMENTS

As of February 28 or 29

2013 2012

(In thousands) Assets Liabilities Assets Liabilities

Derivatives designated as accounting hedges:

Interest rate swaps (1)

$ ― $ ― $ 11 $ ―

Interest rate swaps (2)

― (517) ― (1,643)

Total derivatives designated as accounting hedges ― (517) 11 (1,643)

Derivatives not designated as accounting hedges:

Interest rate swaps (1)

― ― 304 ―

Interest rate swaps (2)

― ― ― (335)

Interest rate caps (1)

26 (26) 83 (81)

Total derivatives not designated as accounting hedges 26 (26) 387 (416)

Total

$ 26 $ (543) $ 398 $ (2,059)

(1) Reported in other current assets on the consolidated balance sheets.

(2) Reported in accounts payable on the consolidated balance sheets.

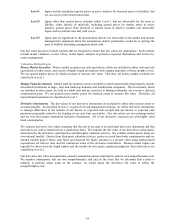

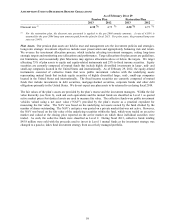

EFFECT OF DERIVATIVE INSTRUMENTS ON COMPREHENSIVE INCOME

As of February 28 or 29

(In thousands) 2013 2012 2011

Derivatives designated as accounting hedges:

Loss recognized in AOCL (1)

$ (6,691)

$ (22,968) $ (10,376)

Loss reclassified from AOCL into CAF income (1) $ (12,981) $ (7,567) $ (2,450)

Loss recognized in CAF income (2)

$ ― $ ― $ (4)

Derivatives not designated as accounting hedges:

Loss recognized in CAF income (3)

$ (2)

$ (86) $ (4,308)

(1) Represents the effective portion.

(2) Represents the ineffective portion and amount excluded from effectiveness testing.

(3) Represents the loss on interest rate swaps, the net periodic settlements and accrued interest.

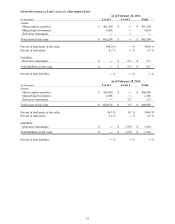

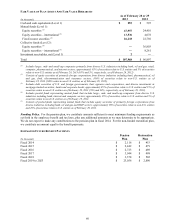

6. FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants in the principal market or, if none exists, the most advantageous market, for

the specific asset or liability at the measurement date (referred to as the “exit price”). The fair value should be based

on assumptions that market participants would use, including a consideration of nonperformance risk.

We assess the inputs used to measure fair value using the three-tier hierarchy. The hierarchy indicates the extent to

which inputs used in measuring fair value are observable in the market.

53