CarMax 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reported on the income tax return are recorded in capital in excess of par value (if the tax deduction exceeds the

deferred tax asset) or in the consolidated statements of earnings (if the deferred tax asset exceeds the tax deduction

and no capital in excess of par value exists from previous awards). See Note 11 for additional information on stock-

based compensation.

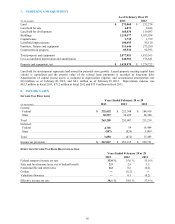

(V) Derivative Instruments and Hedging Activities

We enter into derivative instruments to manage exposures that arise from business activities that result in the future

known receipt or payment of uncertain cash amounts, the values of which are impacted by interest rates. We

recognize the derivatives at fair value as either current assets or current liabilities on the consolidated balance sheets.

Where applicable, such contracts covered by master netting agreements are reported net. Gross positive fair values

are netted with gross negative fair values by counterparty. The accounting for changes in the fair value of

derivatives depends on the intended use of the derivative, whether we have elected to designate a derivative in a

hedging relationship and apply hedge accounting and whether the hedging relationship has satisfied the criteria

necessary to apply hedge accounting. We may enter into derivative contracts that are intended to economically

hedge certain risks, even though hedge accounting may not apply or we do not elect to apply hedge accounting. See

Note 5 for additional information on derivative instruments and hedging activities.

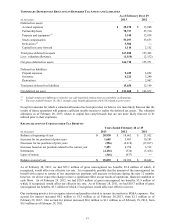

(W) Income Taxes

We file a consolidated federal income tax return for a majority of our subsidiaries. Certain subsidiaries are required

to file separate partnership or corporate federal income tax returns. Deferred income taxes reflect the impact of

temporary differences between the amounts of assets and liabilities recognized for financial reporting purposes and

the amounts recognized for income tax purposes, measured by applying currently enacted tax laws. A deferred tax

asset is recognized if it is more likely than not that a benefit will be realized. Changes in tax laws and tax rates are

reflected in the income tax provision in the period in which the changes are enacted.

We recognize tax liabilities when, despite our belief that our tax return positions are supportable, we believe that

certain positions may not be fully sustained upon review by tax authorities. Benefits from tax positions are

measured at the highest tax benefit that is greater than 50% likely of being realized upon settlement. The current

portion of these tax liabilities is included in accrued income taxes and any noncurrent portion is included in other

liabilities. To the extent that the final tax outcome of these matters is different from the amounts recorded, the

differences impact income tax expense in the period in which the determination is made. Interest and penalties

related to income tax matters are included in SG&A expenses. See Note 8 for additional information on income

taxes.

(X) Net Earnings Per Share

Basic net earnings per share is computed by dividing net earnings available for basic common shares by the

weighted average number of shares of common stock outstanding. Diluted net earnings per share is computed by

dividing net earnings available for diluted common shares by the sum of the weighted average number of shares of

common stock outstanding and dilutive potential common stock. For periods with outstanding participating

securities, diluted net earnings per share reflects the more dilutive of the “if-converted” treasury stock method or the

two-class method. For periods with no outstanding participating securities, diluted net earnings per share is

calculated using the “if-converted” treasury stock method. See Note 12 for additional information on net earnings

per share

(Y) Recent Accounting Pronouncements

In April 2011, the Financial Accounting Standards Board (“FASB”) issued an accounting pronouncement related to

transfers and servicing (FASB ASC Topic 860), which removes the assessment of effective control criterion

requiring the transferor to have the ability to repurchase or redeem the financial assets on substantially the agreed

terms, even in the event of default by the transferee. The guidance in this pronouncement is effective prospectively

for transactions, or modifications of existing transactions, that occur on or after the first interim or annual period

beginning on or after December 15, 2011. We adopted this pronouncement for our fiscal year beginning

March 1, 2012, and there was no effect on our consolidated financial statements.

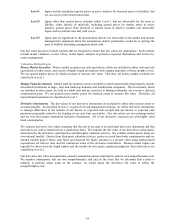

In May 2011, the FASB issued an accounting pronouncement related to fair value measurement (FASB ASC Topic

820), which amends current guidance to achieve common fair value measurement and disclosure requirements in

U.S. GAAP and International Financial Reporting Standards. The amendments generally represent clarification of

FASB ASC Topic 820, but also include instances where a particular principle or requirement for measuring fair

value or disclosing information about fair value measurements has changed. This pronouncement is effective for

fiscal years, and interim periods within those years, beginning after December 15, 2011. We adopted this

48