CarMax 2013 Annual Report Download - page 12

Download and view the complete annual report

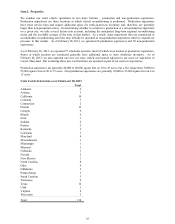

Please find page 12 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We also maintain a website, carmaxauctions.com, that supports our wholesale auctions. This website, which is

accessible only by authorized dealers, provides listings of all vehicles that will be available in upcoming auctions. It

also has many features similar to our retail website, including vehicle photos, free vehicle history reports and vehicle

search and alert capabilities.

Suppliers for Used Vehicles. We acquire used vehicle inventory directly from consumers through our appraisal

process, as well as through other sources, including local, regional and online auctions, wholesalers, franchised and

independent dealers and fleet owners, such as leasing companies and rental companies. The supply of used vehicles

is influenced by a variety of factors, including the total number of vehicles in operation; the rate of new vehicle

sales, which in turn generate used-car trade-ins; and the number of used vehicles sold or remarketed through retail

channels, wholesale transactions and at automotive auctions.

According to industry data, as of December 31, 2012, there were approximately 247 million light vehicles in

operation in the U.S., including approximately 78 million vehicles that were 0 to 6 years old. Prior to the recession,

generally 16 million to 17 million new vehicles and 40 million to 45 million used vehicles were sold annually in the

U.S. In addition, approximately 9 million to 10 million used vehicles were remarketed annually in wholesale

auctions. During the recession, retail vehicle sales dropped sharply, with calendar year 2009 new car sales falling to

10 million and used car sales to 35 million. New car sales have gradually improved since 2009, but they remain

below pre-recession levels. The resulting decline in the total supply of 0-6 year old vehicles, combined with a

reduction in trade-in activity and fewer off-lease vehicles has resulted in a tighter supply of late-model used vehicles

in recent years. While we have maintained steady access to inventory during this period, the used car supply

constraints have resulted in strong wholesale valuations, which have increased our acquisition costs and average

selling prices for used vehicles.

Our used vehicle inventory acquired directly from consumers through our appraisal process helps provide an

inventory of makes and models that reflects the consumer preferences in each market. We have replaced the

traditional “trade-in” transaction with a process in which a CarMax-trained buyer appraises a customer’s vehicle and

provides the owner with a written, guaranteed offer that is good for seven days. An appraisal is available to every

customer free of charge, whether or not the customer purchases a vehicle from us. Based on their age, mileage or

condition, fewer than half of the vehicles acquired through this in-store appraisal process meet our high-quality retail

standards. Those vehicles that do not meet our retail standards are sold to licensed dealers through our on-site

wholesale auctions.

The inventory purchasing function is primarily performed at the store level and is the responsibility of the buyers,

who handle both on-site appraisals and off-site auction purchases. Our buyers evaluate all used vehicles based on

internal and external auction data and market sales, as well as estimated reconditioning costs and, for off-site

purchases, transportation costs. Our buyers, in collaboration with our home office staff, utilize the extensive

inventory and sales trend data available through the CarMax information system to decide which inventory to

purchase at off-site auctions. Our inventory and pricing models help the buyers tailor inventories to the buying

preferences at each superstore, recommend pricing adjustments and optimize inventory turnover to help maintain

gross profit per unit.

Based on consumer acceptance of the in-store appraisal process, our experience and success in acquiring vehicles

from auctions and other sources, and the large size of the U.S. auction market relative to our needs, we believe that

sources of used vehicles will continue to be sufficient to meet our current and future needs.

Suppliers for New Vehicles. Our new car operations are governed by the terms of the sales, service and dealer

agreements. Among other things, these agreements generally impose operating requirements and restrictions,

including inventory levels, working capital, monthly financial reporting, signage and cooperation with marketing

strategies.

Seasonality. Historically, our business has been seasonal. Typically, our superstores experience their strongest

traffic and sales in the spring and summer quarters. Sales are typically slowest in the fall quarter, when used

vehicles generally experience proportionately more of their annual depreciation. We believe this is partly the result

of a decline in customer traffic, as well as discounts on model year closeouts that can pressure pricing for late-model

used vehicles. Customer traffic generally tends to slow in the fall as the weather changes and as customers shift

their spending priorities. We typically experience an increase in subprime traffic and sales in February and March,

coincident with tax refund season.

8