CarMax 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have not entered into any sale-leaseback transactions since fiscal 2009. See Note 14 for information on future

minimum lease obligations.

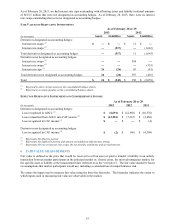

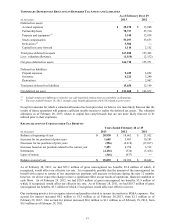

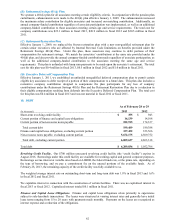

Non-Recourse Notes Payable. The non-recourse notes payable relate to auto loan receivables funded through term

securitizations and our warehouse facilities. The timing of principal payments on non-recourse notes payable is

based on principal collections, net of losses, on the securitized auto loan receivables. The current portion of non-

recourse notes payable represents principal payments that are due to be distributed in the following period.

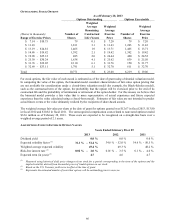

As of February 28, 2013, $5.06 billion of non-recourse notes payable was outstanding related to term securitizations.

These notes payable accrue interest at fixed rates and have scheduled maturities through August 2019, but may

mature earlier or later, depending upon the repayment rate of the underlying auto loan receivables.

As of February 28, 2013, $792.0 million of non-recourse notes payable was outstanding related to our warehouse

facilities. The combined warehouse facility limit is $1.7 billion, and the unused warehouse capacity totaled

$908.0 million. During the fourth quarter of fiscal 2013, we renewed our $800 million warehouse facility that was

scheduled to expire in February 2013 for an additional 364-day term and increased the limit to $900 million. Of the

combined warehouse facility limit, $800 million will expire in August 2013 and $900 million will expire in

February 2014. The notes payable outstanding related to our warehouse facilities do not have scheduled maturities,

instead the principal payments depend upon the repayment rate of the underlying auto loan receivables. The return

requirements of investors could fluctuate significantly depending on market conditions. Therefore, at renewal, the

cost, structure and capacity of the facilities could change. These changes could have a significant impact on our

funding costs.

See Notes 2(F) and 4 for additional information on securitizations and auto loan receivables.

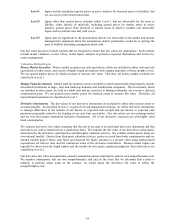

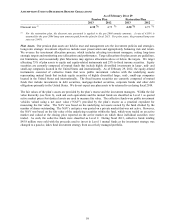

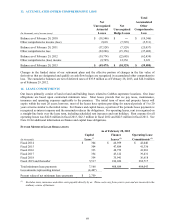

Financial Covenants. The credit facility agreement contains representations and warranties, conditions and

covenants. We must also meet financial covenants in conjunction with certain of the sale-leaseback transactions.

Our securitization agreements contain representations and warranties, financial covenants and performance triggers.

As of February 28, 2013, we were in compliance with all financial covenants and our securitized receivables were in

compliance with the related performance triggers.

11. STOCK AND STOCK-BASED INCENTIVE PLANS

(A) Preferred Stock

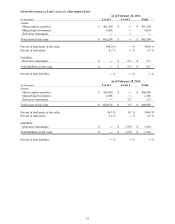

Under the terms of our Articles of Incorporation, the board of directors may determine the rights, preferences and

terms of our authorized but unissued shares of preferred stock. We have authorized 20,000,000 shares of preferred

stock, $20 par value. In 2002, we created a series of preferred stock designated as “Cumulative Participating

Preferred Stock, Series A” in connection with the shareholder rights plan adopted by the company. The number of

shares constituting such series is 300,000. The shareholder rights plan expired in 2012, and no shares of such Series

A Cumulative Participating Preferred Stock or any other preferred stock are currently outstanding.

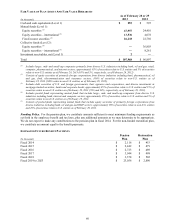

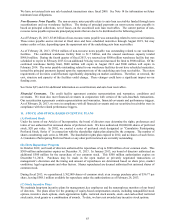

(B) Share Repurchase Program

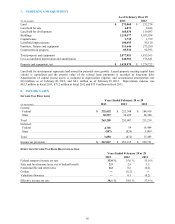

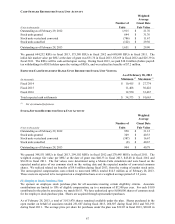

In October 2012, our board of directors authorized the repurchase of up to $300 million of our common stock. This

$300 million authorization expires on December 31, 2013. In January 2013, our board of directors authorized an

additional $500 million for the repurchase of our common stock. This $500 million authorization expires on

December 31, 2014. Purchases may be made in the open market or privately negotiated transactions at

management’s discretion and the timing and amount of repurchases are determined based on share price, market

conditions, legal requirements and other factors. Shares repurchased are deemed authorized but unissued shares of

common stock.

During fiscal 2013, we repurchased 5,762,000 shares of common stock at an average purchase price of $36.77 per

share, leaving $588.1 million available for repurchase under the authorizations as of February 28, 2013.

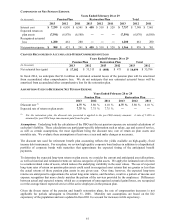

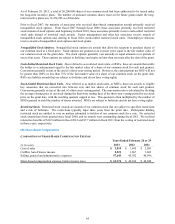

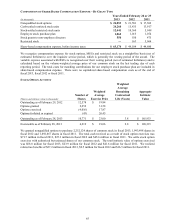

(C) Stock Incentive Plans

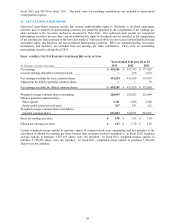

We maintain long-term incentive plans for management, key employees and the nonemployee members of our board

of directors. The plans allow for the granting of equity-based compensation awards, including nonqualified stock

options, incentive stock options, stock appreciation rights, restricted stock awards, stock- and cash-settled restricted

stock units, stock grants or a combination of awards. To date, we have not awarded any incentive stock options.

63