CarMax 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

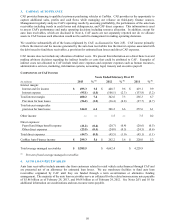

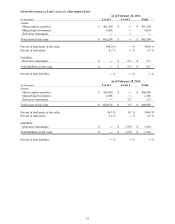

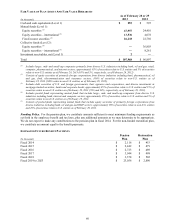

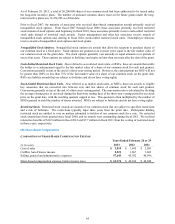

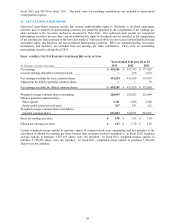

ASSUMPTIONS USED TO DETERMINE BENEFIT OBLIGATIONS

As of February 28 or 29

Pension Plan Restoration Plan

2013 2012 2013 2012

Discount rate (1) 4.30 % 4.75 % 4.30 % 4.75 %

(1) For the restoration plan, the discount rate presented is applied to the pre-2004 annuity amounts. A rate of 4.50% is

assumed for the post-2004 lump sum amounts paid from the plan for fiscal 2013. For prior years, the presumed lump sum

rate was 5.00%.

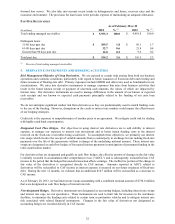

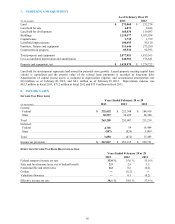

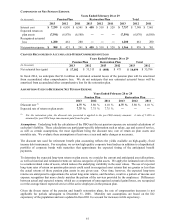

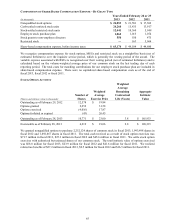

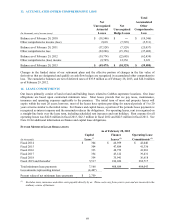

Plan Assets. Our pension plan assets are held in trust and management sets the investment policies and strategies.

Long-term strategic investment objectives include asset preservation and appropriately balancing risk and return.

We oversee the investment allocation process, which includes selecting investment managers, setting long-term

strategic targets and monitoring asset allocations and performance. Target allocations for plan assets are guidelines,

not limitations, and occasionally plan fiduciaries may approve allocations above or below the targets. We target

allocating 75% of plan assets to equity and equity-related instruments and 25% to fixed income securities. Equity

securities are currently composed of mutual funds that include highly diversified investments in large-, mid- and

small-cap companies located in the United States and internationally. As of February 29, 2012, the equity-related

instruments consisted of collective funds that were public investment vehicles with the underlying assets

representing mutual funds that include equity securities of highly diversified large-, mid-, small-cap companies

located in the United States and internationally. The fixed income securities are currently composed of mutual

funds that include investments in debt securities, mortgage-backed securities, corporate bonds and other debt

obligations primarily in the United States. We do not expect any plan assets to be returned to us during fiscal 2014.

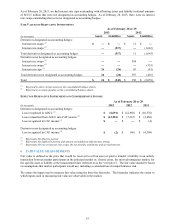

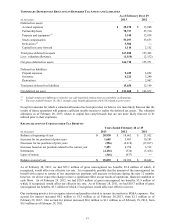

The fair values of the plan’s assets are provided by the plan’s trustee and the investment managers. Within the fair

value hierarchy (see Note 6), cash and cash equivalents and the mutual funds are classified as Level 1 as quoted

active market prices for identical assets are used to measure fair value. The collective funds were public investment

vehicles valued using a net asset value (“NAV”) provided by the plan’s trustee as a practical expedient for

measuring the fair value. The NAV was based on the underlying net assets owned by the fund divided by the

number of shares outstanding. The NAV’s unit price was quoted on a private market that was not active. However,

the NAV was based on the fair value of the underlying securities within the fund, which were traded on an active

market and valued at the closing price reported on the active market on which those individual securities were

traded. As such, the collective funds were classified as Level 2. During fiscal 2013, collective funds totaling

$45.9 million were sold with the proceeds used to invest in Level 1 mutual funds as the investment strategy was

changed to a passive, index fund investment strategy from an actively managed portfolio.

59