CarMax 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of February 28, 2013, a total of 50,200,000 shares of our common stock had been authorized to be issued under

the long-term incentive plans. The number of unissued common shares reserved for future grants under the long-

term incentive plans was 12,474,285 as of that date.

Prior to fiscal 2007, the majority of associates who received share-based compensation awards primarily received

nonqualified stock options. From fiscal 2007 through fiscal 2009, these associates primarily received restricted

stock instead of stock options, and beginning in fiscal 2010, these associates primarily receive cash-settled restricted

stock units instead of restricted stock awards. Senior management and other key associates receive awards of

nonqualified stock options and, starting in fiscal 2010, stock-settled restricted stock units. Nonemployee directors

receive awards of nonqualified stock options and stock grants.

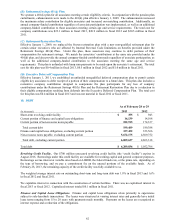

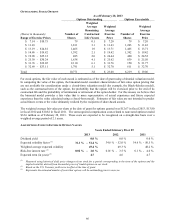

Nonqualified Stock Options. Nonqualified stock options are awards that allow the recipient to purchase shares of

our common stock at a fixed price. Stock options are granted at an exercise price equal to the fair market value of

our common stock on the grant date. The stock options generally vest annually in equal amounts over periods of

one to four years. These options are subject to forfeiture and expire no later than ten years after the date of the grant.

Cash-Settled Restricted Stock Units. Also referred to as restricted stock units, or RSUs, these are awards that entitle

the holder to a cash payment equal to the fair market value of a share of our common stock for each unit granted.

Conversion generally occurs at the end of a three-year vesting period. However, the cash payment per RSU will not

be greater than 200% or less than 75% of the fair market value of a share of our common stock on the grant date.

RSUs are liability awards that are subject to forfeiture and do not have voting rights.

Stock-Settled Restricted Stock Units. Also referred to as market stock units, or MSUs, these are awards to eligible

key associates that are converted into between zero and two shares of common stock for each unit granted.

Conversion generally occurs at the end of a three-year vesting period. The conversion ratio is calculated by dividing

the average closing price of our stock during the final forty trading days of the three-year vesting period by our stock

price on the grant date, with the resulting quotient capped at two. This quotient is then multiplied by the number of

MSUs granted to yield the number of shares awarded. MSUs are subject to forfeiture and do not have voting rights.

Restricted Stock. Restricted stock awards are awards of our common stock that are subject to specified restrictions

and a risk of forfeiture. The restrictions typically lapse three years from the grant date. Participants holding

restricted stock are entitled to vote on matters submitted to holders of our common stock for a vote. No restricted

stock awards have been granted since fiscal 2009, and no awards were outstanding during fiscal 2013. We realized

related tax benefits of $10.9 million in fiscal 2012 and $7.7 million in fiscal 2011 from the vesting of restricted stock

in those years, respectively.

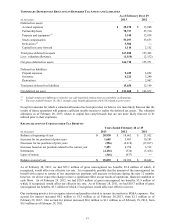

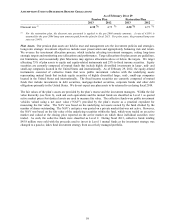

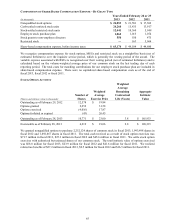

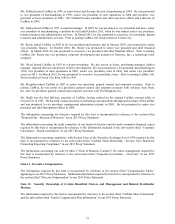

(D) Share-Based Compensation

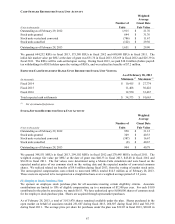

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE

Years Ended February 28 or 29

(In thousands) 2013 2012 2011

Cost of sales $ 3,010

$ 1,845 $ 2,081

CarMax Auto Finance income 2,521 1,867 1,603

Selling, general and administrative expenses 57,643 45,392 40,996

Share-based compensation expense, before income taxes $ 63,174 $ 49,104 $ 44,680

64