CarMax 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

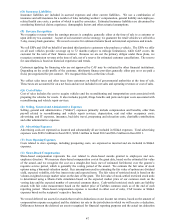

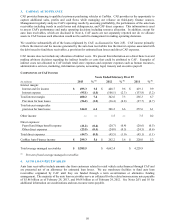

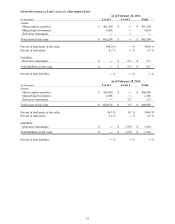

(J) Property and Equipment

Property and equipment is stated at cost less accumulated depreciation and amortization. Depreciation and

amortization are calculated using the straight-line method over the shorter of the asset’s estimated useful life or the

lease term, if applicable. Property held under capital lease is stated at the lesser of the present value of the future

minimum lease payments at the inception of the lease or fair value. Amortization of capital lease assets is computed

on a straight-line basis over the shorter of the initial lease term or the estimated useful life of the asset and is

included in depreciation expense. Costs incurred during new store construction are capitalized as construction-in-

progress and reclassified to the appropriate fixed asset categories when the store is completed.

ESTIMATED USEFUL LIVES

Life

Buildings 25 years

Capital lease 20 years

Leasehold improvements 8 – 15 years

Furniture, fixtures and equipment 3 – 15 years

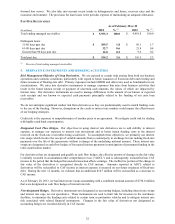

We review long-lived assets for impairment when events or changes in circumstances indicate the carrying amount

of an asset may not be recoverable. We recognize impairment when the sum of undiscounted estimated future cash

flows expected to result from the use of the asset is less than the carrying value of the asset. We recognized an

impairment of $0.2 million in fiscal 2012 related to assets within land held for sale. There was no impairment of

long-lived assets in fiscal 2013 or fiscal 2011. See Note 7 for additional information on property and equipment.

(K) Other Assets

Goodwill and Intangible Assets. Goodwill and other intangibles had a carrying value of $10.1 million as of

February 28, 2013 and February 29, 2012. We review goodwill and intangible assets for impairment annually or

when circumstances indicate the carrying amount may not be recoverable. No impairment of goodwill or intangible

assets resulted from our annual impairment tests in fiscal 2013, fiscal 2012 or fiscal 2011.

Restricted Cash on Deposit in Reserve Accounts. The restricted cash on deposit in reserve accounts is for the

benefit of the securitization investors. In the event that the cash generated by the securitized receivables in a given

period was insufficient to pay the interest, principal and other required payments, the balances on deposit in the

reserve accounts would be used to pay those amounts. These funds are restricted for the benefit of holders of non-

recourse notes payable and are not expected to be available to the company or its creditors. Restricted cash on

deposit in reserve accounts was $41.3 million as of February 28, 2013, and $45.3 million as of February 29, 2012.

Restricted Investments. Restricted investments includes money market securities primarily held to satisfy certain

insurance program requirements, as well as mutual funds held in a rabbi trust established to fund informally our

executive deferred compensation plan. Restricted investments totaled $35.0 million as of February 28, 2013, and

$31.4 million as of February 29, 2012.

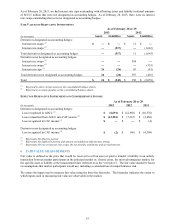

(L) Finance Lease Obligations

We generally account for sale-leaseback transactions as financings. Accordingly, we record certain of the assets

subject to these transactions on our consolidated balance sheets in property and equipment and the related sales

proceeds as finance lease obligations. Depreciation is recognized on the assets over 25 years. Payments on the

leases are recognized as interest expense and a reduction of the obligations. See Notes 10 and 14 for additional

information on finance lease obligations.

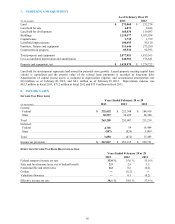

(M) Other Accrued Expenses

As of February 28, 2013 and February 29, 2012, accrued expenses and other current liabilities included accrued

compensation and benefits of $103.4 million and $87.9 million, respectively, and loss reserves for general liability

and workers’ compensation insurance of $26.6 million and $23.0 million, respectively.

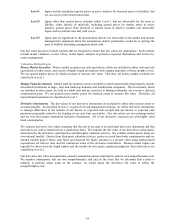

(N) Defined Benefit Plan Obligations

The recognized funded status of defined benefit retirement plan obligations is included both in accrued expenses and

other current liabilities and in other liabilities. The current portion represents benefits expected to be paid from our

benefit restoration plan over the next 12 months. The defined benefit retirement plan obligations are determined by

independent actuaries using a number of assumptions provided by CarMax. Key assumptions used in measuring the

plan obligations include the discount rate, rate of return on plan assets and mortality rate. See Note 8 for additional

information on our benefit plans.

46