CarMax 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pronouncement for our fiscal year beginning March 1, 2012, and there was no effect on our consolidated financial

statements.

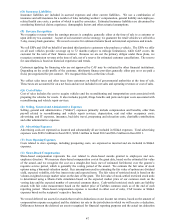

In June 2011, the FASB issued an accounting pronouncement, as amended December 2011, that provides new

guidance on the presentation of comprehensive income (FASB ASC Topic 220) in financial statements. Entities are

required to present total comprehensive income either in a single, continuous statement of comprehensive income or

in two separate, but consecutive, statements. The provisions for this pronouncement as amended are effective for

fiscal years, and interim periods within those years, beginning after December 15, 2011. We adopted this amended

pronouncement for our fiscal year beginning March 1, 2012. We have included the additional required statement for

our fiscal year ended February 28, 2013.

In September 2011, the FASB issued an accounting pronouncement related to intangibles – goodwill and other

(FASB ASC Topic 350), which allows for companies to first consider qualitative factors as a basis for assessing

impairment and determining the necessity of a detailed impairment test. The provisions for this pronouncement are

effective for fiscal years beginning after December 15, 2011, with early adoption permitted. We adopted this

pronouncement for our fiscal year beginning March 1, 2012, and there was no effect on our consolidated financial

statements.

In December 2011, the FASB issued an accounting pronouncement related to offsetting of assets and liabilities on

the balance sheet (FASB ASC Topic 210). The amendments require additional disclosures related to offsetting

either in accordance with U.S. GAAP or master netting arrangements. In January 2013, an update was issued to

clarify the scope applies to derivatives. The provisions of this pronouncement and update are effective for fiscal

years, and interim periods within those years, beginning after January 1, 2013. We will adopt this pronouncement

for our fiscal year beginning March 1, 2013. We do not expect this pronouncement to have a material effect on our

consolidated financial statements.

In July 2012, the FASB issued an accounting pronouncement related to intangibles – goodwill and other (FASB

ASC Topic 350), which permits companies to first consider qualitative factors as a basis for assessing impairment

and determining the necessity of a detailed impairment test of indefinite-lived intangible assets. The provisions of

this pronouncement are effective for annual and interim impairment tests performed for fiscal years beginning after

September 15, 2012. We will adopt this pronouncement for our fiscal year beginning March 1, 2013. We do not

expect this pronouncement to have a material effect on our consolidated financial statements.

In February 2013, the FASB issued an accounting pronouncement related to liabilities (FASB ASC Topic 405). The

amendments provide guidance on the recognition, measurement and disclosure of obligations resulting from joint

and several liability arrangements, including debt arrangements, other contractual obligations, and settled litigation

and judicial rulings. This pronouncement is effective for fiscal years, and interim periods within those years,

beginning after December 15, 2013. We will adopt this pronouncement for our fiscal year beginning March 1, 2014.

We do not expect this pronouncement to have a material effect on our consolidated financial statements.

In February 2013, the FASB issued an accounting pronouncement related to comprehensive income (FASB ASC

Topic 220), requiring improved disclosures of reclassifications out of accumulated other comprehensive income.

The provisions of the pronouncement require an entity to report the amounts reclassified, in their entirety, out of

accumulated other comprehensive income and the effect on the respective line items in net income. For amounts not

reclassified in their entirety to net income in the same reporting period, an entity is required to cross-reference the

amounts to other related disclosures. This pronouncement is effective for fiscal years, and interim periods within

those years, beginning after December 15, 2013. We will adopt this pronouncement for our fiscal year beginning

March 1, 2013. We do not expect this pronouncement to have a material effect on our consolidated financial

statements.

49