CarMax 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

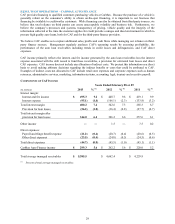

Investing Activities. Net cash used in investing activities totaled $255.3 million in fiscal 2013, $219.4 million in

fiscal 2012 and $72.2 million in fiscal 2011. Investing activities primarily consist of capital expenditures, which

totaled $235.7 million in fiscal 2013, $172.6 million in fiscal 2012 and $76.6 million in fiscal 2011. Capital

expenditures primarily include real estate acquisitions for planned future store openings and store construction costs.

We maintain a multi-year pipeline of store sites to support our store growth, so portions of capital spending in one

year may relate to stores that we plan to open in subsequent fiscal years. The increases in capital expenditures in

fiscal 2013 and fiscal 2012 primarily related to the growth in our store opening pace, as we increased store openings

from 5 in fiscal 2012, to 10 in fiscal 2013.

Historically, capital expenditures have been funded with internally-generated funds, debt and sale-leaseback

transactions. No sale-leasebacks have been executed since fiscal 2009.

As of February 28, 2013, we owned 60 and leased 58 of our 118 used car superstores.

Restricted cash from collections on auto loan receivables increased $20.0 million in fiscal 2013 and $43.3 million in

fiscal 2012 versus a decrease of $1.6 million in fiscal 2011. These collections vary depending on the timing of the

receipt of principal and interest payments on securitized auto loan receivables, the change in average managed

receivables and the funding vehicle utilized.

Financing Activities. Net cash provided by financing activities totaled $1.04 billion in fiscal 2013, $683.1 million

in fiscal 2012 and $101.8 million in fiscal 2011. Included in these amounts were net increases in total non-recourse

notes payable of $1.17 billion, $670.4 million and $187.3 million, respectively, which were used to provide the

financing for the majority of the increases of $992.2 million, $675.7 million and $304.7 million, respectively, in auto

loan receivables. In fiscal 2013, net cash provided by financing activities was net of $203.4 million of stock

repurchases. In fiscal 2011, net cash provided by financing activities was net of a $121.5 million net reduction in

borrowings under the revolving credit facility.

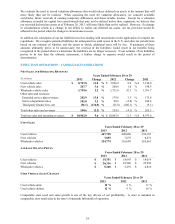

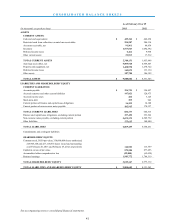

TOTAL DEBT AND CASH AND CASH EQUIVALENTS

As of February 28 or 29

(In thousands) 2013 2012

Borrowings under revolving credit facility $ 355 $ 943

Finance and capital lease obligations 353,591 367,674

N

on-recourse notes payable 5,855,090 4,684,089

Total debt $ 6,209,036 $ 5,052,706

Cash and cash equivalents $ 449,364 $ 442,658

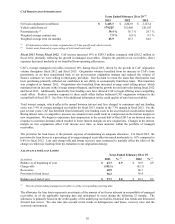

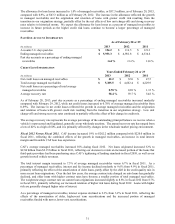

We have a $700 million unsecured revolving credit facility, which expires in August 2016. Borrowings under this

credit facility are available for working capital and general corporate purposes, and the unused portion is fully

available to us. See Note 10 for additional information on the revolving credit facility.

The credit facility agreement contains representations and warranties, conditions and covenants. If these

requirements were not met, all amounts outstanding or otherwise owed could become due and payable immediately

and other limitations could be placed on our ability to use any available borrowing capacity.

CAF auto loan receivables are primarily funded through securitization transactions. Our securitizations are

structured to legally isolate the auto loan receivables, and we would not expect to be able to access the assets of our

securitization vehicles, even in insolvency, receivership or conservatorship proceedings. Similarly, the investors in

the non-recourse notes payable have no recourse to our assets beyond the securitized receivables, the amounts on

deposit in reserve accounts and the restricted cash from collections on auto loan receivables. We do, however,

continue to have the rights associated with the interest we retain in these securitization vehicles.

The timing of principal payments on the non-recourse notes payable is based on principal collections, net of losses,

on the securitized auto loan receivables. The current portion of non-recourse notes payable represents principal

payments that are due to be distributed in the following period.

As of February 28, 2013, $5.06 billion of non-recourse notes payable was outstanding related to term securitizations.

These notes payable accrue interest at fixed rates and have scheduled maturities through August 2019, but may

33