CarMax 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

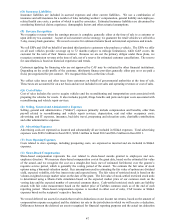

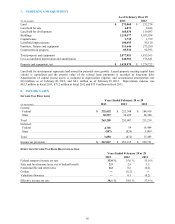

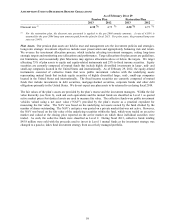

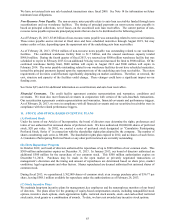

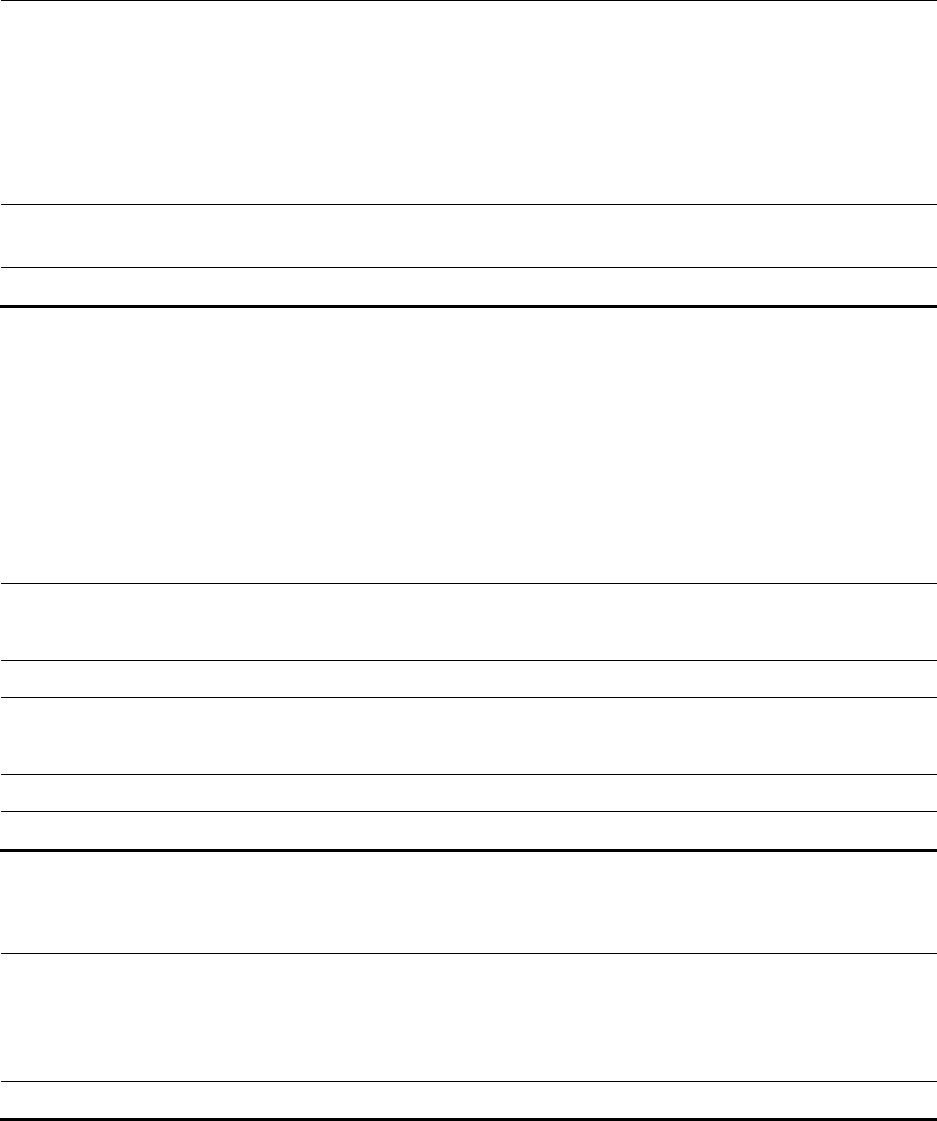

7. PROPERTY AND EQUIPMENT

As of February 28 or 29

(In thousands) 2013 2012

Land $ 275,060 $ 232,274

Land held for sale 4,872 8,446

Land held for development 168,830 119,087

Buildings 1,119,577 1,033,034

Capital leases 1,739 1,739

Leasehold improvements 106,695 95,110

Furniture, fixtures and equipment 311,646 273,280

Construction in progress 89,532 92,393

Total property and equipment 2,077,951 1,855,363

Less accumulated depreciation and amortization 648,981 576,641

Property and equipment, net $ 1,428,970 $ 1,278,722

Land held for development represents land owned for potential store growth. Leased property meeting capital lease

criteria is capitalized and the present value of the related lease payments is recorded as long-term debt.

Amortization of capital leased assets is included in depreciation expense, and accumulated amortization was

$0.2 million as of February 28, 2013, and $0.1 million as of February 29, 2012. Depreciation expense was

$82.3 million in fiscal 2013, $75.2 million in fiscal 2012 and $73.9 million in fiscal 2011.

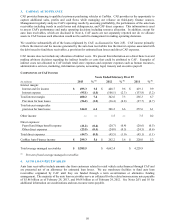

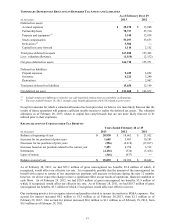

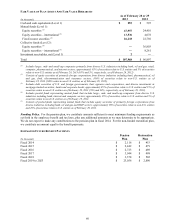

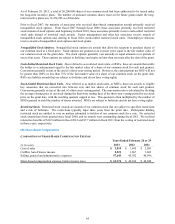

8. INCOME TAXES

INCOME TAX PROVISION

Years Ended February 28 or 29

(In thousands) 2013 2012 2011

Current:

Federal $ 232,652 $ 223,548 $ 184,919

State 30,557 30,439 28,300

Total 263,209 253,987 213,219

Deferred:

Federal 4,705 54 16,484

State (847) (926) 1,009

Total 3,858 (872) 17,493

Income tax provision $ 267,067 $ 253,115 $ 230,711

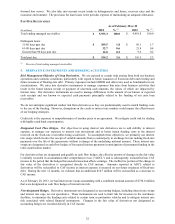

EFFECTIVE INCOME TAX RATE RECONCILIATION

Years Ended February 28 or 29

2013 2012 2011

Federal statutory income tax rate 35.0 % 35.0 % 35.0 %

State and local income taxes, net of federal benefit 2.9 2.9 3.3

N

ondeductible and other items 0.2 0.2 (0.2)

Credits

― (0.2) ―

Valuation allowance ― 0.1 (0.2)

Effective income tax rate 38.1 % 38.0 % 37.9 %

56