CarMax 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

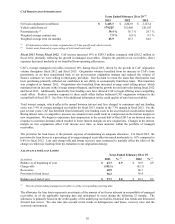

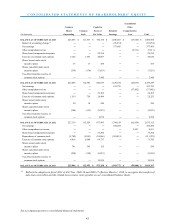

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

See accompanying notes to consolidated financial statements.

Years Ended February 28 or 29

(In thousands) 2013 2012 2011

NET EARNINGS $ 434,284 $ 413,795 $ 377,495

Other comprehensive income (loss), net of taxes:

Retirement plans:

Net actuarial (loss) gain arising during the year (1) (10,456) (22,591) 1,828

Amortization recognized in net pension expense (2) 751 345 190

Cash flow hedges:

Effective portion of changes in fair value (3) 4,485 (22,723) (9,979)

Reclassifications to CarMax Auto Finance income (4) 7,871 7,567 2,450

Other comprehensive income (loss), net of taxes 2,651 (37,402) (5,511)

TOTAL COMPREHENSIVE INCOME $ 436,935 $ 376,393 $ 371,984

(1) Net of tax benefit of $6,238, tax benefit of $13,195 and tax of $1,124 for the years ended February 28, 2013,

February 29, 2012, and February 28, 2011, respectively.

(2) Net of tax of $449, $116 and $90 for the years ended February 28, 2013, February 29, 2012, and February 28, 2011,

respectively.

(3) Net of tax benefit of $11,176, $245 and $397 for the years ended February 28, 2013, February 29, 2012, and

February 28, 2011, respectively. The year ended February 28, 2013, includes a tax benefit adjustment of $8,518 related to

prior years.

(4) Net of tax of $5,110, $0 and $0 for the years ended February 28, 2013, February 29, 2012, and February 28, 2011,

respectively.

40