CarMax 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

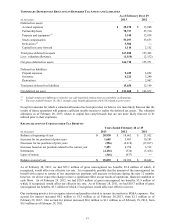

(B) Retirement Savings 401(k) Plan

We sponsor a 401(k) plan for all associates meeting certain eligibility criteria. In conjunction with the pension plan

curtailments, enhancements were made to the 401(k) plan effective January 1, 2009. The enhancements increased

the maximum salary contribution for eligible associates and increased our matching contribution. Additionally, an

annual company-funded contribution regardless of associate participation was implemented, as well as an additional

company-funded contribution to those associates meeting certain age and service requirements. The total cost for

company contributions was $23.1 million in fiscal 2013, $20.9 million in fiscal 2012 and $20.5 million in fiscal

2011.

(C) Retirement Restoration Plan

Effective January 1, 2009, we replaced the frozen restoration plan with a new non-qualified retirement plan for

certain senior executives who are affected by Internal Revenue Code limitations on benefits provided under the

Retirement Savings 401(k) Plan. Under this plan, these associates may continue to defer portions of their

compensation for retirement savings. We match the associates’ contributions at the same rate provided under the

401(k) plan, and also provide the annual company-funded contribution made regardless of associate participation, as

well as the additional company-funded contribution to the associates meeting the same age and service

requirements. This plan is unfunded with lump sum payments to be made upon the associate’s retirement. The total

cost for this plan was $0.4 million in fiscal 2013, $0.5 million in fiscal 2012 and $1.0 million in fiscal 2011.

(D) Executive Deferred Compensation Plan

Effective January 1, 2011, we established an unfunded nonqualified deferred compensation plan to permit certain

eligible key associates to defer receipt of a portion of their compensation to a future date. This plan also includes a

restorative company contribution designed to compensate the plan participants for any loss of company

contributions under the Retirement Savings 401(k) Plan and the Retirement Restoration Plan due to a reduction in

their eligible compensation resulting from deferrals into the Executive Deferred Compensation Plan. The total cost

for this plan was $0.4 million in fiscal 2013 and was not material in fiscal 2012 or fiscal 2011.

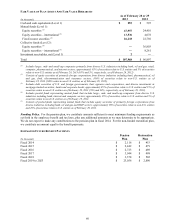

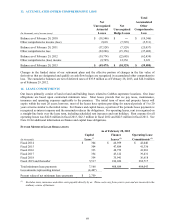

10. DEBT

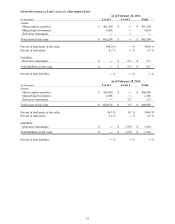

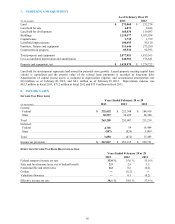

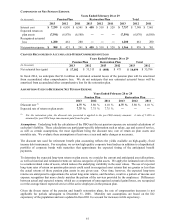

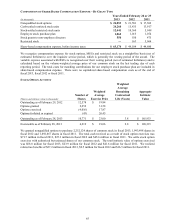

As of February 28 or 29

(In thousands) 2013 2012

Short-term revolving credit facility $ 355 $ 943

Current portion of finance and capital lease obligations 16,139 14,108

Current portion of non-recourse notes payable 182,915 174,337

Total current debt 199,409 189,388

Finance and capital lease obligations, excluding current portion 337,452

353,566

N

on-recourse notes payable, excluding current portion 5,672,175 4,509,752

Total debt, excluding current portion 6,009,627 4,863,318

Total debt $ 6,209,036 $ 5,052,706

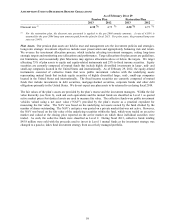

Revolving Credit Facility. Our $700 million unsecured revolving credit facility (the “credit facility”) expires in

August 2016. Borrowings under this credit facility are available for working capital and general corporate purposes.

Borrowings accrue interest at variable rates based on LIBOR, the federal funds rate, or the prime rate, depending on

the type of borrowing, and we pay a commitment fee on the unused portions of the available funds. As of

February 28, 2013, the remaining capacity of the credit facility was fully available to us.

The weighted average interest rate on outstanding short-term and long-term debt was 1.8% in fiscal 2013 and 1.6%

in fiscal 2012 and fiscal 2011.

We capitalize interest in connection with the construction of certain facilities. There was no capitalized interest in

fiscal 2013 or fiscal 2012. Capitalized interest totaled $0.1 million in fiscal 2011.

Finance and Capital Lease Obligations. Finance and capital lease obligations relate primarily to superstores

subject to sale-leaseback transactions. The leases were structured at varying interest rates and generally have initial

lease terms ranging from 15 to 20 years with payments made monthly. Payments on the leases are recognized as

interest expense and a reduction of the obligations.

62