CarMax 2013 Annual Report Download - page 38

Download and view the complete annual report

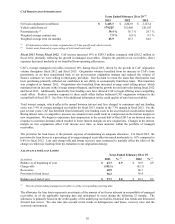

Please find page 38 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.mature earlier or later, depending upon the repayment rate of the underlying auto loan receivables. During fiscal

2013, we completed three term securitizations, funding a total of $2.99 billion of auto loan receivables.

Our term securitizations typically contain an option to repurchase the securitized receivables when the outstanding

balance in the pool of auto loan receivables falls below 10% of the original pool balance. During fiscal 2013, we

exercised this option on three term securitizations that had originally been issued in 2008, and for which CarMax

had provided $115.0 million of capital. Upon the exercise of these options, we funded substantially all of the

remaining receivables through our warehouse facilities.

As of February 28, 2013, $792.0 million of non-recourse notes payable was outstanding related to our warehouse

facilities. The combined warehouse facility limit is $1.7 billion, and the unused warehouse capacity totaled

$908.0 million. During the fourth quarter of fiscal 2013, we renewed our $800 million warehouse facility that was

scheduled to expire in February 2013 for an additional 364-day term and increased the limit to $900 million. Of the

combined warehouse facility limit, $800 million will expire in August 2013 and $900 million will expire in

February 2014. The return requirements of the warehouse facility investors could fluctuate significantly depending

on market conditions. At renewal, the cost, structure and capacity of the facilities could change. These changes

could have a significant effect on our funding costs. See Notes 2(F) and 10 for additional information on the

warehouse facilities.

The securitization agreements related to the warehouse facilities include various representations and warranties,

covenants and performance triggers. If these requirements are not met, we could be unable to continue to securitize

the receivables through the warehouse facilities. In addition, warehouse facility investors could charge us a higher

rate of interest and could have us replaced as servicer. Further, we could be required to deposit collections on the

securitized receivables with the warehouse facility agents on a daily basis and deliver executed lockbox agreements

to the warehouse facility agents.

We expect that cash generated by operations and proceeds from securitization transactions or other funding

arrangements, sale-leaseback transactions and borrowings under existing, new or expanded credit facilities will be

sufficient to fund CAF, capital expenditures and working capital for the foreseeable future. We anticipate that we

will be able to enter into new, or renew or expand existing, funding arrangements to meet our future funding needs.

However, based on conditions in the credit markets, the cost for these arrangements could be materially higher than

historical levels and the timing and capacity of these transactions could be dictated by market availability rather than

our requirements.

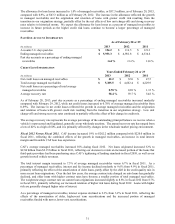

In October 2012, our board of directors authorized the repurchase of up to $300 million of our common stock, with

an expiration of December 31, 2013. In January 2013, our board of directors authorized an additional $500 million

for the repurchase of our common stock, expiring December 31, 2014. Purchases may be made in open market or

privately negotiated transactions at management’s discretion, and the timing and amount of repurchases are

determined based on share price, market conditions, legal requirements and other factors. Shares redeemed are

deemed authorized but unissued shares of common stock.

During fiscal 2013, we repurchased 5.8 million shares of common stock at an average purchase price of $36.77 per

share, leaving $588.1 million available for repurchase under the authorization. Of the $211.9 million of purchases

made during fiscal 2013, $8.6 million related to trades that were not settled until March 2013. This amount was

included in accrued expenses and other current liabilities as of February 28, 2013.

Fair Value Measurements. We report money market securities, mutual fund investments and derivative

instruments at fair value. See Note 6 for more information on fair value measurements.

34