CarMax 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

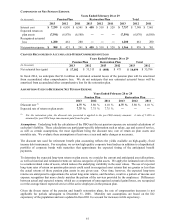

forward loss curves. We also take into account recent trends in delinquencies and losses, recovery rates and the

economic environment. The provision for loan losses is the periodic expense of maintaining an adequate allowance.

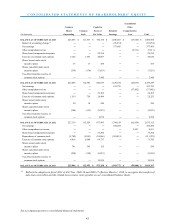

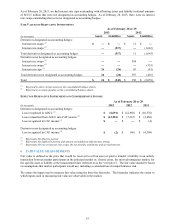

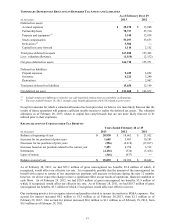

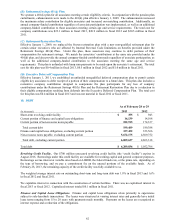

PAST DUE RECEIVABLES

As of February 28 or 29

(In millions) 2013

% (1) 2012 % (1)

Total ending managed receivables $ 5,933.3 100.0 $ 4,981.8 100.0

Delinquent loans:

31-60 days past due $ 109.5 1.8 $ 85.1 1.7

61-90 days past due 32.7 0.6 21.8 0.4

Greater than 90 days past due 12.0 0.2 9.6 0.2

Total past due $ 154.2 2.6 $ 116.5 2.3

(1) Percent of total ending managed receivables

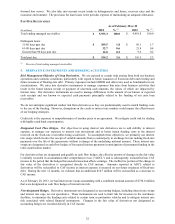

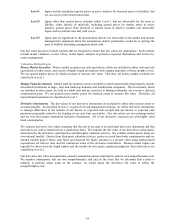

5. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

Risk Management Objective of Using Derivatives. We are exposed to certain risks arising from both our business

operations and economic conditions, particularly with regard to future issuances of fixed-rate debt and existing and

future issuances of floating-rate debt. Primary exposures include LIBOR and other rates used as benchmarks in our

securitizations. We enter into derivative instruments to manage exposures that arise from business activities that

result in the future known receipt or payment of uncertain cash amounts, the values of which are impacted by

interest rates. Our derivative instruments are used to manage differences in the amount of our known or expected

cash receipts and our known or expected cash payments principally related to the funding of our auto loan

receivables.

We do not anticipate significant market risk from derivatives as they are predominantly used to match funding costs

to the use of the funding. However, disruptions in the credit or interest rate markets could impact the effectiveness

of our hedging strategies.

Credit risk is the exposure to nonperformance of another party to an agreement. We mitigate credit risk by dealing

with highly rated bank counterparties.

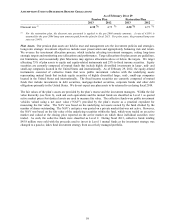

Designated Cash Flow Hedges. Our objectives in using interest rate derivatives are to add stability to interest

expense, to manage our exposure to interest rate movements and to better match funding costs to the interest

received on the fixed-rate receivables being securitized. To accomplish these objectives, we primarily use interest

rate swaps which involve the receipt of variable amounts from a counterparty in exchange for our making fixed-rate

payments over the life of the agreements without exchange of the underlying notional amount. These interest rate

swaps are designated as cash flow hedges of forecasted interest payments in anticipation of permanent funding in the

term securitization market.

For derivatives that are designated and qualify as cash flow hedges, the effective portion of changes in the fair value

is initially recorded in accumulated other comprehensive loss (“AOCL”) and is subsequently reclassified into CAF

income in the period that the hedged forecasted transaction affects earnings. The ineffective portion of the change in

fair value of the derivatives is recognized directly in CAF income. Amounts reported in AOCL related to

derivatives will be reclassified to CAF income as interest expense is incurred on our future issuances of fixed-rate

debt. During the next 12 months, we estimate that an additional $10.7 million will be reclassified as a decrease to

CAF income.

As of February 28, 2013, we had interest rate swaps outstanding with a combined notional amount of $750.0 million

that were designated as cash flow hedges of interest rate risk.

Non-designated Hedges. Derivative instruments not designated as accounting hedges, including interest rate swaps

and interest rate caps, are not speculative. These instruments are used to limit risk for investors in the warehouse

facilities, to minimize the funding costs related to certain term securitization vehicles and to mitigate interest rate

risk associated with related financial instruments. Changes in the fair value of derivatives not designated as

accounting hedges are recorded directly in CAF income.

52