CarMax 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

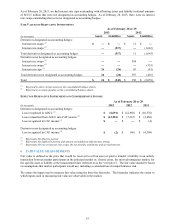

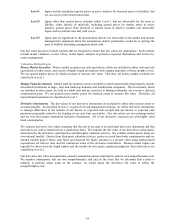

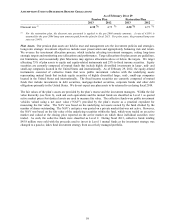

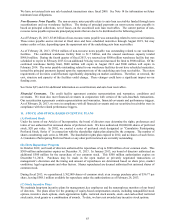

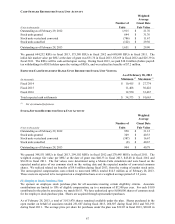

TEMPORARY DIFFERENCES RESULTING IN DEFERRED TAX ASSETS AND LIABILITIES

As of February 28 or 29

(In thousands)

2013 2012

Deferred tax assets:

Accrued expenses

$ 35,270 $ 33,888

Partnership basis

70,737 55,710

Property and equipment (1)

3,510 12,038

Stock compensation

53,297 53,635

Derivatives (2)

3,904 ―

Capital loss carry forward

1,110 2,152

Total gross deferred tax assets 167,828

157,423

Less: valuation allowance (1,110) (2,152)

N

et gross deferred tax assets 166,718

155,271

Deferred tax liabilities:

Prepaid expenses 9,429

6,892

Inventory

6,221 3,240

Derivatives

― 2,067

Total gross deferred tax liabilities 15,650

12,199

N

et deferred tax asset $ 151,068 $ 143,072

(1) Includes temporary differences related to our sale-leaseback transactions accounted for as financings.

(2) The year ended February 28, 2013, includes a tax benefit adjustment of $8,518 related to prior years.

Except for amounts for which a valuation allowance has been provided, we believe it is more likely than not that the

results of future operations will generate sufficient taxable income to realize the deferred tax assets. The valuation

allowance as of February 28, 2013, relates to capital loss carryforwards that are not more likely than not to be

utilized prior to their expiration.

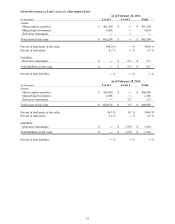

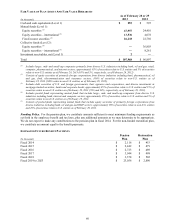

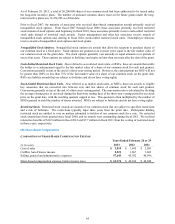

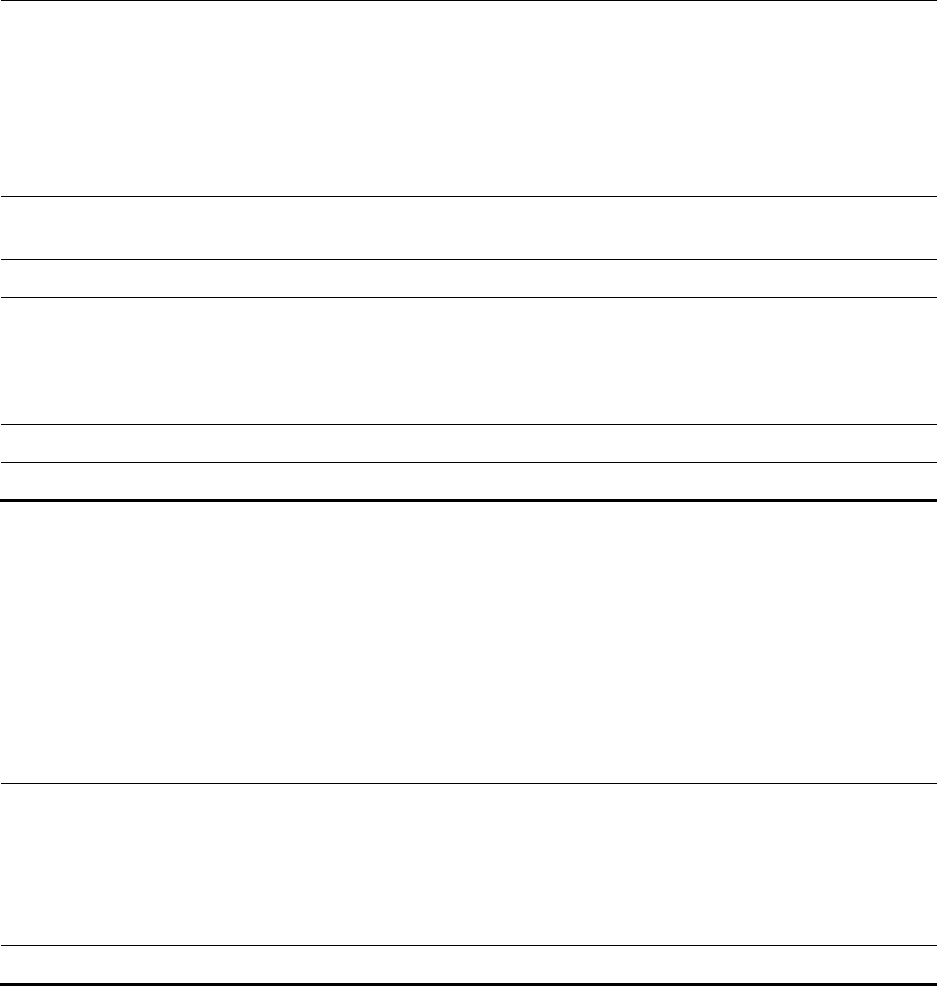

RECONCILIATION OF UNRECOGNIZED TAX BENEFITS

Years Ended February 28 or 29

(In thousands) 2013 2012 2011

Balance at beginning of year $ 20,930 $ 18,662 $ 21,952

Increases for tax positions of prior years 1,685 5,403 10,183

Decreases for tax positions of prior years (596) (6,918) (17,017)

Increases based on tax positions related to the current year 7,491 4,754 6,712

Settlements (4,136) (334) (3,168)

Lapse of statute (315) (637) ―

Balance at end of year $ 25,059 $ 20,930 $ 18,662

As of February 28, 2013, we had $25.1 million of gross unrecognized tax benefits, $5.4 million of which, if

recognized, would affect our effective tax rate. It is reasonably possible that the amount of the unrecognized tax

benefit with respect to certain of our uncertain tax positions will increase or decrease during the next 12 months;

however, we do not expect the change to have a significant effect on our results of operations, financial condition or

cash flows. As of February 29, 2012, we had $20.9 million of gross unrecognized tax benefits, $3.9 million of

which, if recognized, would affect our effective tax rate. As of February 28, 2011, we had $18.7 million of gross

unrecognized tax benefits, $3.5 million of which, if recognized, would affect our effective tax rate.

Our continuing practice is to recognize interest and penalties related to income tax matters in SG&A expenses. Our

accrual for interest increased $0.2 million to $1.3 million as of February 28, 2013, from $1.1 million as of

February 29, 2012. Our accrual for interest increased $0.6 million to $1.1 million as of February 29, 2012, from

$0.5 million as of February 28, 2011.

57