CarMax 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

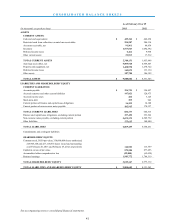

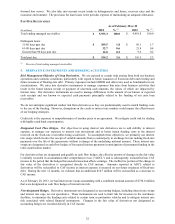

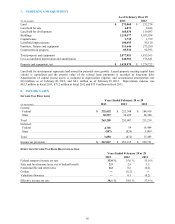

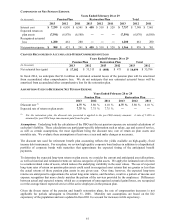

AUTO LOAN RECEIVABLES, NET

As of February 28 or 29

(In millions) 2013 2012

Warehouse facilities $ 792.0 $ 553.0

Term securitizations 4,989.7 4,211.8

Other receivables (1) 151.6 217.0

Total ending managed receivables 5,933.3 4,981.8

Accrued interest and fees 24.9 23.1

Other (5.0) (1.8)

Less allowance for loan losses (57.3) (43.3)

Auto loan receivables, net $ 5,895.9 $ 4,959.8

(1) Other receivables includes receivables not funded through the warehouse facilities or term securitizations.

Credit Quality. When customers apply for financing, CAF uses proprietary scoring models that rely on the

customers’ credit history and certain application information to evaluate and rank their risk. Credit histories are

obtained from credit bureau reporting agencies and include information such as number, age, type of and payment

history for prior or existing credit accounts. The application information that is used includes income, collateral

value and down payment. Our scoring models yield credit grades that represent the relative likelihood of repayment.

Customers assigned a grade of “A” are determined to have the highest probability of repayment, and customers

assigned a lower grade are determined to have a lower probability of repayment. For loans that are approved, the

credit grade influences the terms of the agreement, such as the required loan-to-value ratio and interest rate.

CAF uses a combination of the initial credit grades and historical performance to monitor the credit quality of the

auto loan receivables on an ongoing basis. We validate the accuracy of the scoring models periodically. Loan

performance is reviewed on a recurring basis to identify whether the assigned grades adequately reflect the

customers’ likelihood of repayment.

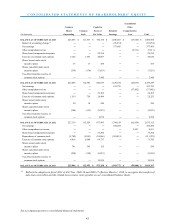

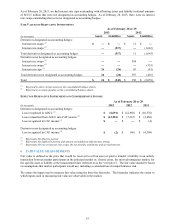

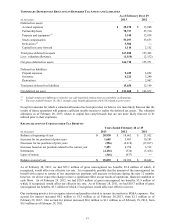

ENDING MANAGED RECEIVABLES BY MAJOR CREDIT GRADE

As of February 28 or 29

(In millions) 2013 (1) % (2) 2012 (1) % (2)

A $ 2,841.4 47.9 $ 2,452.8 49.2

B 2,265.6 38.2 1,923.6 38.6

C and other 826.3 13.9 605.4 12.2

Total ending managed receivables $ 5,933.3 100.0 $ 4,981.8 100.0

(1) Classified based on credit grade assigned when customers were initially approved for financing.

(2) Percent of total ending managed receivables.

ALLOWANCE FOR LOAN LOSSES

As of February 28 or 29

(In millions)

2013 % (1) 2012 % (1)

Balance as of beginning of year $ 43.3 0.9

$ 38.9 0.9

Charge-offs (103.1) (92.7)

Recoveries

60.9 60.7

Provision for loan losses 56.2 36.4

Balance as of end of year $ 57.3 1.0

$ 43.3 0.9

(1) Percent of total ending managed receivables as of the corresponding reporting date.

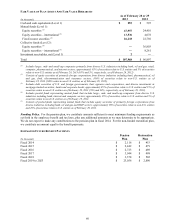

The allowance for loan losses represents an estimate of the amount of net losses inherent in our portfolio of managed

receivables as of the applicable reporting date and anticipated to occur during the following 12 months. The

allowance is primarily based on the credit quality of the underlying receivables, historical loss trends and forecasted

51