CarMax 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT FISCAL YEAR 2013

Table of contents

-

Page 1

ANNUAL REPORT FISCAL YEAR 2013 -

Page 2

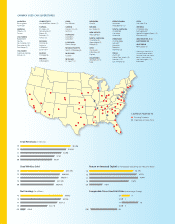

CARMAX USED CAR SUPERSTORES ALABAMA CONNECTICUT IOWA NEBRASKA PENNSYLVANIA UTAH Birmingham Huntsville ARIZONA Hartford /New Haven (2) FLORIDA Des Moines KANSAS Omaha NEVADA Lancaster Philadelphia* (2) SOUTH CAROLINA Salt Lake City VIRGINIA Phoenix (2) Tucson CALIFORNIA Bakersï¬eld Fresno ... -

Page 3

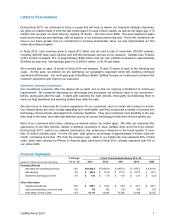

... shareholder value, we also implemented our first share repurchase program. In fiscal 2013, total revenues grew to nearly $11 billion and we sold a total of more than 780,000 vehicles, including 448,000 retail used vehicles and 325,000 wholesale vehicles at our auctions. CarMax Auto Finance (CAF... -

Page 4

...100 Best Companies to Work For." We are committed to providing the environment, training and materials needed to develop deeply engaged, highly skilled associates who are ready to embrace changes that elevate our success. To support our store growth plans, we must equip associates to take leadership... -

Page 5

...ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended February 28, 2013 OR ï,¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from Commission File Number: 1-31420 to CARMAX... -

Page 6

... is a shell company (as defined in Rule 12b-2 of the Act). Yes ï,¨ No ï¸ The aggregate market value of the registrant's common stock held by non-affiliates as of August 31, 2012, computed by reference to the closing price of the registrant's common stock on the New York Stock Exchange on that date... -

Page 7

... 12. Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions and Director Independence Principal Accountant Fees and Services PART IV... -

Page 8

... a tax-free transaction, becoming an independent, publicly traded company. CarMax Business. We operate in two reportable segments: CarMax Sales Operations and CarMax Auto Finance ("CAF"). Our CarMax Sales Operations segment consists of all aspects of our auto merchandising and service operations... -

Page 9

... wholesale vehicle auction operators, based on the 324,779 wholesale vehicles we sold through our on-site auctions in fiscal 2013. We were the first used vehicle retailer to offer a large selection of high quality used vehicles at competitively low, "no-haggle" prices using a customer-friendly sales... -

Page 10

... returns, CAF financed 39% of our retail vehicle unit sales in fiscal 2013. As of February 28, 2013, CAF serviced approximately 459,000 customer accounts in its $5.93 billion portfolio of managed receivables. Industry and Competition. CarMax Sales Operations: The U.S. used car marketplace is highly... -

Page 11

..., noting mechanical and other issues found during our appraisal process, is also not a typical practice used at other auctions of older, higher mileage vehicles. Together, these factors make our auctions attractive to dealers, resulting in a high dealer-to-car attendance ratio. CarMax Auto Finance... -

Page 12

..., mileage or condition, fewer than half of the vehicles acquired through this in-store appraisal process meet our high-quality retail standards. Those vehicles that do not meet our retail standards are sold to licensed dealers through our on-site wholesale auctions. The inventory purchasing function... -

Page 13

... frame or flood damage, branded titles, salvage history and unknown true mileage. Professional, licensed auctioneers conduct our auctions. The average auction sales rate was 97% in fiscal 2013. Dealers pay a fee to us based on the sales price of the vehicles they purchase. Extended Service Plans and... -

Page 14

... of store operations, such as inventory management, pricing, vehicle transfers, wholesale auctions and sales consultant productivity. In addition, our store system provides a direct link to our proprietary credit processing information system to facilitate the credit review and approval process of... -

Page 15

... buyers, and they generally will assist with the appraisal of more than 1,000 cars before making their first independent purchase. Business office associates undergo a 3- to 6-month, on-the-job certification process in order to be fully cross-trained in all functional areas of the business office... -

Page 16

..." link on our investor information home page at investor.carmax.com, shortly after we file them with, or furnish them to, the Securities and Exchange Commission (the "SEC"): annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements on Schedule 14A... -

Page 17

.... Changes in the availability or cost of capital and working capital financing, including the long-term financing to support the origination of auto loan receivables through CAF and our geographic expansion, could adversely affect sales, operating strategies and store growth. Further, our current... -

Page 18

... results of operations. Information Systems. Our business is dependent upon the integrity and efficient operation of our information systems. In particular, we rely on our information systems to effectively manage sales, inventory, carmax.com, consumer financing and customer information. The failure... -

Page 19

..., sales and results of operations. Accounting Policies and Matters. We have identified several accounting policies as being "critical" to the fair presentation of our financial condition and results of operations because they involve major aspects of our business and require management to make... -

Page 20

... auctions, most of which were located at production superstores. Stores at which auctions are conducted generally have additional space to store wholesale inventory. As of February 28, 2013, we also operated one new car store, which was located adjacent to our used car superstore in Laurel, Maryland... -

Page 21

... 28, 2013, we leased 58 of our 118 used car superstores, our new car store and our CAF office building in Atlanta, Georgia. We owned the remaining 60 stores currently in operation. We also owned our home office building in Richmond, Virginia, and land associated with planned future store openings... -

Page 22

... common stock. During the fourth quarter of fiscal 2013, we sold no CarMax equity securities that were not registered under the Securities Act of 1933, as amended. Issuer Purchases of Equity Securities The following table provides information relating to the company's repurchase of common stock... -

Page 23

... the reinvestment of all dividends, as applicable. COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN $250 $200 $150 $100 $50 $0 2008 2009 CarMax Inc 2010 2011 2012 S&P 500 Retailing Index 2013 S&P 500 Index - Total Returns CarMax S&P 500 Index S&P 500 Retailing Index 2008 $ 100.00 $ 100... -

Page 24

...103 15,565 FY10 Income statement information Used vehicle sales New vehicle sales Wholesale vehicle sales Other sales and revenues Net sales and operating revenues Gross profit CarMax Auto Finance income SG&A Interest expense Earnings before income taxes Income tax provision Net earnings Share and... -

Page 25

... the sale of vehicles purchased through our appraisal process that do not meet our retail standards. These vehicles are sold through on-site wholesale auctions. Wholesale auctions are generally held on a weekly or bi-weekly basis, and as of February 28, 2013, we conducted auctions at 57 used car... -

Page 26

... market competitiveness. After the effect of 3-day payoffs and vehicle returns, CAF financed 39% of our retail vehicle unit sales in fiscal 2013. As of February 28, 2013, CAF serviced approximately 459,000 customer accounts in its $5.93 billion portfolio of managed receivables. Over the long term... -

Page 27

... and auto loan receivables. Revenue Recognition We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day, money-back... -

Page 28

...AND OPERATING REVENUES (In millions) Used vehicle sales New vehicle sales Wholesale vehicle sales Other sales and revenues: Extended service plan revenues Service department sales Third-party finance fees, net Total other sales and revenues Total net sales and operating revenues UNIT SALES $ 2013... -

Page 29

...units Used vehicle dollars WHOLESALE VEHICLE SALES CHANGES Wholesale vehicle units Wholesale vehicle dollars CHANGE IN USED CAR SUPERSTORE BASE Years Ended February 28 or 29 2013 2012 2011 20 % 33 % 3% 32 % 54 % 2% Used car superstores, beginning of period Superstore openings Used car superstores... -

Page 30

... subsequent retail sale. Those vehicles that do not meet our standards are sold through on-site wholesale auctions. Our wholesale auction prices usually reflect the trends in the general wholesale market for the types of vehicles we sell, although they can also be affected by changes in vehicle mix... -

Page 31

... adjust appraisal offers to be consistent with the broader market trade-in trends and our rapid inventory turns reduce our exposure to the inherent continual fluctuation in used vehicle values and contribute to our ability to manage gross profit dollars per unit. We employ a volume-based strategy... -

Page 32

...market that was caused by the dramatic decline in new car industry sales and the associated slow down in used vehicle trade-in activity, compared with pre-recession periods. The higher wholesale values increased both our vehicle acquisition costs and our average selling prices for used and wholesale... -

Page 33

...and business risk. Furthermore, we believe the company's processes and systems, transparency of pricing, vehicle quality and the integrity of the information collected at the time the customer applies for credit provide a unique and ideal environment in which to procure high quality auto loans, both... -

Page 34

... units financed Penetration rate (2) Weighted average contract rate Weighted average term (in months) (1) (2) $ All information relates to loans originated net of 3-day payoffs and vehicle returns. Vehicle units financed as a percentage of total retail units sold. Fiscal 2013 Versus Fiscal 2012... -

Page 35

... principal balance we receive when a vehicle is repossessed and liquidated, generally at our wholesale auctions. The annual recovery rate has ranged from a low of 42% to a high of 60%, and it is primarily affected by changes in the wholesale market pricing environment. Fiscal 2012 Versus Fiscal 2011... -

Page 36

... and retention of loans with higher risk, partly offset by favorable loss experience in fiscal 2012. FISCAL 2014 PLANNED SUPERSTORE OPENINGS Location Harrisonburg, Virginia (1) Columbus, Georgia (2) Savannah, Georgia Katy, Texas Fairfield, California Jackson, Tennessee Brandywine, Maryland St. Louis... -

Page 37

... sale-leaseback transactions. No sale-leasebacks have been executed since fiscal 2009. As of February 28, 2013, we owned 60 and leased 58 of our 118 used car superstores. Restricted cash from collections on auto loan receivables increased $20.0 million in fiscal 2013 and $43.3 million in fiscal 2012... -

Page 38

...million related to trades that were not settled until March 2013. This amount was included in accrued expenses and other current liabilities as of February 28, 2013. Fair Value Measurements. We report money market securities, mutual fund investments and derivative instruments at fair value. See Note... -

Page 39

... reserve accounts and the restricted cash from collections on auto loan receivables. See Note 2(F). Due to the uncertainty of forecasting expected variable interest rate payments, those amounts are not included in the table. See Note 10. Excludes taxes, insurance and other costs payable directly by... -

Page 40

... or expected cash payments principally related to the funding of our auto loan receivables. Disruptions in the credit markets could impact the effectiveness of our hedging strategies. Other receivables are financed with working capital. Generally, changes in interest rates associated with underlying... -

Page 41

... 2013. KPMG LLP, the company's independent registered public accounting firm, has issued a report on our internal control over financial reporting. Their report is included herein. THOMAS J. FOLLIARD PRESIDENT AND CHIEF EXECUTIVE OFFICER THOMAS W. REEDY EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL... -

Page 42

... these consolidated financial statements and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and... -

Page 43

...,206 230,711 80.3 2.2 14.5 3.0 100.0 85.5 14.5 2.5 9.8 0.4 ― 6.8 2.6 4.2 Cost of sales GROSS PROFIT CARMAX AUTO FINANCE INCOME Selling, general and administrative expenses Interest expense Other income Earnings before income taxes Income tax provision NET EARNINGS WEIGHTED AVERAGE COMMON SHARES... -

Page 44

.... The year ended February 28, 2013, includes a tax benefit adjustment of $8,518 related to prior years. Net of tax of $5,110, $0 and $0 for the years ended February 28, 2013, February 29, 2012, and February 28, 2011, respectively. See accompanying notes to consolidated financial statements. 40 -

Page 45

... ASSETS Auto loan receivables, net Property and equipment, net Deferred income taxes Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable Accrued expenses and other current liabilities Accrued income taxes Short-term debt Current portion of finance and... -

Page 46

... accounts (Purchases) sales of money market securities, net Purchases of investments available-for-sale Sales of investments available-for-sale NET CASH USED IN INVESTING ACTIVITIES FINANCING ACTIVITIES: (Decrease) increase in short-term debt, net Issuances of long-term debt Payments on long-term... -

Page 47

... 28, 2013 (1) Reflects the adoption in fiscal 2012 of ASU Nos. 2009-16 and 2009-17 effective March 1, 2010, to recognize the transfers of auto loan receivables and the related non-recourse notes payable on our consolidated balance sheets. See accompanying notes to consolidated financial statements... -

Page 48

... financing providers; the sale of extended service plans ("ESP"), guaranteed asset protection ("GAP") and accessories; and vehicle repair service. Vehicles purchased through the appraisal process that do not meet our retail standards are sold to licensed dealers through on-site wholesale auctions... -

Page 49

... cash, accounts receivable, money market securities, accounts payable, short-term debt and long-term debt approximates fair value. Our derivative instruments and mutual funds are recorded at fair value. Auto loan receivables are presented net of an allowance for estimated loan losses. See Note 6 for... -

Page 50

... established to fund informally our executive deferred compensation plan. Restricted investments totaled $35.0 million as of February 28, 2013, and $31.4 million as of February 29, 2012. (L) Finance Lease Obligations We generally account for sale-leaseback transactions as financings. Accordingly, we... -

Page 51

... purchase a vehicle. The ESPs we offer on all used vehicles provide coverage up to 72 months (subject to mileage limitations), while GAP covers the customer for the term of their finance contract. Because we are not the primary obligor under these plans, we recognize commission revenue at the time... -

Page 52

... at fair value as either current assets or current liabilities on the consolidated balance sheets. Where applicable, such contracts covered by master netting agreements are reported net. Gross positive fair values are netted with gross negative fair values by counterparty. The accounting for changes... -

Page 53

... year beginning March 1, 2013. We do not expect this pronouncement to have a material effect on our consolidated financial statements. In July 2012, the FASB issued an accounting pronouncement related to intangibles - goodwill and other (FASB ASC Topic 350), which permits companies to first consider... -

Page 54

... average managed receivables. AUTO LOAN RECEIVABLES 4. Auto loan receivables include amounts due from customers related to retail vehicle sales financed through CAF and are presented net of an allowance for estimated loan losses. We use warehouse facilities to fund auto loan receivables originated... -

Page 55

...4,959.8 Other receivables includes receivables not funded through the warehouse facilities or term securitizations. Credit Quality. When customers apply for financing, CAF uses proprietary scoring models that rely on the customers' credit history and certain application information to evaluate and... -

Page 56

.... These instruments are used to limit risk for investors in the warehouse facilities, to minimize the funding costs related to certain term securitization vehicles and to mitigate interest rate risk associated with related financial instruments. Changes in the fair value of derivatives not... -

Page 57

... testing. Represents the loss on interest rate swaps, the net periodic settlements and accrued interest. 6. FAIR VALUE MEASUREMENTS Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants... -

Page 58

... related to the funding of our auto loan receivables. Our derivatives are not exchange-traded and are over-the-counter customized derivative instruments. All of our derivative exposures are with highly rated bank counterparties. We measure derivative fair values assuming that the unit of account... -

Page 59

... (In thousands) Level 1 $ As of February 28, 2013 Level 2 Total 461,260 4,024 ― 465,284 100.0 % 4.7 % Assets: Money market securities Mutual fund investments Derivative instruments Total assets at fair value Percent of total assets at fair value Percent of total assets Liabilities: Derivative... -

Page 60

...Land held for development represents land owned for potential store growth. Leased property meeting capital lease criteria is capitalized and the present value of the related lease payments is recorded as long-term debt. Amortization of capital leased assets is included in depreciation expense, and... -

Page 61

... 12 months; however, we do not expect the change to have a significant effect on our results of operations, financial condition or cash flows. As of February 29, 2012, we had $20.9 million of gross unrecognized tax benefits, $3.9 million of which, if recognized, would affect our effective tax rate... -

Page 62

... 2012 2013 2012 2013 2012 (In thousands) Change in projected benefit obligation: Obligation at beginning of year Interest cost Actuarial loss (gain) Benefits paid Obligation at end of year Change in fair value of plan assets: Plan assets at beginning of year Actual return on plan assets Employer... -

Page 63

... plan's trustee and the investment managers. Within the fair value hierarchy (see Note 6), cash and cash equivalents and the mutual funds are classified as Level 1 as quoted active market prices for identical assets are used to measure fair value. The collective funds were public investment vehicles... -

Page 64

... gas and REIT sectors; approximately 90% of securities relate to non-U.S. entities and 10% of securities relate to U.S. entities as of February 29, 2012. Funding Policy. For the pension plan, we contribute amounts sufficient to meet minimum funding requirements as set forth in the employee benefit... -

Page 65

..., rate of return on plan assets and mortality rate. We evaluate these assumptions at least once a year and make changes as necessary. The discount rate used for retirement benefit plan accounting reflects the yields available on high-quality, fixed income debt instruments. For our plans, we review... -

Page 66

... Lease Obligations. Finance and capital lease obligations relate primarily to superstores subject to sale-leaseback transactions. The leases were structured at varying interest rates and generally have initial lease terms ranging from 15 to 20 years with payments made monthly. Payments on the leases... -

Page 67

... 2009. See Note 14 for information on future minimum lease obligations. Non-Recourse Notes Payable. The non-recourse notes payable relate to auto loan receivables funded through term securitizations and our warehouse facilities. The timing of principal payments on non-recourse notes payable is based... -

Page 68

... tax benefits of $10.9 million in fiscal 2012 and $7.7 million in fiscal 2011 from the vesting of restricted stock in those years, respectively. (D) Share-Based Compensation COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE (In thousands) Cost of sales CarMax Auto Finance income Selling, general... -

Page 69

... (net of estimated forfeitures) and is calculated based on the volume-weighted average price of our common stock on the last trading day of each reporting period. The total costs for matching contributions for our employee stock purchase plan are included in share-based compensation expense. There... -

Page 70

... using historical daily price changes of our stock for a period corresponding to the term of the options and the implied volatility derived from the market prices of traded options on our stock. Based on the U.S. Treasury yield curve in effect at the time of grant. Represents the estimated number... -

Page 71

... based on the expected market price of our common stock on the vesting date and the expected number of converted common shares. We realized related tax benefits of $9.6 million during fiscal 2013, from the vesting of market stock units. The unrecognized compensation costs related to nonvested MSUs... -

Page 72

.... The total costs for matching contributions are included in share-based compensation expense. 12. NET EARNINGS PER SHARE Nonvested share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are participating securities and should be... -

Page 73

... land and building leases related to CarMax superstore locations. Our lease obligations are based upon contractual minimum rates. Most leases provide that we pay taxes, maintenance, insurance and operating expenses applicable to the premises. The initial term of most real property leases will expire... -

Page 74

.... As part of our customer service strategy, we guarantee the used vehicles we retail with at least a 30-day limited warranty. A vehicle in need of repair within this period will be repaired free of charge. As a result, each vehicle sold has an implied liability associated with it. Accordingly, based... -

Page 75

16. SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED) 1st Quarter (In thousands, except per share data) 2nd Quarter 3rd Quarter 4th Quarter Fiscal Year Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general and administrative expenses Net earnings Net earnings per... -

Page 76

... and reported within the time periods specified in the U.S. Securities and Exchange Commission's rules and forms. Disclosure controls are also designed to ensure that this information is accumulated and communicated to management, including the chief executive officer ("CEO") and the chief financial... -

Page 77

... chief financial officer. Prior to joining CarMax, Mr. Reedy was vice president, corporate development and treasurer of Gateway, Inc., a technology retail company. Mr. Wood joined CarMax in 1993 as a buyer-in-training. He has served as buyer, purchasing manager, district manager, regional director... -

Page 78

...- Related Person Transactions" in our 2013 Proxy Statement. The information required by this Item concerning director independence is incorporated by reference to the sub-section titled "Corporate Governance - Independence" in our 2013 Proxy Statement. Item 14. Principal Accountant Fees and Services... -

Page 79

... J. Folliard President and Chief Executive Officer April 26, 2013 By: /s/ THOMAS W. REEDY Thomas W. Reedy Executive Vice President and Chief Financial Officer April 26, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons... -

Page 80

... to CarMax's Current Report on Form 8-K, filed February 1, 2013 (File No. 1-31420), is incorporated by this reference. CarMax, Inc. Employment Agreement for Executive Officer, dated December 1, 2011, between CarMax, Inc. and Thomas J. Folliard, filed as Exhibit 10.4 to CarMax's Quarterly Report on... -

Page 81

... non-employee directors of the CarMax, Inc. board of directors, filed as Exhibit 10.5 to CarMax's Current Report on Form 8-K, filed April 28, 2006 (File No. 1-31420), is incorporated by this reference. * Form of Incentive Award Agreement between CarMax, Inc. and certain named executive officers... -

Page 82

... Award Agreement between CarMax, Inc. and certain executive officers, filed as Exhibit 10.17 to CarMax's Annual Report on Form 10-K, filed May 13, 2005 (File No. 1-31420), is incorporated by this reference. * Form of Incentive Award Agreement between CarMax, Inc. and certain non-employee directors... -

Page 83

...COMPANY OFFICERS SENIOR MANAGEMENT TEAM Tom Folliard President and Chief Executive Officer Bill Nash EVP, Human Resources and Administration Tom Reedy EVP, Chief Financial Officer Cliff Wood EVP, Stores Angie Chattin SVP, CarMax Auto Finance Ed Hill SVP, Service Operations Eric Margolin SVP, General... -

Page 84

... RVP, Service Operations Atlanta Region Gary Sheehan AVP, Process Engineering Greg Shull AVP, Information Technology Vaughn Sigmon RVP, General Manager Los Angeles Region Judith Simon AVP, Service Operations David Smith AVP, Pricing and Inventory Strategy Greg Stewart AVP, Associate Relations Mac... -

Page 85

This Page Intentionally Left Blank -

Page 86

This Page Intentionally Left Blank -

Page 87

...HOME OFFICE FINANCIAL INFORMATION CarMax, Inc. 12800 Tuckahoe Creek Parkway Richmond, Virginia 23238 Telephone: (804) 747-0422 WEBSITE www.carmax.com ANNUAL SHAREHOLDERS' MEETING For quarterly sales and earnings information, ï¬nancial reports, ï¬lings with the Securities and Exchange Commission... -

Page 88

CARMAX, INC. 12800 TUCKAHOE CREEK PARKWAY RICHMOND, VIRGINIA 23238 804-747-0422 WWW.CARMAX.COM