CarMax 2000 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

74

(C) INCOME TAXES: The CarMax Group is included in the consolidated fed-

eral income tax return and in certain state tax returns filed by the Com-

pany. Accordingly, the provision for federal income taxes and related

payments of tax are determined on a consolidated basis. The financial

statement provision and the related tax payments or refunds are reflected

in each Group’s financial statements in accordance with the Company’s

tax allocation policy for such Groups. In general,this policy provides that

the consolidated tax provision and related tax payments or refunds will

be allocated between the Groups based principally upon the financial

income,taxable income,credits and other amounts directly related to

each Group. Tax benefits that cannot be used by the Group generating

such attributes,but can be utilized on a consolidated basis,are allocated

to the Group that generated such benefits. As a result,the allocated Group

amounts of taxes payable or refundable are not necessarily comparable to

those that would have resulted if the Groups had filed separate tax returns.

4. BUSINESS ACQUISITIONS

The CarMax Group acquired the franchise rights and the related assets of

six new-car dealerships for an aggregate cost of $34.8 million in fiscal

2000. The acquisitions were financed through available cash resources.

During fiscal 1999, CarMax acquired the franchise rights and the related

assets for four new-car dealerships for an aggregate cost of $49.6 million.

These acquisitions were financed through available cash resources and

the issuance of two promissory notes aggregating $8.0 million. Costs in

excess of the fair value of the net tangible assets acquired (primarily

inventory) have been recorded as goodwill and covenants not to compete.

These acquisitions were accounted for under the purchase method and

the results of the operations of the acquired franchises have been

included in the accompanying CarMax Group financial statements since

the date of acquisition. Unaudited pro forma information related to these

acquisitions is not included as the impact of these acquisitions on the

accompanying CarMax Group financial statements is not material.

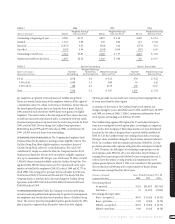

5. ACCOUNTS RECEIVABLE AND

SECURITIZATION TRANSACTIONS

Accounts receivable consist of the following at February 29 or 28:

(Amounts in thousands) 2000 1999

Trade receivables............................................ $ 70,763 $ 23,649

Installment receivables:

Held for sale.............................................. 23,477 14,690

Held for investment .................................. 22,088 38,093

Retained interests..................................... 18,743 26,145

Total accounts receivable................................ 135,071 102,577

Less allowance for doubtful accounts ............ 5,818 5,213

Net accounts receivable.................................. $129,253 $ 97,364

In fiscal 1996,the Company entered into a securitization transaction on

behalf of the CarMax Group to finance the installment receivables gener-

ated by the Group’s wholly owned finance operation. A restructuring of

the facility during fiscal 1997 resulted in the recourse provisions being

eliminated. Proceeds from the auto loan securitization transaction were

$348 million during fiscal 2000, $271 million during fiscal 1999 and

$123 million during fiscal 1998. This auto loan securitization program

has a total program capacity of $500 million.

In October 1999,the Company formed a second securitization facility

that allowed for a $644 million securitization of auto loan receivables in

the public market. The program had a capacity of $559 million as of

February 29, 2000, with no recourse provisions.

Receivables relating to the securitization facilities consist of the following

at February 29 or 28:

(Amounts in thousands) 2000 1999

Managed receivables.................................. $ 931,745 $589,032

Receivables held by the CarMax Group:

For sale................................................. (23,477) (14,690)

For investment* ................................... (21,096) (35,342)

Net receivables sold.................................... $ 887,172 $539,000

Program capacity....................................... $1,059,500 $575,000

*Held by a bankruptcy remote special purpose company

The finance charges from the transferred receivables are used to fund

interest costs,charge-offs and servicing fees. Rights recorded for future

finance income from serviced assets that exceed the contractually speci-

fied servicing fees are carried at fair value and amounted to $15.5 million

at February 29, 2000, $14.7 million at February 28,1999,and $6.8 million

at February 28,1998,and are included in net accounts receivable. Changes

in these retained interests consisted of originated retained interests of

$17.5 million in fiscal 2000,$16.6 million in fiscal 1999 and $7.3 million

in fiscal 1998,less amortization of $16.7 million in fiscal 2000,$8.7 million

in fiscal 1999 and $3.6 million in fiscal 1998. The finance operation’s ser-

vicing revenue totaled $36.9 million for fiscal 2000,$28.2 million for fiscal

1999 and $11.2 million for fiscal 1998. The servicing fee specified in the

auto loan securitization agreements adequately compensates the finance

operation for servicing the accounts. Accordingly,no servicing asset or

liability has been recorded.

In determining the fair value of retained interests,the Company estimates

future cash flows from finance charge collections,reduced by net defaults,

servicing cost and interest cost. The Company employs a risk-based pric-

ing strategy that increases the stated annual percentage rate for accounts

that have a higher predicted risk of default. Accounts with a lower risk

profile also may qualify for promotional financing.

The APRs range from 6 percent to 18 percent fixed,with default rates

varying based on credit quality, but generally aggregating 0.75 percent to

1.25 percent. The weighted average life of the receivables is expected to be

in the 18 month to 20 month range.Interest cost depends on the time at

which accounts were originated,but is in the range of 6.4 percent to 6.6

percent at February 29,2000.