CarMax 2000 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

48

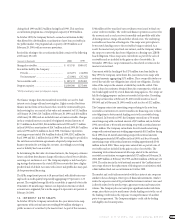

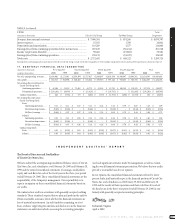

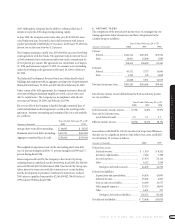

For fiscal 2000,the loss from the discontinued operations of Divx totaled

$16.2 million after an income tax benefit of $9.9 million. The loss from

the discontinued operations of Divx totaled $68.5 million after an income

tax benefit of $42.0 million in fiscal 1999 and $20.6 million after an

income tax benefit of $12.6 million in fiscal 1998.

In fiscal 2000,the loss on the disposal of the Divx business totaled $114.0

million after an income tax benefit of $69.9 million. The loss on the dis-

posal includes a provision for operating losses to be incurred during the

phase-out period. It also includes provisions for commitments under

licensing agreements with motion picture distributors,the write-down of

assets to net realizable value,lease termination costs,employee severance

and benefit costs and other contractual commitments.

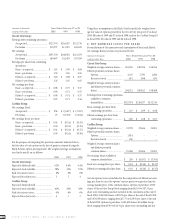

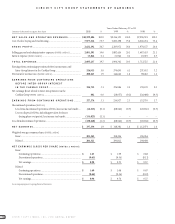

Net Earnings

Net earnings for the Circuit City Group rose 33 percent to $197.3 million,

or 96 cents per share, in fiscal 2000. Net earnings for the Circuit City

Group increased 32 percent to $148.4 million,or 74 cents per share,in fis-

cal 1999,from $112.1 million,or 57 cents per share, in fiscal 1998.

Operations Outlook

Management expects that industry growth, primarily driven by the

introduction of better-featured products and new technologies,will be

the primary contributor to sales and earnings growth for the Circuit City

business during the coming decade. Management anticipates that growth

in the household penetration of products and services such as digital

television,direct broadcast satellite systems,wireless communications,

digital camcorders,DVD players,multi-function set-top boxes and broad-

band Internet access will contribute significantly to overall sales and

earnings growth.

During fiscal 2000,the Group undertook several significant merchandising

initiatives. Consistent with past practice,the Group added displays for new

products,which in fiscal 2000 included digital televisions,digital imaging

and high-speed broadband Internet access. The Group also announced

two significant vendor initiatives. Circuit City entered into a strategic

alliance with America Online,Inc.to provide in-store promotion of AOL

products and services and to increase Circuit City’s presence on the Inter-

net by featuring Circuit City as an anchor tenant on key Shop@ online des-

tinations across several America Online, Inc.brands. Circuit City and Sony

Electronics Inc.also announced plans to co-promote Memory Stick media

and hardware. In virtually all of the Circuit City Superstores opened since

the fall,the Group significantly expanded the number of self-service prod-

ucts. In July,the Group launched its electronic Superstore, circuitcity.com,

and it has continued to develop the site. The Group’s e-commerce business

is tightly integrated with its brick-and-mortar locations,allowing for

product pickup, returns and exchanges at the store.

In fiscal 2001,the Group will build on the initiatives begun in fiscal 2000.

The planned 25 new Superstores and all 571 existing Superstores will fea-

ture new displays designed to highlight the latest advances in technology.

These displays will include AOL Internet Centers; a Sony Memory Stick

Interactive Universe; significantly expanded displays highlighting digital

audio recording technology; redesigned wireless phone displays; more

prominent digital video displays; and additional digital television displays

and assortment. A full selection of video game hardware and software

will be added to all new stores and to a significant percentage of existing

stores. These enhancements will help ensure that Circuit City is in the best

position to capture the sales opportunity presented by the digital cycle.

The Group also will remodel 30 to 35 stores in the Richmond,Va.,and the

Miami,West Palm Beach,Tampa,Fort Myers and Orlando,Fla.,markets.

These remodeled Superstores will allow management to test a concept

dedicated to consumer electronics and home office products. These stores

will feature the technology displays discussed above; expanded assort-

ments of entertainment and computer software,peripherals and acces-

sories; and additional self-service areas. Superstores opened after the first

fiscal quarter also will be dedicated to consumer electronics and home

office products. In the remodel markets, Circuit City will test approxi-

mately six stand-alone major appliance stores to create better selling

space for the new technologies in the appliance business and to increase

consumer awareness of Circuit City’s appliance offering.

Circuit City has established its presence in virtually all of the nation’s

top 100 markets and will continue adding to the existing store base as

attractive market opportunities arise. Management believes that the

Group has the opportunity to operate approximately 800 Superstores

within the United States. In fiscal 2001, the Group will continue to expand

its Superstore concept into new trade areas, adding approximately 25

stores that are either new-market entries or fill-in locations in existing

Circuit City markets.

Management anticipates that the industry’s growth, geographic expan-

sion,Superstore remodeling and continued strong operating controls will

enable the Circuit City business to generate earnings growth of 20 percent

to 25 percent in fiscal 2001. Management believes that continued empha-

sis on revenue growth and operating margin enhancements at CarMax

will deliver solid profitability in fiscal 2001. The Circuit City Group’s

Inter-Group Interest in CarMax will partly reflect the CarMax results.

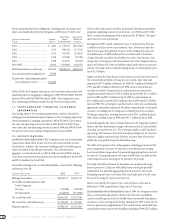

RECENT ACCOUNTING PRONOUNCEMENTS

Refer to the “Management’s Discussion and Analysis of Results of Opera-

tions and Financial Condition”for Circuit City Stores, Inc.for a review of

recent accounting pronouncements.

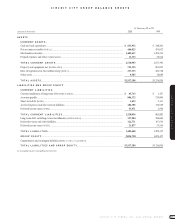

FINANCIAL CONDITION

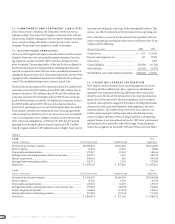

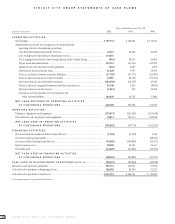

In fiscal 2000, net cash provided by operating activities of continuing

operations was $618.6 million compared with $391.5 million in fiscal

1999 and $314.3 million in fiscal 1998. The fiscal 2000 increase reflects

a 51 percent increase in earnings from continuing operations for the

Circuit City Group and an increase in accounts payable,partly offset

by an increase in inventory. The fiscal 1999 increase primarily reflects a

decrease in net accounts receivable and improvements in net earnings for

the Circuit City business.

Most financial activities,including the investment of surplus cash and the

issuance and repayment of short-term and long-term debt,are managed

by the Company on a centralized basis. Allocated debt of the Circuit City

Group consists of (1) Company debt,if any, that has been allocated in its

entirety to the Circuit City Group and (2) a portion of the Company’s debt

that is allocated between the Groups. This pooled debt bears interest at a

rate based on the average pooled debt balance. Expenses related to