CarMax 2000 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

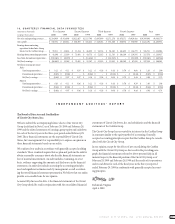

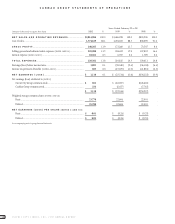

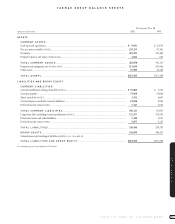

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 73

CARMAX GROUP

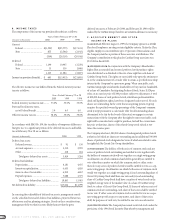

(I) INCOME TAXES: Income taxes are accounted for in accordance with SFAS

No.109,“Accounting for Income Taxes.”Deferred income taxes reflect the

impact of temporary differences between the amounts of assets and lia-

bilities recognized for financial reporting purposes and the amounts rec-

ognized for income tax purposes,measured by applying currently

enacted tax laws. A deferred tax asset is recognized if it is more likely

than not that a benefit will be realized.

(J) DEFERRED REVENUE: The CarMax Group sells service contracts on behalf

of an unrelated third party and,prior to July 1997,sold its own contracts

at one location where third-party warranty sales were not permitted.

Contracts usually have terms of coverage between 12 and 72 months.

Inasmuch as the Company is the primary obligor on these contracts,

revenue from the sale of the CarMax Group’s own service contracts was

deferred and amortized over the life of the contracts consistent with the

pattern of repair experience of the industry. Incremental direct costs

related to the sale of contracts were deferred and charged to expense in

proportion to the revenue recognized. Commission revenue for the unre-

lated third-party service contracts is recognized at the time of sale, since

the third party is the primary obligor under these contracts.

(K) SELLING,GENERAL AND ADMINISTRATIVE EXPENSES: Operating profits

generated by the finance operation are recorded as a reduction to selling,

general and administrative expenses.

(L) ADVERTISING EXPENSES: All advertising costs are expensed as incurred.

(M) NET EARNINGS (LOSS) PER SHARE: The Company calculates earnings per

share based upon SFAS No.128,“Earnings per Share.”Basic net earnings

(loss) per share for CarMax Group Stock is computed by dividing net

earnings (loss) attributed to CarMax Group Stock by the weighted average

number of shares of CarMax Group Stock outstanding. Diluted net earn-

ings per share for CarMax Group Stock is computed by dividing net earn-

ings attributed to CarMax Group Stock by the weighted average number

of shares of CarMax Group Stock outstanding and dilutive potential

CarMax Group Stock.

(N) STOCK-BASED COMPENSATION: The Company accounts for stock-based

compensation in accordance with Accounting Principles Board Opinion No.

25,“Accounting For Stock Issued to Employees,”and provides the pro forma

disclosures of SFAS No.123,“Accounting for Stock-Based Compensation.”

(O) DERIVATIVE FINANCIAL INSTRUMENTS: The Company enters into interest

rate swap agreements to manage exposure to interest rates and to more

closely match funding costs to the use of funding. Interest rate swaps

relating to long-term debt are classified as held for purposes other than

trading and are accounted for on a settlement basis. To qualify for this

accounting treatment,the swap must synthetically alter the nature of a

designated underlying financial instrument. Under this method,pay-

ments or receipts due or owed under the swap agreement are accrued

through each settlement date and recorded as a component of interest

expense. If a swap designated as a synthetic alteration were to be termi-

nated,any gain or loss on the termination would be deferred and recog-

nized over the shorter of the original contractual life of the swap or the

related life of the designated long-term debt.

The Company also enters into interest rate swap agreements as part of

its asset securitization programs. Swaps entered into by a seller as part

of a sale of financial assets are considered proceeds at fair value in the

determination of the gain or loss on the sale. If such a swap were to be

terminated,the impact on the fair value of the financial asset created

by the sale of the related receivables would be estimated and included

in earnings.

(P) RISKS AND UNCERTAINTIES:The CarMax Group is a used- and new-car

retail business. The diversity of the CarMax Group’s customers and suppliers

reduces the risk that a severe impact will occur in the near term as a result of

changes in its customer base or sources of supply. However,because of the

CarMax Group’s limited overall size,management cannot assure that unan-

ticipated events will not have a negative impact on the Group.

The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets,liabilities,

revenues and expenses and the disclosure of contingent assets and liabili-

ties. Actual results could differ from those estimates.

(Q) RECLASSIFICATIONS: Certain amounts in prior years have been reclassi-

fied to conform to classifications adopted in fiscal 2000.

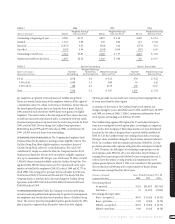

3. CORPORATE ACTIVITIES

The CarMax Group’s financial statements reflect the application of the

management and allocation policies adopted by the board of directors to

various corporate activities, as described below:

(A) FINANCIAL ACTIVITIES: Most financial activities are managed by the

Company on a centralized basis. Such financial activities include the

investment of surplus cash and the issuance and repayment of short-term

and long-term debt. Allocated invested surplus cash of the CarMax Group

consists of (i) Company cash equivalents, if any, that have been allocated

in their entirety to the CarMax Group and (ii) a portion of the Company’s

cash equivalents that are allocated between the Groups. Investment of

surplus cash from the February 1997 CarMax Group equity offering has

been allocated to the CarMax Group. Allocated debt of the CarMax Group

consists of (i) Company debt,if any, that has been allocated in its entirety

to the CarMax Group and (ii) a portion of the Company’s pooled debt,

which is debt allocated between the Groups. The pooled debt bears inter-

est at a rate based on the average pooled debt balance. Expenses related

to increases in pooled debt are reflected in the weighted average interest

rate of such pooled debt as a whole.

(B) CORPORATE GENERAL AND ADMINISTRATIVE COSTS: Corporate general

and administrative costs and other shared services generally have been

allocated to the CarMax Group based upon utilization of such services by

the Group. Where determinations based on utilization alone have been

impractical, other methods and criteria were used that management

believes are equitable and provide a reasonable estimate of the costs

attributable to the Group. Costs allocated to the CarMax Group totaled

approximately $5.6 million for fiscal 2000, $7.5 million for fiscal 1999 and

$6.2 million for fiscal 1998.