CarMax 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

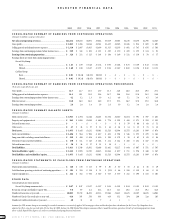

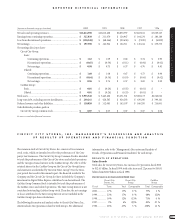

2000 1999 1998 1997 1996 1995 1994 1993 1992 1991

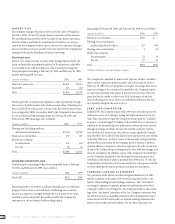

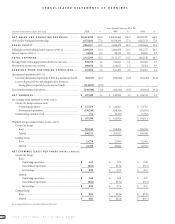

CONSOLIDATED SUMMARY OF EARNINGS FROM CONTINUING OPERATIONS

(Amounts in millions except per share data)

Net sales and operating revenues................................................ $12,614 $10,810 $8,871 $7,664 $7,029 $5,583 $4,130 $3,270 $2,790 $2,367

Gross profit...................................................................................... $ 2,863 $ 2,456 $2,044 $1,761 $1,635 $1,385 $1,106 $ 924 $ 809 $ 690

Selling, general and administrative expenses................................. $ 2,310 $ 2,087 $1,815 $1,499 $1,315 $1,105 $ 892 $ 745 $ 676 $ 586

Earnings from continuing operations before income taxes............ $ 529 $ 341 $ 202 $ 233 $ 295 $ 270 $ 209 $ 175 $ 124 $ 91

Earnings from continuing operations........................................ $ 328 $ 211 $ 125 $ 144 $ 184 $ 169 $ 132 $ 110 $ 78 $ 57

Earnings (loss) per share from continuing operations:

Circuit City Group:

Basic.................................................................................. $ 1.63 $ 1.09 $ 0.68 $ 0.74 $ 0.95 $ 0.88 $ 0.70 $ 0.59 $ 0.43 $ 0.31

Diluted............................................................................... $ 1.60 $ 1.08 $ 0.67 $ 0.73 $ 0.94 $ 0.87 $ 0.69 $ 0.58 $ 0.42 $ 0.31

CarMax Group:

Basic.................................................................................. $ 0.01 $ (0.24) $(0.35) $(0.01) $ – $ – $ – $ – $ – $ –

Diluted............................................................................... $ 0.01 $ (0.24) $(0.35) $(0.01) $ – $ – $ – $ – $ – $ –

CONSOLIDATED SUMMARY OF EARNINGS FROM CONTINUING OPERATIONS PERCENTAGES

(% to sales except effective tax rate)

Gross profit...................................................................................... 22.7 22.7 23.0 23.0 23.3 24.8 26.8 28.3 29.0 29.1

Selling, general and administrative expenses................................. 18.3 19.3 20.5 19.6 18.7 19.8 21.6 22.8 24.2 24.8

Earnings from continuing operations before income taxes............ 4.2 3.2 2.3 3.0 4.2 4.8 5.1 5.4 4.5 3.9

Effective tax rate.............................................................................. 38.0 38.0 38.0 38.0 37.5 37.5 36.7 37.0 37.0 38.0

Earnings from continuing operations............................................. 2.6 2.0 1.4 1.9 2.6 3.0 3.2 3.4 2.8 2.4

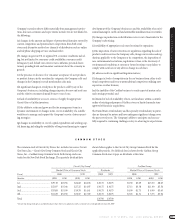

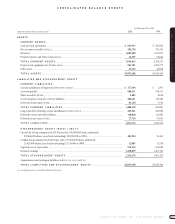

CONSOLIDATED SUMMARY BALANCE SHEETS

(Amounts in millions)

Total current assets ......................................................................... $ 2,943 $ 2,394 $2,146 $2,163 $1,736 $1,387 $1,024 $ 791 $ 597 $ 450

Property and equipment,net.......................................................... $ 965 $ 1,006 $1,049 $ 886 $ 774 $ 593 $ 438 $ 371 $ 319 $ 355

Deferred income taxes..................................................................... $ – $ – $ – $ – $ – $ 6 $ 79 $ 88 $ 68 $ 51

Other assets..................................................................................... $ 47 $ 45 $ 37 $ 32 $ 16 $ 18 $ 14 $ 13 $ 15 $ 18

Total assets..................................................................................... $ 3,955 $ 3,445 $3,232 $3,081 $2,526 $2,004 $1,555 $1,263 $ 999 $ 874

Total current liabilities.................................................................... $ 1,406 $ 964 $ 906 $ 837 $ 831 $ 706 $ 546 $ 373 $ 279 $ 261

Long-term debt,excluding current installments............................ $ 249 $ 426 $ 424 $ 430 $ 399 $ 179 $ 30 $ 82 $ 85 $ 94

Deferred revenue and other liabilities............................................. $ 130 $ 112 $ 145 $ 166 $ 214 $ 242 $ 268 $ 232 $ 187 $ 152

Deferred income taxes .................................................................... $ 28 $ 38 $ 27 $ 33 $ 18 $ – $ – $ – $ – $ –

Total liabilities............................................................................... $ 1,813 $ 1,540 $1,502 $1,466 $1,462 $1,127 $ 844 $ 687 $ 551 $ 507

Total stockholders’ equity............................................................. $ 2,142 $ 1,905 $1,730 $1,615 $1,064 $ 877 $ 711 $ 576 $ 448 $ 367

Total liabilities and stockholders’ equity.................................... $ 3,955 $ 3,445 $3,232 $3,081 $2,526 $2,004 $1,555 $1,263 $ 999 $ 874

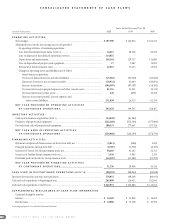

CONSOLIDATED STATEMENTS OF CASH FLOWS FROM CONTINUING OPERATIONS

(Amounts in millions)

Depreciation and amortization....................................................... $ 148 $ 130 $ 115 $ 99 $ 80 $ 67 $ 55 $ 42 $ 36 $ 29

Cash flow from operating activities of continuing operations........ $ 593 $ 310 $ 228 $ 23 $ (51) $ 48 $ 108 $ 150 $ 66 $ 53

Capital expenditures....................................................................... $ 222 $ 352 $ 576 $ 540 $ 517 $ 375 $ 252 $ 190 $ 110 $ 160

OTHER DATA

Cash dividends per share paid on

Circuit City Group common stock............................................ $ 0.07 $ 0.07 $ 0.07 $ 0.07 $ 0.06 $ 0.05 $ 0.04 $ 0.03 $ 0.03 $ 0.03

Return on average stockholders’ equity (%)................................... 9.8 7.9 6.2 10.2 18.5 21.1 20.6 21.5 19.2 16.8

Number of Associates at year-end................................................... 60,083 53,710 46,691 42,312 37,086 31,413 23,625 20,107 16,635 14,982

Number of Circuit City retail units at year-end .............................. 616 587 556 493 419 352 294 260 228 185

Number of CarMax retail units at year-end.................................... 40 31 18 7 4 2 1 – – –

Amounts for 1991 assume change in accounting for extended warranties is retroactively applied. All earnings per share and dividend per share calculations for the Circuit City Group have been

adjusted to reflect a two-for-one stock split effective June 30, 1999. On June 16, 1999, Digital Video Express announced that it would discontinue operations. Results of continuing operations shown

above exclude Digital Video Express.See notes to consolidated and group financial statements.

SELECTED FINANCIAL DATA

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

22