CarMax 2000 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 63

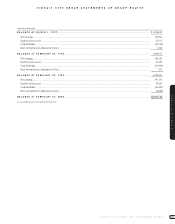

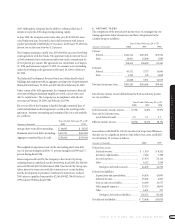

CIRCUIT CITY GROUP

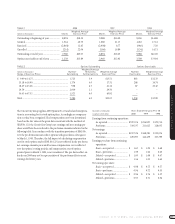

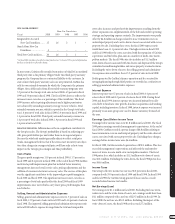

16. QUARTERLY FINANCIAL DATA (UNAUDITED)

(Amounts in thousands First Quarter Second Quarter Third Quarter Fourth Quarter Year

except per share data) 2000 1999 2000 1999 2000 1999 2000 1999 2000 1999

Net sales and operating revenues....... $2,204,919 $1,924,698 $2,422,667 $2,117,796 $2,495,649 $2,272,258 $3,476,171 $3,029,418 $10,599,406 $9,344,170

Gross profit......................................... $ 540,731 $ 465,012 $ 604,503 $ 526,622 $ 618,182 $ 553,388 $ 858,776 $ 738,950 $ 2,622,192 $2,283,972

Earnings from continuing

operations before Inter-Group

Interest in the CarMax Group........ $ 39,311 $ 23,818 $ 71,234 $ 46,053 $ 54,714 $ 38,340 $ 161,453 $ 126,773 $ 326,712 $ 234,984

Earnings from continuing operations $ 41,398 $ 21,339 $ 73,692 $ 43,773 $ 52,335 $ 32,710 $ 160,149 $ 119,105 $ 327,574 $ 216,927

Loss from discontinued operations.... $ (130,240) $ (8,070) $ – $ (11,626) $ – $ (16,765) $ – $ (32,085) $ (130,240) $ (68,546)

Net (loss) earnings............................. $ (88,842) $ 13,269 $ 73,692 $ 32,147 $ 52,335 $ 15,945 $ 160,149 $ 87,020 $ 197,334 $ 148,381

Net (loss) earnings per share:

Basic:

Continuing operations ............. $ 0.21 $ 0.11 $ 0.37 $ 0.22 $ 0.26 $ 0.16 $ 0.79 $ 0.60 $ 1.63 $ 1.09

Discontinued operations.......... $ (0.65) $ (0.04) $ – $ (0.06) $ – $ (0.08) $ – $ (0.16) $ (0.65) $ (0.34)

Net (loss) earnings................... $ (0.44) $ 0.07 $ 0.37 $ 0.16 $ 0.26 $ 0.08 $ 0.79 $ 0.44 $ 0.98 $ 0.75

Diluted:

Continuing operations ............. $ 0.20 $ 0.11 $ 0.36 $ 0.22 $ 0.26 $ 0.16 $ 0.78 $ 0.59 $ 1.60 $ 1.08

Discontinued operations.......... $ (0.64) $ (0.04) $ – $ (0.06) $ – $ (0.08) $ – $ (0.16) $ (0.64) $ (0.34)

Net (loss) earnings................... $ (0.44) $ 0.07 $ 0.36 $ 0.16 $ 0.26 $ 0.08 $ 0.78 $ 0.44 $ 0.96 $ 0.74

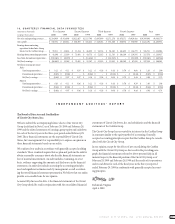

INDEPENDENT AUDITORS’ REPORT

The Board of Directors and Stockholders

of Circuit City Stores, Inc.:

We have audited the accompanying balance sheets of the Circuit City

Group (as defined in Note 1) as of February 29,2000 and February 28,

1999 and the related statements of earnings,group equity and cash flows

for each of the fiscal years in the three-year period ended February 29,

2000.These financial statements are the responsibility of Circuit City

Stores,Inc.’s management.Our responsibility is to express an opinion on

these financial statements based on our audits.

We conducted our audits in accordance with generally accepted auditing

standards. Those standards require that we plan and perform the audit to

obtain reasonable assurance about whether the financial statements are

free of material misstatement.An audit includes examining,on a test

basis,evidence supporting the amounts and disclosures in the financial

statements.An audit also includes assessing the accounting principles

used and significant estimates made by management,as well as evaluat-

ing the overall financial statement presentation.We believe that our audits

provide a reasonable basis for our opinion.

As more fully discussed in Note 1,the financial statements of the Circuit

City Group should be read in conjunction with the consolidated financial

statements of Circuit City Stores,Inc.and subsidiaries and the financial

statements of the CarMax Group.

The Circuit City Group has accounted for its interest in the CarMax Group

in a manner similar to the equity method of accounting.Generally

accepted accounting principles require that the CarMax Group be consoli-

dated with the Circuit City Group.

In our opinion,except for the effects of not consolidating the CarMax

Group with the Circuit City Group as discussed in the preceding para-

graph,the financial statements referred to above present fairly, in all

material respects,the financial position of the Circuit City Group as of

February 29, 2000 and February 28,1999 and the results of its operations

and its cash flows for each of the fiscal years in the three-year period

ended February 29, 2000 in conformity with generally accepted account-

ing principles.

Richmond,Virginia

April 4,2000