CarMax 2000 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

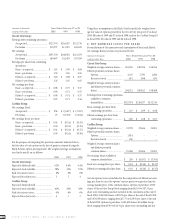

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 43

CIRCUIT CITY STORES, INC.

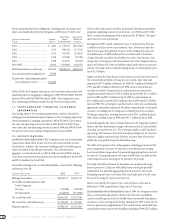

during fiscal 1999 and $123 million during fiscal 1998. This auto loan

securitization program has a total program capacity of $500 million.

In October 1999,the Company formed a second securitization facility

that allowed for a $644 million securitization of auto loan receivables in

the public market. The program had a capacity of $559 million as of

February 29, 2000, with no recourse provisions.

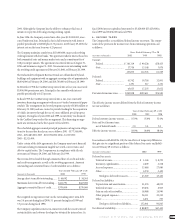

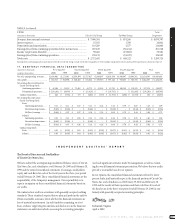

Receivables relating to the securitization facilities consist of the following

at February 29 or 28:

(Amounts in thousands) 2000 1999

Managed receivables .......................................... $ 931,745 $589,032

Receivables held by the Company:

For sale.......................................................... (23,477) (14,690)

For investment*............................................ (21,096) (35,342)

Net receivables sold............................................ $ 887,172 $539,000

Program capacity ............................................... $1,059,500 $575,000

*Held by a bankruptcy remote special purpose company

The finance charges from the transferred receivables are used to fund

interest costs,charge-offs and servicing fees. Rights recorded for future

finance income from serviced assets that exceed the contractually speci-

fied servicing fees are carried at fair value and amounted to $15.5 million

at February 29, 2000, $14.7 million at February 28,1999,and $6.8 million

at February 28,1998,and are included in net accounts receivable. Changes

in these retained interests consisted of originated retained interests of

$17.5 million in fiscal 2000,$16.6 million in fiscal 1999 and $7.3 million

in fiscal 1998,less amortization of $16.7 million in fiscal 2000,$8.7 million

in fiscal 1999 and $3.6 million in fiscal 1998. The finance operation’s

servicing revenue totaled $36.9 million for fiscal 2000,$28.2 million for

fiscal 1999 and $11.2 million for fiscal 1998. The servicing fee specified in

the auto loan securitization agreements adequately compensates the

finance operation for servicing the accounts. Accordingly, no servicing

asset or liability has been recorded.

In determining the fair value of retained interests,the Company estimates

future cash flows from finance charge collections,reduced by net defaults,

servicing cost and interest cost. The Company employs a risk-based pric-

ing strategy that increases the stated APR for accounts that have a higher

predicted risk of default. Accounts with a lower risk profile also may qual-

ify for promotional financing.

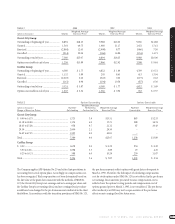

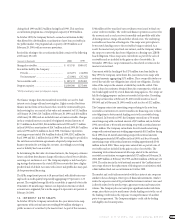

The APRs range from 6 percent to 18 percent fixed,with default rates vary-

ing based on credit quality,but generally aggregating 0.75 percent to 1.25

percent. The weighted average life of the receivables is expected to be in the

18 month to 20 month range. Interest cost depends on the time at which

accounts were originated,but is in the range of 6.4 percent to 6.6 percent at

February 29, 2000.

13. INTEREST RATE SWAPS

In October 1994,the Company entered into five-year interest rate swap

agreements with notional amounts totaling $300 million relating to a

public issuance of securities by the master trust. As part of this issuance,

$344 million of five-year,fixed-rate certificates were issued to fund con-

sumer credit receivables. The credit card finance operation is servicer for

the accounts,and as such,receives its monthly cash portfolio yield after

deducting interest,charge-offs and other related costs. The underlying

receivables are based on a floating rate. The swaps were put in place to

better match funding costs to the receivables being securitized. As a

result,the master trust pays fixed-rate interest,and the Company utilizes

the swaps to convert the fixed-rate obligation to a floating-rate,LIBOR-

based obligation. These swaps were entered into as part of the sales of

receivables and are included in the gain on sales of receivables. In

November 1999,these swaps terminated as the related securities in the

master trust matured.

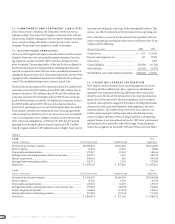

Concurrent with the funding of the $175 million term loan facility in

May 1995, the Company entered into five-year interest rate swaps with

notional amounts aggregating $175 million. These swaps effectively con-

verted the variable-rate obligation into a fixed-rate obligation. The fair

value of the swaps is the amount at which they could be settled. This

value is based on estimates obtained from the counterparties, which are

two banks highly rated by several financial rating agencies. The swaps are

held for hedging purposes and are not recorded at fair value. Recording

the swaps at fair value at February 29, 2000, would result in a loss of

$90,000,and at February 28, 1999, would result in a loss of $2.2 million.

The Company enters into amortizing swaps relating to the auto loan

receivable securitization to convert variable-rate financing costs to fixed-

rate obligations to better match funding costs to the receivables being

securitized. In November 1995,the Company entered into a 50-month

amortizing swap with a notional amount of $75 million and,in October

1996,entered into a 40-month amortizing swap with a notional amount

of $64 million. The Company entered into four 40-month amortizing

swaps with notional amounts totaling approximately $162 million during

fiscal 1998, four 40-month amortizing swaps with notional amounts

totaling approximately $387 million in fiscal 1999,and four 40-month

amortizing swaps with notional amounts totaling approximately $344

million in fiscal 2000. These swaps were entered into as part of sales of

receivables and are included in the gain on sales of receivables. The

remaining total notional amount of all swaps related to the auto loan

receivable securitization was approximately $327 million at February 29,

2000,$499 million at February 28, 1999, and $224 million at February 28,

1998. The reduction in the total notional amount of the CarMax interest

rate swaps relates to the replacement of floating rate securitizations with

a $644 million fixed-rate securitization in October 1999.

The market and credit risks associated with these interest rate swaps are

similar to those relating to other types of financial instruments. Market

risk is the exposure created by potential fluctuations in interest rates and

is directly related to the product type, agreement terms and transaction

volume. The Company does not anticipate significant market risk from

swaps,since their use is to match more closely funding costs to the use of

the funding. Credit risk is the exposure to nonperformance of another

party to an agreement. The Company mitigates credit risk by dealing

with highly rated counterparties.