CarMax 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

44

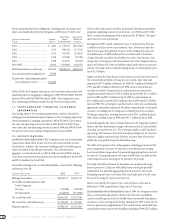

14. COMMITMENTS AND CONTINGENT LIABILITIES

In the normal course of business,the Company is involved in various

legal proceedings. Based upon the Company’s evaluation of the informa-

tion presently available,management believes that the ultimate resolution

of any such proceedings will not have a material adverse effect on the

Company’s financial position,liquidity or results of operations.

15. DISCONTINUED OPERATIONS

On June 16, 1999,Digital Video Express announced that it would cease mar-

keting the Divx home video system and discontinue operations,but exist-

ing,registered customers would be able to view discs during a two-year

phase-out period. The operating results of Divx and the loss on disposal of

the Divx business have been segregated from continuing operations and

reported as separate line items,after tax,on the consolidated statements of

earnings for the periods presented. Discontinued operations also have been

segregated on the consolidated statements of cash flows for the periods pre-

sented. The consolidated balance sheets,however,include Divx.

The loss from the discontinued Divx operations totaled $16.2 million after

an income tax benefit of $9.9 million in fiscal 2000, $68.5 million after an

income tax benefit of $42.0 million in fiscal 1999 and $20.6 million after

an income tax benefit of $12.6 million in fiscal 1998. The loss on the dis-

posal of the Divx business totaled $114.0 million after an income tax bene-

fit of $69.9 million in fiscal 2000. The loss on the disposal includes a

provision for operating losses to be incurred during the phase-out period.

It also includes provisions for commitments under licensing agreements

with motion picture distributors,the write-down of assets to net realizable

value,lease termination costs,employee severance and benefit costs and

other contractual commitments. At February 29,2000,the provision for

operating losses during the phase-out period increased to $6.2 million

from the original estimate of $3.0 million because of higher than expected

operating costs during the early stages of discontinuing the business. This

increase was offset by reductions in the provisions for non-operating costs.

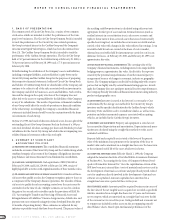

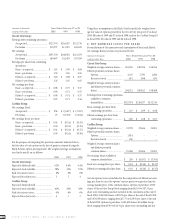

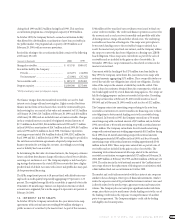

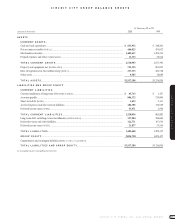

The net liabilities or assets of the discontinued Divx operations reflected

in the accompanying consolidated balance sheets at February 29 or 28 are

comprised of the following:

(Amounts in thousands) 2000 1999

Current assets......................................................... $ 612 $ 25,630

Property and equipment,net ................................. 513 23,589

Other assets............................................................ – 7,895

Current liabilities ................................................... (32,650) (23,126)

Other liabilities....................................................... (35,291) (3,397)

Net (liabilities) assets of discontinued operations... $(66,816) $ 30,591

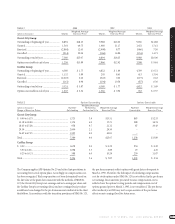

16. OPERATING SEGMENT INFORMATION

The Company conducts business in two operating segments: the Circuit

City Group and the CarMax Group. These segments are identified and

managed by the Company based on the different products and services

offered by each. The Circuit City Group refers to the retail operations bear-

ing the Circuit City name and to all related operations,such as its finance

operation. This segment is engaged in the business of selling brand-name

consumer electronics,personal computers,major appliances and enter-

tainment software. The CarMax Group refers to the used- and new-car

retail locations bearing the CarMax name and to all related operations,

such as its finance operation. Divx is no longer included as an operating

segment because it was discontinued on June 16,1999. Prior year financial

information has been adjusted to reflect this change. Financial informa-

tion for these segments for fiscal 2000,1999 and 1998 are shown in Table 3.

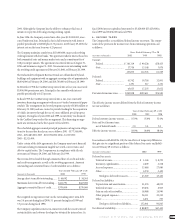

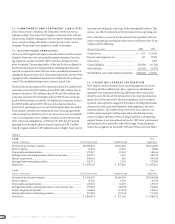

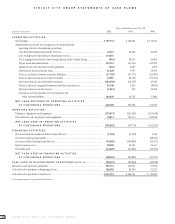

TABLE 3

2000 Total

(Amounts in thousands) Circuit City Group CarMax Group Segments

Revenues from external customers ............................................................ $10,599,406 $2,014,984 $12,614,390

Interest expense.......................................................................................... 13,844 10,362 24,206

Depreciation and amortization .................................................................. 132,923 15,241 148,164

Earnings from continuing operations before income taxes ....................... 526,955 1,803 528,758

Income tax provision.................................................................................. 200,243 685 200,928

Earnings from continuing operations........................................................ 326,712 1,118 327,830

Total assets ................................................................................................. $ 3,278,728 $ 675,495 $ 3,954,223

1999 Total

(Amounts in thousands) Circuit City Group CarMax Group Segments

Revenues from external customers ............................................................ $ 9,344,170 $1,466,298 $10,810,468

Interest expense.......................................................................................... 21,926 6,393 28,319

Depreciation and amortization .................................................................. 119,724 10,003 129,727

Earnings (loss) from continuing operations before income taxes ............ 379,630 (38,549) 341,081

Income tax provision (benefit)................................................................... 144,646 (15,035) 129,611

Earnings (loss) from continuing operations.............................................. 234,984 (23,514) 211,470

Total assets ................................................................................................. $ 2,816,954 $ 571,198 $ 3,388,152