CarMax 2000 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

62

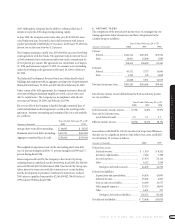

In determining the fair value of retained interests,the Company estimates

future cash flows from finance charge collections,reduced by net defaults,

servicing cost and interest cost. The Company employs a risk-based pric-

ing strategy that increases the stated annual percentage rate for accounts

that have a higher predicted risk of default. Accounts with a lower risk

profile also may qualify for promotional financing.

The APRs of the private-label card programs,excluding promotional bal-

ances,range from 22 percent to 24 percent,with default rates varying

based on portfolio composition,but generally aggregating from 4 percent

to 6 percent. Principal payment rates vary widely both seasonally and by

credit terms but are in the range of 11 percent to 13 percent.

The bank card APRs are based on the prime rate and generally range

from 10 percent to 23 percent,with default rates varying by portfolio

composition,but generally aggregating from 8 percent to 12 percent.

Principal payment rates vary widely both seasonally and by credit terms

but are in the range of 7 percent to 9 percent.

Interest cost paid by the master trusts varies between series and,at

February 29, 2000, ranged from 6.2 percent to 6.7 percent.

13. INTEREST RATE SWAPS

In October 1994,the Company entered into five-year interest rate swap

agreements with notional amounts totaling $300 million relating to a

public issuance of securities by the master trust. As part of this issuance,

$344 million of five-year,fixed-rate certificates were issued to fund con-

sumer credit receivables. The finance operation is servicer for the

accounts,and as such,receives its monthly cash portfolio yield after

deducting interest,charge-offs and other related costs. The underlying

receivables are based on a floating rate. The swaps were put in place to

better match funding costs to the receivables being securitized. As a

result,the master trust pays fixed-rate interest,and the Company utilizes

the swaps to convert the fixed-rate obligation to a floating-rate,LIBOR-

based obligation. These swaps were entered into as part of the sales of

receivables and are included in the gain on sales of receivables. In

November 1999,these swaps terminated as the related securities in the

master trust matured.

Concurrent with the funding of the $175 million term loan facility in

May 1995, the Company entered into five-year interest rate swaps with

notional amounts aggregating $175 million. These swaps effectively con-

verted the variable-rate obligation into a fixed-rate obligation. The fair

value of the swaps is the amount at which they could be settled. This

value is based on estimates obtained from the counterparties, which are

two banks highly rated by several financial rating agencies. The swaps are

held for hedging purposes and are not recorded at fair value. Recording

the swaps at fair value at February 29, 2000, would result in a loss of

$90,000,and at February 28, 1999, would result in a loss of $2.2 million.

The market and credit risks associated with these interest rate swaps are

similar to those relating to other types of financial instruments. Market

risk is the exposure created by potential fluctuations in interest rates and

is directly related to the product type, agreement terms and transaction

volume. The Company does not anticipate significant market risk from

swaps,since their use is to match more closely funding costs to the use of

the funding. Credit risk is the exposure to nonperformance of another

party to an agreement. Credit risk is mitigated by dealing with highly

rated counterparties.

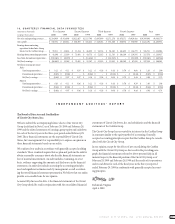

14. COMMITMENTS AND CONTINGENT LIABILITIES

In the normal course of business,the Company is involved in various

legal proceedings. Based upon the Circuit City Group’s evaluation of the

information presently available,management believes that the ultimate

resolution of any such proceedings will not have a material adverse effect on

the Circuit City Group’s financial position,liquidity or results of operations.

15. DISCONTINUED OPERATIONS

On June 16,1999,Digital Video Express announced that it would cease

marketing the Divx home video system and discontinue operations,but

existing,registered customers would be able to view discs during a two-

year phase-out period. The operating results of Divx and the loss on dis-

posal of the Divx business have been segregated from continuing

operations and reported as separate line items,after tax,on the Circuit

City Group statements of earnings for the periods presented. Discontin-

ued operations also have been segregated on the Circuit City Group state-

ments of cash flows for the periods presented. The Circuit City Group

balance sheets,however, include Divx.

The loss from the discontinued Divx operations totaled $16.2 million

after an income tax benefit of $9.9 million in fiscal 2000,$68.5 million

after an income tax benefit of $42.0 million in fiscal 1999 and $20.6 mil-

lion after an income tax benefit of $12.6 million in fiscal 1998. The loss

on the disposal of the Divx business totaled $114.0 million after an

income tax benefit of $69.9 million in fiscal 2000. The loss on the disposal

includes a provision for operating losses to be incurred during the phase-

out period. It also includes provisions for commitments under licensing

agreements with motion picture distributors,the write-down of assets to

net realizable value, lease termination costs,employee severance and ben-

efit costs and other contractual commitments. At February 29, 2000, the

provision for operating losses during the phase-out period increased to

$6.2 million from the original estimate of $3.0 million because of higher

than expected operating costs during the early stages of discontinuing the

business. This increase was offset by reductions in the provisions for non-

operating costs.

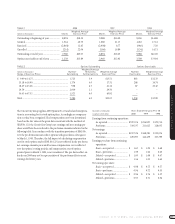

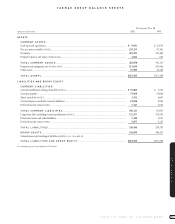

The net liabilities or assets of the discontinued Divx operations reflected

in the accompanying Group balance sheets at February 29 or 28 are com-

prised of the following:

(Amounts in thousands) 2000 1999

Current assets......................................................... $ 612 $ 25,630

Property and equipment,net ................................. 513 23,589

Other assets............................................................ – 7,895

Current liabilities ................................................... (32,650) (23,126)

Other liabilities....................................................... (35,291) (3,397)

Net (liabilities) assets of discontinued operations... $(66,816) $ 30,591