CarMax 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 61

CIRCUIT CITY GROUP

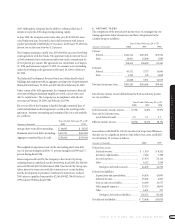

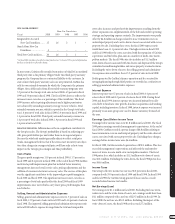

10. LEASE COMMITMENTS

The Circuit City Group conducts a substantial portion of its business in

leased premises. The Circuit City Group’s lease obligations are based

upon contractual minimum rates. For certain locations,amounts in

excess of these minimum rates are payable based upon specified percent-

ages of sales. Rental expense and sublease income for all operating leases

are summarized as follows:

Years Ended February 29 or 28

(Amounts in thousands) 2000 1999 1998

Minimum rentals.............................. $288,037 $273,185 $236,962

Rentals based on sales volume.......... 1,327 1,247 730

Sublease income................................ (16,425) (14,857) (12,879)

Net..................................................... $272,939 $259,575 $224,813

The Circuit City Group computes rent based on a percentage of sales vol-

umes in excess of defined amounts in certain store locations. Most of the

Circuit City Group’s other leases are fixed-dollar rental commitments,

with many containing rent escalations based on the Consumer Price

Index. Most provide that the Circuit City Group pay taxes, maintenance,

insurance and certain other operating expenses applicable to the premises.

The initial term of most real property leases will expire within the next 22

years; however, most of the leases have options providing for additional

lease terms of five years to 25 years at terms similar to the initial terms.

Future minimum fixed lease obligations,excluding taxes,insurance and other

costs payable directly by the Circuit City Group,as of February 29,2000,were:

Operating Operating

(Amounts in thousands) Capital Lease Sublease

Fiscal Leases Commitments Income

2001.................................................. $ 1,681 $ 279,204 $(13,042)

2002.................................................. 1,725 276,428 (11,791)

2003.................................................. 1,726 272,626 (10,801)

2004.................................................. 1,768 271,123 (9,238)

2005.................................................. 1,798 269,236 (8,664)

After 2005......................................... 14,666 2,845,835 (44,935)

Total minimum lease payments....... $23,364 $4,214,452 $(98,471)

Less amounts representing interest... 10,948

Present value of net minimum capital

lease payments [NOTE 5] .............. $12,416

In fiscal 2000,the Company entered into sale-leaseback transactions with

unrelated parties on behalf of the Circuit City Group at an aggregate sell-

ing price of $24,295,000 ($103,750,000 in fiscal 1999 and $120,670,000 in

fiscal 1998). Neither the Company nor the Circuit City Group has continu-

ing involvement under the sale-leaseback transactions.

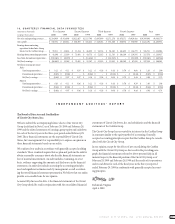

11. SUPPLEMENTARY FINANCIAL STATEMENT

INFORMATION

Advertising expense from continuing operations,which is included in

selling,general and administrative expenses in the accompanying state-

ments of earnings, amounted to $390,144,000 (3.7 percent of net sales

and operating revenues) in fiscal 2000, $376,316,000 (4.0 percent of net

sales and operating revenues) in fiscal 1999 and $369,998,000 (4.6 per-

cent of net sales and operating revenues) in fiscal 1998.

12. SECURITIZATIONS

On behalf of the Circuit City Group,the Company enters into securitiza-

tion transactions,which allow for the sale of credit card receivables to

unrelated entities,to finance the consumer revolving credit receivables

generated by its wholly owned finance operation. The reduction in the

aggregate securitized amount was $63.8 million for fiscal 2000,and pro-

ceeds from securitization transactions were $224.6 million for fiscal 1999

and $331.4 million for fiscal 1998.

Receivables relating to the securitization facilities consist of the following

at February 29 or 28:

(Amounts in thousands) 2000 1999

Managed receivables ....................................... $2,844,377 $2,957,132

Receivables/residual interests held

by the Circuit City Group:

For sale....................................................... (18,288) (39,948)

For investment........................................... (144,806) (161,996)

Net receivables sold ......................................... $2,681,283 $2,755,188

Net receivables sold with recourse .................. $ 229,000 $ 322,000

Program capacity ............................................ $3,598,350 $3,127,000

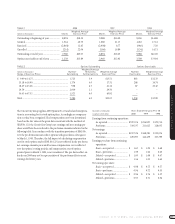

Private-label credit card receivables are financed through securitization

programs employing a master trust structure. As of February 29, 2000,

these securitization programs had a capacity of $1.85 billion. The agree-

ment has no recourse provisions.

During fiscal 1998,a bank card master trust securitization facility was estab-

lished and issued two series from the trust. Provisions under the master

trust agreement provide recourse to the Company for any cash flow deficien-

cies on $229 million of the receivables sold. The finance charges from the

transferred receivables are used to fund interest costs,charge-offs,servicing

fees and other related costs. The Company believes that as of February 29,

2000,no liability existed under these recourse provisions. The bank card

securitization program has a total program capacity of $1.75 billion.

Rights recorded for future finance income from serviced assets that exceed

the contractually specified servicing fees are carried at fair value and

amounted to $37.3 million at February 29,2000,$27.3 million at February 28,

1999,and $25.0 million at February 28, 1998, and are included in net

accounts receivable. Changes in these retained interests consisted of

originated retained interests of $52.9 million for fiscal 2000,$37.3 million

for fiscal 1999 and $33.3 million for fiscal 1998,less amortization of

$42.9 million in fiscal 2000,$35.0 million in fiscal 1999 and $11.5 million

in fiscal 1998. The servicing fees specified in the credit card securitization

agreements adequately compensate the finance operation for servicing the

accounts. Accordingly, no servicing asset or liability has been recorded.

The finance operation’s servicing revenue totaled $213.1 million for fiscal

2000,$210.4 million for fiscal 1999 and $195.7 million for fiscal 1998.