CarMax 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

56

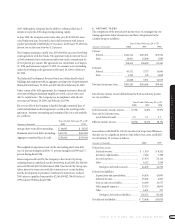

The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets,liabilities,

revenues and expenses and the disclosure of contingent assets and liabili-

ties. Actual results could differ from those estimates.

(Q) RECLASSIFICATIONS: Certain amounts in prior years have been reclassi-

fied to conform to classifications adopted in fiscal 2000.

3. CORPORATE ACTIVITIES

The Circuit City Group’s financial statements reflect the application of the

management and allocation policies adopted by the board of directors to

various corporate activities, as described below:

(A) FINANCIAL ACTIVITIES: Most financial activities are managed by the

Company on a centralized basis. Such financial activities include the

investment of surplus cash and the issuance and repayment of short-term

and long-term debt. Allocated invested surplus cash of the Circuit City

Group consists of (i) Company cash equivalents,if any, that have been

allocated in their entirety to the Circuit City Group and (ii) a portion of

the Company’s cash equivalents that are allocated between the Groups.

Allocated debt of the Circuit City Group consists of (i) Company debt,if

any,that has been allocated in its entirety to the Circuit City Group and (ii) a

portion of the Company’s pooled debt,which is debt allocated between

the Groups. The pooled debt bears interest at a rate based on the average

pooled debt balance. Expenses related to increases in pooled debt are

reflected in the weighted average interest rate of such pooled debt as a whole.

(B) CORPORATE GENERAL AND ADMINISTRATIVE COSTS: Corporate general

and administrative costs and other shared services generally have been

allocated to the Circuit City Group based upon utilization of such services

by the Group. Where determinations based on utilization alone have been

impractical, other methods and criteria were used that management

believes are equitable and provide a reasonable estimate of the costs

attributable to the Group.

(C) INCOME TAXES: The Circuit City Group is included in the consolidated

federal income tax return and certain state tax returns filed by the Com-

pany. Accordingly, the provision for federal income taxes and related pay-

ments of tax are determined on a consolidated basis. The financial

statement provision and the related tax payments or refunds are reflected

in each Group’s financial statements in accordance with the Company’s

tax allocation policy for such Groups. In general,this policy provides that

the consolidated tax provision and related tax payments or refunds will

be allocated between the Groups based principally upon the financial

income,taxable income,credits and other amounts directly related to

each Group. Tax benefits that cannot be used by the Group generating

such attributes,but can be utilized on a consolidated basis,are allocated

to the Group that generated such benefits. As a result,the allocated Group

amounts of taxes payable or refundable are not necessarily comparable to

those that would have resulted if the Groups had filed separate tax returns.

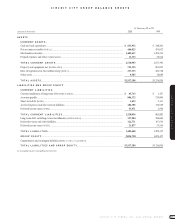

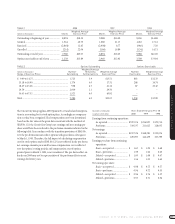

4. PROPERTY AND EQUIPMENT

Property and equipment, at cost,at February 29 or 28 is summarized as

follows:

(Amounts in thousands) 2000 1999

Land and buildings (20 to 25 years)............ $ 98,537 $ 59,823

Construction in progress............................. 51,378 103,309

Furniture, fixtures and equipment

(3 to 8 years).......................................... 690,512 654,156

Leasehold improvements

(10 to 15 years)...................................... 566,103 534,015

Capital leases,primarily buildings

(20 years)............................................... 12,471 12,471

1,419,001 1,363,774

Less accumulated depreciation and

amortization.......................................... 665,676 561,947

Property and equipment,net ...................... $ 753,325 $ 801,827

5. DEBT

Long-term debt of the Company at February 29 or 28 is summarized as

follows:

(Amounts in thousands) 2000 1999

Term loans...................................................... $405,000 $405,000

Industrial Development Revenue

Bonds due through 2006 at various

prime-based rates of interest ranging

from 5.0% to 7.0%.................................... 5,419 6,564

Obligations under capital

leases [NOTE 10].......................................... 12,416 12,728

Note payable................................................... 3,750 5,000

Total long-term debt....................................... 426,585 429,292

Less current installments............................... 177,344 2,707

Long-term debt,excluding

current installments ................................. 249,241 426,585

Portion of long-term debt allocated

to the Circuit City Group........................... $213,719 $288,322

In July 1994,the Company entered into a seven-year,$100,000,000,unse-

cured bank term loan. The loan was restructured in August 1996 as a

$100,000,000,six-year unsecured bank term loan. Principal is due in full

at maturity with interest payable periodically at LIBOR plus 0.40 percent.

At February 29, 2000, the interest rate on the term loan was 6.29 percent.

In May 1995,the Company entered into a five-year,$175,000,000,unse-

cured bank term loan. Principal is due in full at maturity with interest

payable periodically at LIBOR plus 0.35 percent. At February 29, 2000, the

interest rate on the term loan was 6.23 percent. This term loan is due in

May 2000 and has been classified as a current liability as of February 29,