CarMax 2000 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 49

CIRCUIT CITY GROUP

increases in pooled debt are reflected in the weighted average interest rate

of the pooled debt.

In addition to the allocation of cash and debt,interest-bearing loans, with

terms determined by the board of directors,are used to manage cash

between the Groups. These loans are reflected as inter-group payables or

receivables on the financial statements of each Group. During fiscal 1998,

an inter-group note was issued by the Circuit City Group on behalf of the

CarMax Group as a temporary financing vehicle for CarMax inventory. At

the end of fiscal 2000 and fiscal 1999, the Circuit City Group maintained

no inter-group notes,payables or receivables with the CarMax Group.

During fiscal 2000, a term loan totaling $175 million and due in May 2000

was classified as a current liability. Although the Company has the ability

to refinance this loan,it intends to repay the debt using existing working

capital. Payment of corporate debt will not necessarily reduce Circuit City

Group allocated debt.

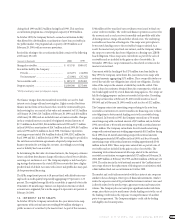

The Circuit City Group’s capital expenditures were $176.9 million in fiscal

2000,$214.1 million in fiscal 1999 and $341.6 million in fiscal 1998. Circuit

City’s capital expenditures through fiscal 2000 primarily were related to

Superstore expansion. Capital expenditures for the Circuit City Group

have been funded through sale-leaseback transactions,landlord reim-

bursements and allocated short- and long-term debt. In fiscal 2001, the

Group anticipates capital expenditures of approximately $245 million,

primarily related to construction of new Superstores and the remodeling

of 30 to 35 existing Superstores. Sale-leaseback and landlord reimburse-

ment transactions totaled $74.8 million in fiscal 2000,$134.3 million in

fiscal 1999 and $199.0 million in fiscal 1998.

The Group’s finance operation primarily funds its credit card programs

through securitization transactions that allow the operation to sell its

receivables while retaining a small interest in them. The finance opera-

tion has a master trust securitization facility for its private-label credit

card that allows the transfer of up to $1.85 billion in receivables through

both private placement and the public market. A second master trust

securitization program allows for the transfer of up to $1.75 billion in

receivables related to the operation’s bank card programs. Securitized

receivables totaled $2.79 billion at February 29, 2000. Under the securiti-

zation programs,receivables are sold to an unaffiliated third party with

the servicing rights retained. Management expects that both securitiza-

tion programs can be expanded to accommodate future receivables growth.

At the end of fiscal 2000,the Circuit City Group retained a 74.7 percent

interest in the equity of the CarMax Group. As of February 29, 2000, the

Circuit City Group’s equity in the CarMax Group was $257.5 million.

Management believes that proceeds from sales of property and equip-

ment and receivables,future increases in Circuit City Stores, Inc. debt

allocated to the Circuit City Group and cash generated by operations will

be sufficient to fund the capital expenditures and operations of the Circuit

City business.

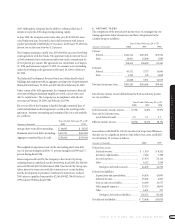

MARKET RISK

The Company manages the private-label and bank card revolving loan

portfolios of the Group’s finance operation. Portions of these portfolios

are securitized and,therefore,are not presented on the Group’s balance

sheets. Interest rate exposure relating to these receivables represents a

market risk exposure that the Company has managed with matched fund-

ing and interest rate swaps.

Interest rates charged on the accounts in the managed private-label and

bank card portfolios are primarily indexed to the prime rate,adjustable

on a monthly basis,with the balance at a fixed annual percentage rate.

Total principal outstanding at February 29, 2000, and February 28, 1999,

had the following APR structure:

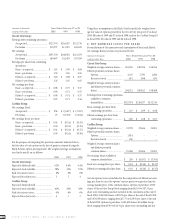

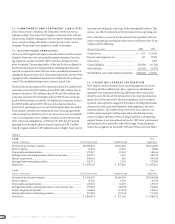

(Amounts in millions) 2000 1999

Indexed to prime rate............................................. $2,631 $2,714

Fixed APR............................................................... 213 243

Total ....................................................................... $2,844 $2,957

Financing for the securitization programs is achieved primarily through

the issuance of public market debt,which is issued either at floating rates

based on LIBOR or at fixed rates. Certain of the fixed-rate issuances have

been swapped to LIBOR. Receivables held by the Company for investment

or sale are financed with working capital. At February 29, 2000, and

February 28, 1999, financings were as follows:

(Amounts in millions) 2000 1999

Floating-rate (including synthetic

alteration) securitizations................................ $2,544 $2,568

Fixed-rate securitizations ...................................... 137 187

Held by the Company:

For investment ................................................. 145 162

For sale............................................................. 18 40

Total ....................................................................... $2,844 $2,957

The Company has analyzed its interest rate exposure and has concluded

that it did not represent a material market risk at February 29, 2000, or

February 28, 1999. Because programs are in place to manage interest rate

exposure relating to the consumer loan portfolios,the Company expects

to experience relatively little impact if interest rates fluctuate. The Com-

pany also has the ability to adjust fixed-APR revolving cards and the

index on floating-rate cards, subject to cardholder ratification,but does

not currently anticipate the need to do so.

YEAR 2000 CONVERSION

Refer to the “Management’s Discussion and Analysis of Results of Opera-

tions and Financial Condition”for Circuit City Stores, Inc.for a discussion

of the Year 2000 issue and its impact on the Group’s financial statements.

FORWARD-LOOKING STATEMENTS

Company statements that are not historical facts, including statements

about management’s expectations for fiscal year 2001 and beyond,are

forward-looking statements and involve various risks and uncertainties.

Refer to the “Circuit City Stores, Inc. Management’s Discussion and Anal-

ysis of Results of Operations and Financial Condition”for a review of pos-

sible risks and uncertainties.