CarMax 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

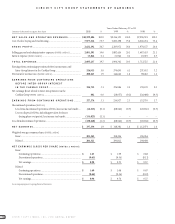

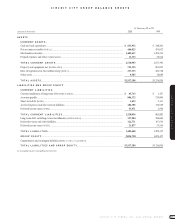

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

42

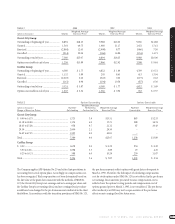

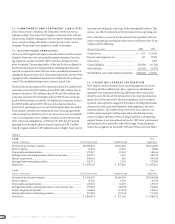

Future minimum fixed lease obligations,excluding taxes,insurance and

other costs payable directly by the Company,as of February 29,2000,were:

Operating Operating

(Amounts in thousands) Capital Lease Sublease

Fiscal Leases Commitments Income

2001.................................................. $ 1,681 $ 313,535 $(13,042)

2002.................................................. 1,725 309,516 (11,791)

2003.................................................. 1,726 305,503 (10,801)

2004.................................................. 1,768 303,380 (9,238)

2005.................................................. 1,798 301,155 (8,664)

After 2005......................................... 14,666 3,303,866 (44,935)

Total minimum lease payments....... $23,364 $4,836,955 $(98,471)

Less amounts representing interest... 10,948

Present value of net minimum capital

lease payments [NOTE 5] .............. $12,416

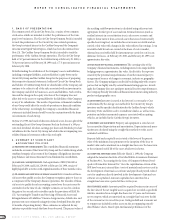

In fiscal 2000,the Company entered into sale-leaseback transactions with

unrelated parties at an aggregate selling price of $36,795,000 ($235,500,000

in fiscal 1999 and $218,768,000 in fiscal 1998). The Company does not

have continuing involvement under the sale-leaseback transactions.

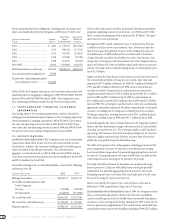

11. SUPPLEMENTARY FINANCIAL STATEMENT

INFORMATION

Advertising expense from continuing operations,which is included in

selling,general and administrative expenses in the accompanying consol-

idated statements of earnings, amounted to $438,781,000 (3.5 percent of

net sales and operating revenues) in fiscal 2000,$426,359,000 (3.9 per-

cent of net sales and operating revenues) in fiscal 1999 and $399,619,000

(4.5 percent of net sales and operating revenues) in fiscal 1998.

12. SECURITIZATIONS

(A) CREDIT CARD SECURITIZATIONS: The Company enters into securitization

transactions,which allow for the sale of credit card receivables to unre-

lated entities,to finance the consumer revolving credit receivables gener-

ated by its wholly owned finance operation. The reduction in the

aggregate securitized amount was $63.8 million for fiscal 2000,and pro-

ceeds from securitization transactions were $224.6 million for fiscal 1999

and $331.4 million for fiscal 1998.

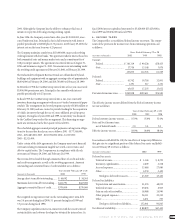

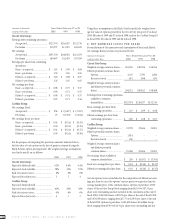

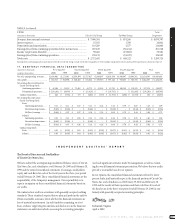

Receivables relating to the securitization facilities consist of the following

at February 29 or 28:

(Amounts in thousands) 2000 1999

Managed receivables ....................................... $2,844,377 $2,957,132

Receivables/residual interests held

by the Company:

For sale....................................................... (18,288) (39,948)

For investment........................................... (144,806) (161,996)

Net receivables sold ......................................... $2,681,283 $2,755,188

Net receivables sold with recourse .................. $ 229,000 $ 322,000

Program capacity ............................................ $3,598,350 $3,127,000

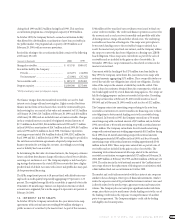

Private-label credit card receivables are financed through securitization

programs employing a master trust structure. As of February 29, 2000,

these securitization programs had a capacity of $1.85 billion. The agree-

ment has no recourse provisions.

During fiscal 1998, a bank card master trust securitization facility was

established and issued two series from the trust. Provisions under the

master trust agreement provide recourse to the Company for any cash

flow deficiencies on $229 million of the receivables sold. The finance

charges from the transferred receivables are used to fund interest costs,

charge-offs,servicing fees and other related costs. The Company believes

that as of February 29, 2000, no liability existed under these recourse pro-

visions. The bank card securitization program has a total program capac-

ity of $1.75 billion.

Rights recorded for future finance income from serviced assets that exceed

the contractually specified servicing fees are carried at fair value and

amounted to $37.3 million at February 29,2000,$27.3 million at February 28,

1999,and $25.0 million at February 28, 1998, and are included in net

accounts receivable. Changes in these retained interests consisted of

originated retained interests of $52.9 million for fiscal 2000,$37.3 million

for fiscal 1999 and $33.3 million for fiscal 1998,less amortization of

$42.9 million in fiscal 2000,$35.0 million in fiscal 1999 and $11.5 million

in fiscal 1998. The servicing fees specified in the credit card securitization

agreements adequately compensate the finance operation for servicing the

accounts. Accordingly, no servicing asset or liability has been recorded.

The finance operation’s servicing revenue totaled $213.1 million for fiscal

2000,$210.4 million for fiscal 1999 and $195.7 million for fiscal 1998.

In determining the fair value of retained interests,the Company estimates

future cash flows from finance charge collections reduced by net defaults,

servicing cost and interest cost. The Company employs a risk-based pric-

ing strategy that increases the stated annual percentage rate for accounts

that have a higher predicted risk of default. Accounts with a lower risk

profile also may qualify for promotional financing.

The APRs of the private-label card programs,excluding promotional bal-

ances,range from 22 percent to 24 percent,with default rates varying

based on portfolio composition,but generally aggregating from 4 percent

to 6 percent. Principal payment rates vary widely both seasonally and by

credit terms but are in the range of 11 percent to 13 percent.

The bank card APRs are based on the prime rate and generally range

from 10 percent to 23 percent,with default rates varying by portfolio

composition,but generally aggregating from 8 percent to 12 percent.

Principal payment rates vary widely both seasonally and by credit terms

but are in the range of 7 percent to 9 percent.

Interest cost paid by the master trusts varies between series and,at

February 29, 2000, ranged from 6.2 percent to 6.7 percent.

(B) AUTOMOBILE LOAN SECURITIZATION: In fiscal 1996,the Company entered

into a securitization agreement to finance the consumer installment

credit receivables generated by its wholly owned automobile loan finance

operation. A restructuring of the facility during fiscal 1997 resulted in the

recourse provisions being eliminated. Proceeds from the automobile loan

securitization transaction were $348 million during fiscal 2000,$271 million